Finnair Plc Stock Exchange Release 11 February 2026 at 9:00 a.m. EET

Strong Q4 driven by robust demand and solid execution

October-December 2025

- Revenue increased by 0.8% to 789.5 million euros (782.9).

- Comparable operating result was 61.7 million euros (47.9).

- Operating result was 46.4 million euros (12.1).

- Earnings per share were 0.13 euros (-0.04).

- Net cash flow from operating activities was 102.1 million euros (201.8) and net cash flow from investing activities -18.4 million euros (-175.3)*.

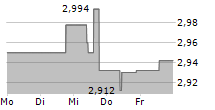

- Number of passengers increased by 2.2% to 2.9 million (2.8**).

- Available seat kilometres (ASK) increased by 1.7% to 9,498.6 million kilometres (9,341.7). Including wet leases, ASKs increased by 1.5%.

- Passenger load factor (PLF) increased by 0.7 percentage points to 77.1% (76.4).

January-December 2025

- Revenue increased by 1.9% to 3,106.2 million euros (3,048.8).

- Comparable operating result was 60.1 million euros (151.4). Industrial action had a direct negative impact of around 68 million euros on the comparable operating result.

- Operating result was 64.2 million euros (114.2).

- Earnings per share were 0.09 euros (0.18).

- Net cash flow from operating activities was 401.9 million euros (612.7) and net cash flow from investing activities -221.7 million euros (-286.4)*.

- Number of passengers increased by 2.0% to 11.9 million (11.7**).

- Available seat kilometres (ASK) increased by 2.7% to 39,306.6 million kilometres (38,259.3). Including wet leases, ASKs increased by 1.4%.

- Passenger load factor (PLF) increased by 1.1 percentage points to 76.9% (75.8).

- The Board of Directors proposes to the Annual General Meeting that a return of capital of 0.09 euros per share be distributed to shareholders.

Unless otherwise stated, comparisons and figures in parentheses refer to the comparison period, i.e., the same period last year.

*In October-December, net cash flow from investing activities included 8.7 million euros of redemptions (20.1 million euros of redemptions) in money market funds or other financial assets (maturity over three months). In January-December, net cash flow from investing activities included 21.4 million euros of investments (4.1 million euros of redemptions). They are part of the Group's liquidity management.

**The number of passengers and cargo tonnes for January-November 2024 were corrected in December 2024, with a total impact of 59,100 additional passengers and 828.7 additional cargo tonnes for the period.

Outlook and guidance

Outlook on 11 February 2026

Global air traffic is expected to continue to grow in 2026. Finnair plans to increase its total capacity, measured by ASKs, by approximately 5% in 2026. The capacity estimate includes the agreed wet leases. Supported by an improving macroeconomic situation, including a rise in purchasing power among consumers, demand for air travel is anticipated to strengthen in Finnair's key markets.

However, international conflicts, global political instability and the threat of trade wars cause uncertainty in the operating environment. The increase in costs related to environmental regulation continues to burden Finnair's profitability during the year, although current fuel prices offset the impact.

Guidance on 11 February 2026

Finnair estimates its revenue to be 3.3-3.4 billion euros and comparable operating result to be 120-190 million euros in 2026.

Sensitivities to fuel prices and exchange rates

Finnair's comparable operating result is sensitive to fuel prices and exchange rates. A 10% change in fuel prices would have an impact of 34 million euros on the annual comparable operating result, taking hedges into account. A 10% change in the US dollar against the euro, on the other hand, would have an impact of 31 million euros on the annual comparable operating result, taking hedges into account. The sensitivities are determined on a rolling basis for the 12 months following the end of 2025.

Previous outlook and guidance issued on 30 October 2025

Global air traffic is expected to continue growing in 2025. However, international conflicts, global political instability and the threat of trade wars cause uncertainty in the operating environment. In particular, the risk levels related to tariffs between different countries and their direct and indirect impacts are elevated. The direct cost impact of known tariffs is estimated to be limited, but it is too early to estimate the magnitude of potential indirect effects. During the year, Finnair's profitability is burdened particularly by additional costs caused by the sustainable aviation fuel distribution obligation introduced in the EU, as well as rising navigation and landing charges.

Finnair plans to increase its total capacity, measured by ASKs, by c. 2% in 2025. The capacity estimate includes the agreed wet leases. Finnair estimates its revenue to be approximately 3.1 billion euros and its comparable operating result to be within the range of 30-60 million euros in 2025 (previously 30-130 million euros). The upper end of the comparable operating result guidance range has been lowered, because reaching the previous upper end is considered unlikely. The new guidance is in line with the previous guidance, based on which the comparable operating result was estimated to be closer to the lower end of the previously given range. Lowering the upper end of the comparable operating result range as well as capacity and revenue guidance is mainly due to the continued weak demand and yield development in North Atlantic traffic, the indirect effects of industrial action on demand in broader terms, unplanned aircraft repair and maintenance needs, and fuel price developments.

The estimates above regarding capacity, revenue and comparable operating result include the impacts of the industrial action that took place in 2025. In January-September, the direct impact of industrial action was approximately -96 million euros on revenue and approximately -68 million euros on comparable operating result. The industrial action had a direct negative impact of approximately 5% on the total capacity in 2025, measured by ASKs.

Finnair will update its outlook and guidance in connection with the financial statements release for 2025.

CEO Turkka Kuusisto:

We concluded 2025 with a strong fourth quarter. Our revenue remained stable, while our comparable operating result increased by 29%, driven by healthy demand and solid operational execution. The result was also supported by lower fuel prices and favourable currency movements. These positive effects were partly offset by higher costs related to increased environmental regulation, including greater use of sustainable aviation fuel, as well as higher navigation and landing charges.

Our unflown ticket liability grew year-on-year, indicating healthy demand as consumers continued to prioritise travel. Demand developed well in Asia and Europe, but was softer in North Atlantic traffic, which burdened yields.

During the fourth quarter, we carried 2.9 million passengers. Customer satisfaction, measured by Net Promoter Score, was 33, representing a good level in international comparison. Among our most frequent Finnair Plus tier members (Gold, Platinum and Lumo), the Net Promoter Score exceeded 40.

In November, we announced our long-term financial targets and strategy for the period 2026-2029. The cornerstones of the strategy are a customer-centric, choice-based product offering, deeper engagement with customers also beyond travel, a network that meets customer needs, and reliable and efficient operations. The successful issuance of a 300-million-euro bond at the end of November supports the execution of our strategy. Our strong cash position also provides flexibility for fleet investments, about which we will communicate more as negotiations progress.

We took concrete steps to implement our new strategy during the quarter. We announced seven new European destinations for the summer season, increasing the total number of new European destinations to twelve. In addition, we announced the opening of a new long-haul route to Melbourne, Australia, in October 2026. These new connections will bring new passenger flows into Finnair's network and enable growth in line with the market.

Developing the employee experience is a key element of our strategy execution. In the employee survey conducted in December, the engagement index was 7.0 (on a scale of 1-10), an improvement of 0.6 points compared with the previous survey. This provides a strong foundation for advancing our strategic initiatives and for the continuous development of the customer experience.

The start of 2026 brought exceptionally challenging winter weather conditions, causing a marked increase in both flight cancellations and de-icing operations compared to previous years. Despite these adverse circumstances, our teams demonstrated remarkable resilience and adaptability, managing the disruptions with professionalism and efficiency.

During 2026, we will bring our strategy implementation to life across Finnair's network, customer experience, the development of our loyalty programme, as well as in our continued focus on reliable, safe and punctual operations. By leveraging advanced data analytics and AI-driven customer service solutions, we aim to deliver even more personalised experiences and further improve our responsiveness to customer needs. I am confident that these actions will enable us to create value for our customers, shareholders and employees.

I would like to warmly thank all our customers for their trust in Finnair, as well as our entire personnel and partners for their committed work throughout 2025. I am pleased that our positive result and stable financial position again allow us to reward our shareholders this year with a proposed capital return of 0.09 euros per share, as proposed by the Board of Directors.

Shareholder return policy and the Board's proposal for the distribution of profit

The aim of Finnair's shareholder return policy is to pay, on average, one-third of earnings per share as dividend or capital distribution during an economic cycle. When deciding on such distribution, Finnair intends to take into account its earnings trend and outlook, financial situation, as well as capital and investment needs for any given period. Any distributions may be made in two annual payments.

In 2025, earnings per share were 0.09 euros (0.18). Finnair Plc's distributable equity amounted to 541,269,557.65 euros on 31 December 2025. The Board of Directors proposes to the Annual General Meeting that a return of capital of 0.09 euros per share be distributed to shareholders. The return of capital shall be paid in two instalments. The first instalment of 0.05 euros per share shall be paid to a shareholder who is registered in the shareholder register of the company maintained by Euroclear Finland Oy on the record date of 26 March 2026. The payment date proposed by the Board of Directors for this instalment is 8 April 2026. The second instalment of 0.04 euros per share shall be paid in November 2026. It shall be paid to a shareholder who is registered in the shareholder register of the company maintained by Euroclear Finland Oy on the record date, which, together with the payment date, shall be decided by the Board of Directors in its meeting scheduled for 26 October 2026.

Financial reporting in 2026

The publication dates of Finnair's financial reports in 2026 are the following:

- Interim Report for January-March 2026 on Wednesday 22 April 2026

- Half-year Report for January-June 2026 on Wednesday 22 July 2026

- Interim Report for January-September 2026 on Tuesday 27 October 2026

This release is a summary of Finnair's Financial Statements Release 1 January-31 December 2025. The full report is available as an attachment to this release.

FINNAIR PLC

Board of Directors

Briefings

Finnair will hold a results press conference (in Finnish) on 11 February 2026 at 11:00 a.m. Finnish time at its office at Tietotie 9 in Vantaa, Finland. It is also possible to participate in the press conference via a live webcast at https://finnairgroup.videosync.fi/2026-02-11-media.

An English-language telephone conference and webcast will begin on 11 February 2026 at 1:00 p.m. Finnish time. To access the telephone conference, kindly register at https://events.inderes.com/finnairgroup/q4-2025/dial-in. After the registration, you will be provided with phone numbers and a conference ID. To join the live webcast, please register at https://finnairgroup.events.inderes.com/q4-2025.

For further information, please contact:

Chief Financial Officer Pia Aaltonen-Forsell, tel. +358 9 818 4960, pia.aaltonen-forsell@finnair.com

Head of Investor Relations Erkka Salonen, tel. +358 9 818 5101, erkka.salonen@finnair.com

FINNAIR PLC

Further information:

Finnair communications, +358 9 818 4020, comms(a)finnair.com

Distribution:

NASDAQ OMX Helsinki

Principal media

Finnair is a network airline, specialising in connecting passenger and cargo traffic between Asia, North America and Europe. Finnair is the only airline with year-round direct flights to Lapland. Customers have chosen Finnair as the Best Airline in Northern Europe in the Skytrax Awards for 15 times in a row. Finnair is a member of the oneworld alliance. Finnair Plc's shares are quoted on Nasdaq Helsinki.