SLOUGH (dpa-AFX) - SEGRO PLC (SGRO.L), a British real estate investment trust, on Friday reported a rise in revenue for the full year, helped by increased rental income. In addition, the company has increased its total annual dividend.

For the 12-month period to December 31, 2025, SEGRO recorded a pre-tax income of GBP 560 million, less than GBP 636 million last year. Excluding items, pre-tax profit improved to GBP 509 million from GBP 470 million a year ago.

The Trust posted net earnings of GBP 551 million, or 40.7 pence per share, compared with GBP 594 million, or 44.7 pence per share, in the previous year. Adjusted profit was GBP 495 million, or 36.5 pence per share, higher than GBP 458 million, or 34.4 pence per share, in 2024.

Operating profit slipped to GBP 663 million from GBP 703 million a year ago. Realized and unrealized property gains plunged to GBP 55 million from the previous year's GBP 195 million.

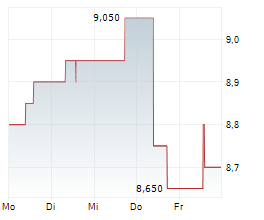

Assets under management moved up to GBP 22.004 billion from last year's GBP 20.296 billion. Net asset value per share increased to 906 pence from 889 pence per share a year ago. Excluding items, net asset value per share stood at 925 pence per share as against the prior year's 907 pence per share.

Revenue was GBP 726 million, up from GBP 675 million in the previous year. Net rental income stood at GBP 543 million, higher than GBP 500 million last year.

For 2025, SEGRO will pay a final dividend of 21.4 pence per share on May 8 to shareholders of record as of March 27. This final dividend will bring the total annual dividend for the year to 31.1 pence per share, higher than the 29.3 pence per share of 2024.

Copyright(c) 2026 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2026 AFX News