Catena has signed an agreement to acquire a portfolio of logistics properties from Urban Partners for approximately SEK 8,8 billion. The portfolio comprises 20 properties in Sweden, Denmark and Finland.

19 February 2026 5:00 p.m. CET

On 22 December 2025, Catena announced that a letter of intent relating to the acquisition had been signed. Following the usual due diligence, the parties have now signed an acquisition agreement. The vendor is Urban Partners on behalf of its funds NIP, NSF III, NSF IV och NSF V.

The lettable area in the portfolio acquired totals 612,000 m². The land area amounts to just over 1,300,000 m², of which approximately 70,000 m² consists of building rights. The acquisition is being undertaken as a corporate transaction with an underlying property value of approximately SEK 8,8 billion, subject to deductions for deferred tax. The acquisition is being financed with internal funds and external credit facilities.

The tenants in the portfolio acquired include companies such as Dagab, Dahl and Tokmanni. The occupancy rate is approximately 96.5 percent, and the average lease term is approximately 11 years. The properties in the portfolio are expected, fully let, to generate total annual net operating income of approximately SEK 483 million.

"Catena's position in the Nordic logistics property market is now even stronger and we are pleased to be moving into Finland. The acquisition improves our range of high-quality modern properties and expands both our geographical presence and our customer base. We are looking forward to getting to know the customers that operate in the facilities and we hope to enter into rewarding partnerships in which we can support their needs and develop together," says Catena's CEO, Jörgen Eriksson.

The Swedish logistics properties in the acquisition represent a value of SEK 6,45 billion and a total lettable area of 444,000 m². The portfolio acquired also includes a Danish logistics property with a value of SEK 250 million and a total lettable area of 15,500 m². The properties in Finland, which is a new market for Catena, represent a value of SEK 2,1 billion and a total lettable area of 152,500 m².

The transfer date is 1 April 2026. The acquisition also means that Catena's four regions will become five with the addition of Region Finland (this will be reflected in the segment reporting from 1 April 2026).

For further information, please contact:

Jörgen Eriksson, CEO, tel. +46 (0)730 70 22 42, jorgen.eriksson@catena.se

Magnus Thagg, CFO, tel. +46 (0)70 425 90 33 magnus.thagg@catena.se

Johan Franzén, Head of Property, tel. +46 (0)73 089 9282 johan.franzen@catena.se

Follow us: catena.se / LinkedIn

Overview, properties acquired in Sweden

| Property | Municipality |

| Lundby 2:11 | Håbo |

| Viby 19:1 | Upplands-Bro |

| Hagalund 1:34 | Enköping |

| Hagalund 1:35 | Enköping |

| Tveta-Valsta 4:10 | Södertälje |

| Aspestahult 1:9 | Eskilstuna |

| Mobilkranen 7 | Örebro |

| Stödstorp 2:35 | Vaggeryd |

| Örja 1:23 | Landskrona |

| Kronan 5 | Landskrona |

| Hyllinge 36:326 | Åstorp |

| Kronoslätt 1:11 | Staffanstorp |

Overview, properties acquired in Finland

| Property | Municipality |

| Moreenikatu 5 | Mäntsälä |

| Ilvesvuorenkatu 8 | Nurmijärvi |

| Rahtiraitti 11 | Sipoo |

| Kurikantie 200 | Pirkkala |

| Kurikantie 202 | Pirkkala |

| Aviatie 2 | Turku |

| Polarpakintie 4 | Hämeenlinna |

Overview, properties acquired in Denmark

| Property | Municipality |

| Køge Egedesvej | Køge |

This is information that Catena AB (publ) is obliged to publish under the EU Market Abuse Regulation (MAR) 596/2014. The information was provided by the above contacts for publication at the aforementioned time.

About Catena

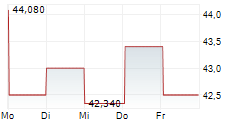

Catena is a listed property company that sustainably develops and durably manages efficient logistics facilities through collaboration. Its strategically located properties supply the Scandinavian metropolitan areas and are adapted for both current and future flows of goods. The overarching objective is to generate a strong cash flow from operating activities to enable sustainable growth and stable returns. As of 31 December 2025, the properties had a total value of SEK 44.5 billion. Catena shares are traded on NASDAQ Stockholm, Large Cap.