Mitteilung der Iute Group AS:

Iute Group Reports Unaudited Results for 12M/2025

Transformation into Digital Bank OngoingSTRATEGIC HIGHLIGHTS

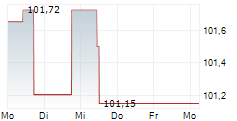

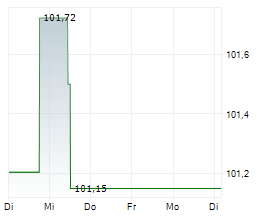

- Data-driven credit decisioning enhanced portfolio quality, improved loan pricing discipline and supported margin stability in a higher interest rate environment. - AI-driven product bundling and value proposition to the right person in the right time drives revenue growth; revenue per customer (LTM) increased 6,7% to 461 EUR (12M/2024: 432 EUR), reflecting deeper product integration and higher ecosystem engagement, while active customer base is up 4,5% to 274 thousand (31 Dec. 2024: 262 thousand). - Non-lending revenue streams (wallet services and digital insurance intermediation) continued to grow above lending business. - SEPA Credit Transfer certification for IutePay Bulgaria unlocks scalable IBAN-to-IBAN payments across all Iute markets and enhances cross-border transaction capabilities with the wallet ecosystem. - Successful early partial refinancing (around 78 million EUR) of EUR 2021/2026 Bonds (125 million EUR) through issuance of EUR 2025/2030 Bonds (160 million EUR), extending maturity profile, strengthening financial flexibility and supporting long-term growth - Refinancing activities for remaining EUR 2021/2026 Bond to commence in early 2026.OPERATIONAL HIGHLIGHTS

- Loan payouts increased by 13,6% to record level of 424,6 million EUR (12M/2024: 376,5 million EUR), while underwriting standards ...Den vollständigen Artikel lesen ...© 2026 Anleihen Finder GmbH