Teleste Corporation

Stock exchange release

February 13, 2026 at 8.30 a.m. EET

TELESTE CORPORATION: STRONG FINANCIAL PERFORMANCE CONTINUED IN THE FOURTH QUARTER

Unless otherwise specified, the figures in parentheses refer to the year-on-year comparison period.

OCTOBER-DECEMBER 2025 IN BRIEF

- Net sales were EUR 36.1 (36.5) million, on level with previous year.

- Adjusted EBITDA was EUR 2.5 (2.2) million, representing an increase of 12.9%.

- The adjusted operating profit was EUR 1.2 (0.9) million, representing an increase of 38.6%.

- The operating profit was EUR 1.2 (-5.6) million, representing an increase of EUR 6,8 million.

- Earnings per share were EUR 0.02 (-0.27), representing an increase of EUR 0.29.

- Cash flow from operations was EUR 1.8 (1.8) million.

- Orders received decreased by 13.0% to EUR 31.6 (36.3) million.

JANUARY-DECEMBER 2025 IN BRIEF

- Net sales were EUR 138.6 (132,5) million, representing an increase of 4.6%.

- Adjusted EBITDA was EUR 12.1 (9.3) million, representing an increase of 29.1%.

- The adjusted operating profit was EUR 7.1 (4.2) million, representing increase of 69.7%.

- The operating profit was EUR 6.8 (-5.4) million, representing an increase of EUR 12.2 million.

- Earnings per share were EUR 0.15 (-0.32), representing an increase of EUR 0.47.

- Cash flow from operations was EUR 12.9 (12.4) million, representing an increase of 3.6%.

- Orders received were EUR 138.2 (124.9) million, representing an increase of 10.7%.

OUTLOOK FOR FINANCIAL YEAR 2026

Teleste estimates that Net sales for 2026 will be in the range of 140 to 160 million euros and adjusted Operating profit in the range of 7 to 10 million euros. Profit is expected to be weighted toward the second half of the year. Material changes in the operating environment, including geopolitical tensions, changes in trade policies, and the development of the US dollar exchange rate can create uncertainty for parts of the business.

DIVIDEND

The Board of Directors proposes to the Annual General Meeting that a total dividend of up to EUR 0.08 (0.03) per outstanding share will be distributed from the distributable funds for the financial year ended 31 December 2025. In addition, the Board proposes that the dividend will be paid in two instalments, the first during the third quarter of 2026 and the second at the latest during the first quarter of 2027.

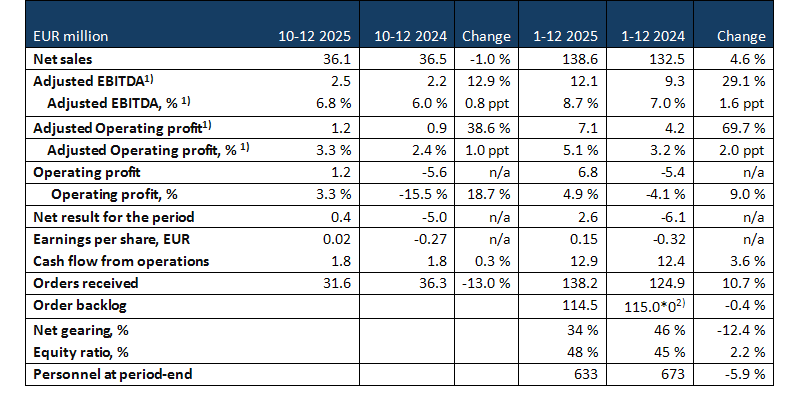

KEY FINANCIALS

1) An alternative performance measure defined in the tables section of the report.

2) Specified order backlog value, EUR 118.3 million as reported in the 2024 financial statements.

COMMENTS BY ESA HARJU, PRESIDENT AND CEO

"The fourth quarter of 2025 was another strong quarter for both business segments. Net sales were in line with the comparison period and increased from the previous quarter. Profitability improved significantly year-on-year, and cash flow from operations continued positive. For the full year, orders received and net sales increased from the prior year, and profitability improved considerably, with full-year operating profit landing at the top end of the guidance range.

In the Broadband Networks segment, orders received returned to growth in the fourth quarter and increased significantly from the previous quarter. In the European markets, we strengthened our position and accelerated deliveries of DOCSIS 4.0 network systems. Consolidation among customers in the U.S. has temporarily slowed some ordering activity, but we have successfully broadened our customer base. Late in the year, Canada's largest operator selected Teleste's intelligent amplifiers as part of its network solution. The first orders from this significant new customer were received in December, and deliveries are expected to continue over several years. For the full year, orders received, net sales and operating profit all increased from the prior year. North America's share of full-year segment revenue increased significantly year-on-year, reaching 30% of total segment revenue.

In the Public Safety and Mobility segment, performance in the fourth quarter was positive and in line with our plans. Net sales were generated from multiple projects, and we delivered several key projects scheduled for year-end in accordance with contract terms. In December, we signed a multi-year framework agreement with France's national railway operator (SNCF) for the delivery of station displays. In addition, we announced the start of station display deliveries to the Belgian railways. For the full year, orders received, net sales and operating profit all increased year-on-year.

The global operating environment remained quite unpredictable. Considering many uncertainties, we continue to proactively prepare for multiple scenarios. Market consolidation in North America is driving significant activity in the broadband technology market, and we are closely monitoring developments and responding as needed. We expect some uncertainty in the operating environment to continue in 2026.

We will continue to execute consistently toward our long-term strategic growth targets in 2026, and our new guidance anticipates growth in both net sales and profitability."

For further information, please contact:

Esa Harju

President and CEO

Mervi Kerkelä-Hiltunen

CFO

tel. +358 40 596 3012

investor.relations@teleste.com

About Teleste

Teleste offers an integrated product and service portfolio that makes it possible to build and run a better networked society. Our solutions bring television and broadband services to you, secure your safety in public places and guide your use of public transport. With solid industry experience and drive for innovations, we are a leading international company in broadband, security and information technologies and related services. We connect with our customers through a global network of offices and partners. In 2025, Teleste's net sales reached EUR 138.6 million and it had approximately 630 employees. Teleste is listed on Nasdaq Helsinki. For more information, visit www.teleste.com .