Morrow Bank, a leading Nordic digital niche bank, increased profit before tax by 19% to NOK 100 million in Q4 and 31% to NOK 369 million for 2025.

"In Q4, we delivered on our plan: deploying as much capital as possible to profitable growth, combining strong underlying demand with disciplined, accretive M&A. 2025 was a step-change year for Morrow Bank where we grew the loan book well above our organic target and delivered record high income. Furthermore, improved credit performance and cost/income ratio contributed to profit before tax growing by 31% for the year, demonstrating the capabilities of our scalable platform", said CEO Øyvind Oanes.

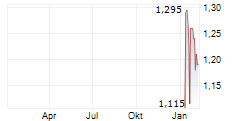

The redomiciliation to Sweden, effective 2 January 2026, reduces capital requirements and puts Morrow Bank on a level playing field with Swedish peers. Lower Swedish capital requirements improve capital efficiency, supporting higher returns on the same underwriting framework. Additionally, Morrow Bank's shares began trading on Nasdaq Stockholm on 9 January 2026.

"Reflecting the strong momentum and higher starting balance into 2026, we increase our end-2026 loan book target to SEK 19 billion from SEK 18 billion. Our end-2028 ambition remains >10% annualised growth and ~20% ROTE. This implies a potential of SEK 400-500 million net profit in 2028 and SEK 600-700 million in excess capital available for further growth or shareholder distribution over the period, based on the current Nordic market and macroeconomic outlook," said Oanes.

"We will continue our opportunistic approach to accretive M&A. For illustrative purposes, should we deploy all the capital we have available and generate, annualised growth could on average reach around 25% and 2028 net profit could reach SEK 650-750 million."

Highlights of the quarter

21% loan book growth amid strong demand and M&A

- Gross loans at NOK 18.5 billion/SEK 17 billion, up 21% from Q4 2024 (vs 10% organic target)

- Strong underlying demand, successful product launches and SEK ~640 million loan portfolio acquisition in Sweden in Q4

- All-time-high total income of NOK 378 million in Q4 2025 and NOK 1.4 billion for the full year

31% earnings growth enabled by scalable platform

- Cost/income ratio at 24.9% excl. One-off redomiciliation costs (25.9% in Q4 2024), reflecting highly scalable platform

- Return on equity (ROE) increased to 11.6% (9.9% in Q4 2024) and ROTE3 to 12.6% (10.6%) - 15.5% with Swedish capital requirements

- Earnings per share (EPS): NOK 0.30 (NOK 0.24 in Q4-2024); NOK 1.13 in 2025 (NOK 0.82 in 2024)

Successful Swedish redomiciliation and Nasdaq Stockholm listing

- Redomiciliation to Sweden reducing capital requirements - now operating on a level playing field

- Listing on Nasdaq Stockholm main market strengthens access to largest Nordic capital market

Increased end-2026 loan book target

- Increased end-2026 loan book target to SEK ~19 billion (SEK ~18 billion) following strong growth in Q4

- End-2028 ambition >10% annual loan growth and ~20% ROTE, providing capacity for shareholder distributions

- Continued focus on accretive M&A, leveraging scalable platform, to accelerate growth and returns

The Q4 2025 report and presentation are attached and available at www.ir.morrowbank.com.

CEO Øyvind Oanes and CFO Eirik Holtedahl will present the Bank's results at 08:30 CET today, 12 February 2026.

To participate in the conference call, please click on the link below:

https://www.finwire.tv/webcast/morrow-bank/year-end-report-2025/

For dialing in: +46850520017, then enter the meeting ID: 868 7032 32443 followed by #. (To ask a question, press *9 to raise your hand, then *6 to unmute)

Contact

Eirik Holtedahl, CFO

Tel: +47 96 91 22 91

Email: ir@morrowbank.com

About Morrow Bank

Morrow Bank is a Nordic consumer finance bank offering digital and flexible financing solutions to creditworthy individuals in Norway, Sweden and Finland. The bank offers consumer loans, credit cards and high-yield deposit accounts, supported by a modern and scalable banking platform.