Outcome October- December

Outcome October- December

- Net sales amounted to 297 (264) Ksek

- Profit after financial items amounted to -16 221(-6 167133) kSEK

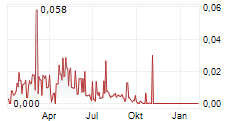

- Earnings per share before and after dilution: -0,21(-0,13) SEK

- Cash flow from operating and investing activities: -4 508 (-4 132) kSEK

Outcome January - December

- Net sales amounted to 1 877 (1 865) kSEK

- Profit after financial items amounted to -28 807(-19 665) kSEK

- Earnings per share before and after dilution: SEK -0,44(-0,67) SEK

- Cash flow from operating and investing activities: -20 135 (-18 650) kSEK

Significant events October - December

- Insplorion and MannTek sign a Letter of Intent.

- Insplorion announces management changes and initiates a strategic review.

- Insplorion provides an update regarding ATEX certification.

- Additional information regarding the follow-up order from Consilium Safety Group valued at SEK 720,000.

Significant events after the end of the period

- Insplorion has completed its strategic review and entered into an agreement in principle regarding the sale of its hydrogen sensor business to Mann Teknik AB for SEK 5.5 million.

Watch CEO Johan Rask comment and answer questions about the report at 2.00 pm February 18, 2026. Link to the meeting (Swedish).

A word from the CEO

During the end of 2025, it became clear that the hydrogen industry was entering a period of slowdown, which led to several projects being paused or delayed. This development also affected Insplorion's operations and contributed to the Board of Directors' decision to conduct a strategic review of the business which has resulted in a preliminary agreement in principle to divest our hydrogen sensor business to MannTek for 5.5 MSEK.

Despite external challenges, we remain confident in the future importance of hydrogen and the long-term potential of our sensor technology. However, to ensure the best possible conditions for continued development, we believe that a transfer to MannTek is the the best way forward.

MannTek is a well-known Swedish company with international recognition in areas including hydrogen, and has three decades of experience in fuel handling, with proprietary innovations supporting the safe, automated, and spill-free transfer of hydrogen. As part of MannTek, Insplorion's hydrogen business will gain further opportunities to position themselves as a safe and reliable supplier within the hydrogen sector.

Negotiations are currently underway regarding a binding agreement with MannTek, which subsequently will be subject to approval at an extraordinary general meeting. MannTek also intends to assume responsibility for personnel and premises associated with the business.

Insplorion's work on ATEX certification for the hydrogen detector NPS-P2 is in full progress following the conclusion of collaboration in Q4 with the Swedish state research institute, RISE. A new certification body has taken over, and we expect the final product test report in March or April of the current year. Following this the certification body will audit our Quality Management System before final ATEX approval can be issued.

At the same time, we are focusing on further developing and realizing remaining business values, including research instruments based on NanoPlasmonic Sensing technology and our position on Nasdaq First North Growth Market. The instrument platform has a long history of use and a strong scientific foundation, creating opportunities for strategic partnerships or a reversed merger.

I would like to extend my sincere thanks to our employees, partners, and shareholders for your commitment and patience. Despite a challenging situation, we remain focused on developing solutions that create value.

Gothenburg, Sweden

February 2025

Johan Rask, CEO

The report is also available on the company website at the IR-page.

Questions are answered by:

Johan Rask, CEO

+46 705 08 46 00, johan.rask@insplorion.com

About Insplorion

Insplorion's vision is to use sensor technology for an accelerated transition to a sustainable future. With its unique sensor platform NanoPlasmonic Sensing (NPS), Insplorion operates within two fields; hydrogen sensors and research instruments. The hydrogen sensors enable safe and efficient deployment of hydrogen infrastructure through its unique benefits in detection speed, selectivity and ability to function in environments where many sensor technologies cannot. Our instruments give scientists around the world real time data within battery research and surface processes in fields like catalysis, material- and life science. Redeye Sweden AB is Insplorion's Certified Adviser on Nasdaq First North Growth Market.

Insplorion AB¦ Arvid Wallgrens backe 20 ¦413 46 Göteborg¦ Sweden ¦ 46-(0)31 380 26 95 ¦ www.insplorion.com ¦ info@insplorion.com