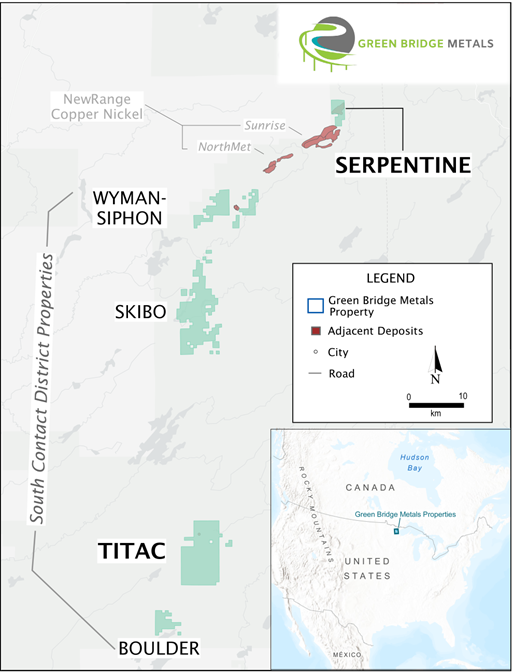

VANCOUVER, BC / ACCESS Newswire / February 17, 2026 / Green Bridge Metals Corporation (CSE:GRBM)(OTCQB:GBMCF)(FWB:J48)(WKN: A3EW4S) ("Green Bridge" or the "Company") is pleased to announce that it is advancing long-lead technical and operational work in preparation for a Phase 1 diamond drilling program planned for the second half of 2026 at its flagship Serpentine Copper-Nickel Project ("Serpentine" or the "Project"), located in St. Louis County, Minnesota, U.S.A. (Figure 1).

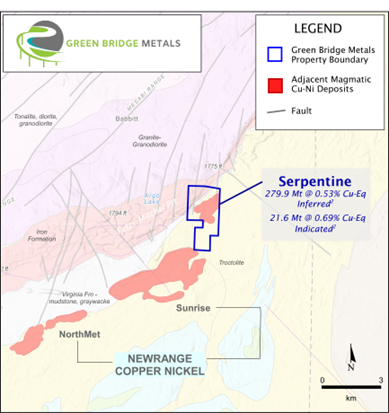

Serpentine is a large, open-pit style copper-nickel sulphide system in the Duluth Complex, located immediately adjacent to the NewRange Copper Nickel's ("NewRange") NorthMet and Sunrise deposits (Figure 2). The Company believes Serpentine's scale, grade, geometry and strategic location make it one of the most compelling copper and other critical minerals development opportunities in the Duluth Complex, particularly with copper and nickel prices at or near multi-year highs. Serpentine hosts an Inferred Mineral Resource Estimate ("MRE") of 279.9 million tonnes at 0.37% Cu, 0.12% Ni, and 0.007% Co (0.53% CuEq), with an additional Indicated 21.6 million tonnes at 0.46% Cu and 0.16% Ni (0.69% CuEq), as disclosed in the Company's NI 43-101 Technical Report ("Technical Report") dated July 14, 2025, a copy of which may be obtained under the Company's profile at www.sedarplus.ca1.

Inferred mineral resources have a great amount of uncertainty as to their existence and as to whether they can be mined economically. It cannot be assumed that all or any part of the inferred mineral resources will ever be upgraded to a higher category. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

The Phase 1 program is designed to achieve three objectives:

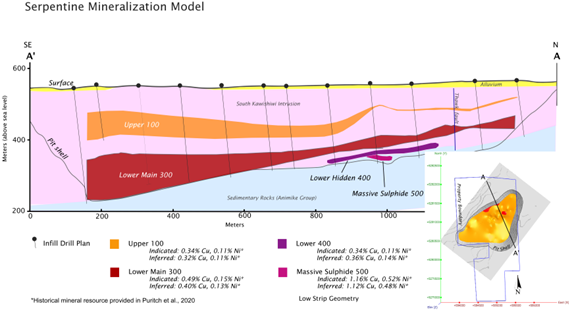

Test viability of the existing MRE, which, as noted above, is currently based on both indicated and inferred resources1 (Figure 3).

Test the overall copper-equivalent grade by examining the potential for indications of Platinum Group Metals ("PGM") and cobalt ("Co").

Position the Company toward completing a Preliminary Economic Assessment ("PEA") in respect of Serpentine within the next 18 months.

PROGRAM OVERVIEW

Planned Drilling: Phase 1 drilling planned for H2 2026: approximately 6 to 10 diamond core holes totaling ~2,000 to 2,500 meters.

Permitting: the Company is currently working with the Minnesota Department of Natural Resources on permitting of six new drill sites.

Execution Readiness: logistics and planning are advanced, with the Company targeting one rig for Phase 1 with Foraco, which are currently drilling at the Company's Titac Project.

Planned Drilling Depths: generally consistent with historical drilling (approximately 90 to >305m).

Technical Advancement: Down-hole geophysical surveys will be conducted, with the aim of improving confidence in structural interpretation, directing future exploratory drilling, and reducing uncertainty in targeting.

Dual-purpose Drilling: one or more holes may be designed to support hydrogeological monitoring following core recovery, providing a permitting and baseline study advantage. This approach is intended to support baseline data collection for future permitting and engineering studies.

Sampling: full multi-element assaying will be conducted, with the aim of improving CuEq and NSR reporting.

Systematic multi-element assaying and metallurgy planning: to evaluate potential for Copper Equivalent grade ("CuEq") upside through the potential inclusion of PGMs and cobalt, which are not included in the current MRE.

Strong technical de-risking advantage: shallow, low-strip geometry supported by geological modeling, plus downhole geophysical surveys and select dual-purpose core holes to be used as hydrogeology monitoring wells in support of future engineering and permitting work.

Inferred mineral resources have a great amount of uncertainty as to their existence and as to whether they can be mined economically. It cannot be assumed that all or any part of the inferred mineral resources will ever be upgraded to a higher category. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Figure 1. Map view of Green Bridge Metals properties (teal polygons) in Northeastern Minnesota, USA. Serpentine is located adjacent to NewRange Copper Nickel's Sunrise deposit.

Figure 2. Geologic map with known magmatic copper-nickel deposits (red) at, and adjacent to, the Property.

Figure 3: Simplified long-section schematic of Serpentine mineralization illustrating shallow, low-strip geometry and the Company's infill drill plan concept (black lines).

REFERENCES

1 Dufresne, M.B., et al. 2024. "Technical Report and Mineral Resource Estimate for the South Contact Zone Project, St Louis County, Minnesota, USA". Apex Geoscience Ltd. Edmonton, AB, Canada. Green Bridge Metals Corp. September 18, 2024.

QUALIFIED PERSON

Ajeet Milliard, Chief Geologist of Green Bridge Metals Corporation, is a Qualified Person as defined under National Instrument 43-101 and has reviewed and approved the scientific and technical information contained in this news release.

For a discussion of the Company's QA/QC and data verification procedures and processes, please see its most recently-filed Technical Report, a copy of which may be obtained under the Company's profile at www.sedarplus.ca.

About Green Bridge Metals Corporation

Green Bridge Metals Corporation is a Canadian-based exploration company focused on the acquisition and advancement of critical-mineral assets in established mining jurisdictions. Green Bridge's Minnesota property package hosts copper, nickel, cobalt, titanium, vanadium, and platinum group element mineralization associated with the Duluth Complex.

ON BEHALF OF GREEN BRIDGE METALS CORPORATION

"David Suda"

President and Chief Executive Officer

For more information, please contact:

David Suda

President and Chief Executive Officer

Tel: 604.928.3101

Email: investors@greenbridgemetals.com

Forward-Looking Information

Certain statements and information herein, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable securities laws.

Although management of the Company believe that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that forward-looking statements or information herein will prove to be accurate. Forward-looking statements in this news release include statements about: the Company's ability to complete its proposed drilling and other work programs; its ability to obtain required permits and regulatory approvals; the proposed scope and timing of expansion drilling programs; the timing and results (drill targets) from new core assay results; and the development of its properties. Forward-looking statements and information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These risk factors include, but are not limited to: locating mineral deposits is inherently risky; the exploration and development of the Company's mineral properties may not result in any commercially successful outcome for the Company; risks associated with the business of the Company; business and economic conditions in the mining industry generally; changes in general economic conditions or conditions in the financial markets; changes in laws (including regulations respecting mining concessions); and other risk factors as detailed from time to time.

The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws. Investors should not attribute undue certainty or place undue reliance on forward looking statements. Investors are urged to consider closely the disclosures in Green Bridge's annual and quarterly reports and other public filings, available at www.sedarplus.ca.

Certain figures and references contain information supported by public and corporate references that may have been updated, changed, or modified since their referenced date.

The Canadian Securities Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this news release.

SOURCE: Green Bridge Metals Corporation

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/green-bridge-metals-advances-plans-for-h2-2026-phase-1-drill-program-for-serpenti-1138115