WASHINGTON (dpa-AFX) - TransUnion (TRU), an information and insights company, on Thursday reported its net income increased in the fourth quarter compared with the previous year.

For the fourth quarter, net income attributable to the company increased to $101.2 million from $66.2 million in the previous year.

Earnings per share were $0.52 versus $0.34 last year.

Adjusted net income surged to $208.4 million from $192.2 million in the prior year.

Adjusted earnings per share were $1.07 versus $0.97 last year.

EBITDA increased to $340.8 million from $286.8 million in the previous year.

Adjusted EBITDA increased to $416.7 million from $377.9 million in the prior year.

Revenue increased to $1.17 billion from $1.04 billion in the prior year.

The company declared a cash dividend of $0.125 per share for the fourth quarter of 2025. The dividend will be payable on March 13 to shareholders of record on February 26.

For the first quarter of 2026, the company expects revenue in the range of $1.195 billion to $1.205 billion, representing growth of 9% to 10% as reported.

Net income attributable to the company for the first quarter is projected to be between $118 million and $123 million, reflecting a decline of 20% to 17% year over year. Earnings per share are expected in the range of $0.60 to $0.63, down 19% to 17%.

Adjusted EBITDA is anticipated to be between $414 million and $420 million, with adjusted earnings per share of $1.08 to $1.10, representing growth of 2% to 5% for the first quarter.

For the full year 2026, revenue is expected in the range of $4.946 billion to $4.981 billion, representing growth of 8% to 9%.

Net income attributable to the company for the full year 2026 is projected to be between $538 million and $553 million, reflecting growth of 18% to 21%. Earnings per share are expected in the range of $2.75 to $2.83, up 19% to 22%.

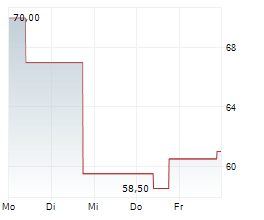

For the full year 2026, Adjusted EBITDA is anticipated to be between $1.756 billion and $1.777 billion, while adjusted earnings per share are projected in the range of $4.63 to $4.71, representing growth of 8% to 10%. In the pre-market trading, TransUnion is 1.38% lesser at $70.75 on the New York Stock Exchange.

For more earnings news, earnings calendar, and earnings for stocks, visit rttnews.com.

Copyright(c) 2026 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2026 AFX News