VANCOUVER, BC / ACCESS Newswire / April 7, 2025 / (TSX.V:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce an update to the mineral reserve and resource estimates on the Ermitaño gold mine in Sonora, Mexico, provided by mine operator First Majestic Silver Corp. ("First Majestic")1 Orogen holds a cash-flowing 2% net smelter return ("NSR") royalty on the 167 square-kilometre Ermitaño concession.

Highlights of 2024 Resource and Reserve update

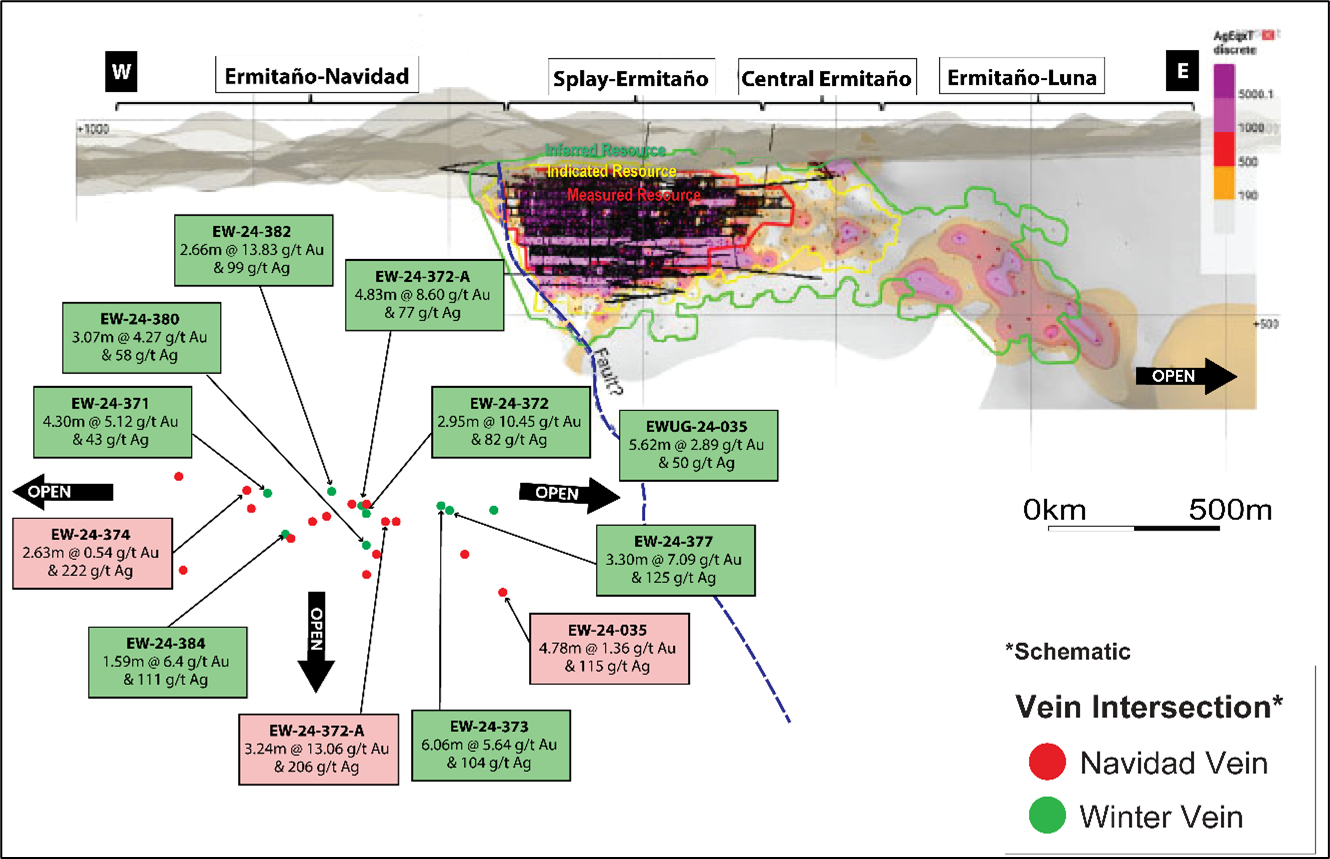

Initial Inferred resources for the Navidad vein system of 2.3 million tonnes consisting of 5.9 million ounces of silver and 249,000 ounces of gold at grades of 81 grams per tonne (g/t) and 3.42 g/t respectively.

Only a portion of the delineated vein system at Navidad has been estimated, with significant growth potential.

Several areas of mineralization within the Ermitaño mine complex remain open including the Luna vein to the east and the Navidad and Winter veins in multiple directions.

Paddy Nicol, Orogen's CEO, commented, "The initial Inferred resource at Navidad represents an exciting development for Orogen's producing royalty on the Ermitaño Mine, with the announced update increasing contained gold in the Inferred category by 260% year on year. The Navidad resource represents only a portion of the newly delineated vein system with 55,000 metres of drilling planned in 2025 to further test the upside potential of the area."

About the Ermitaño and Navidad Veins

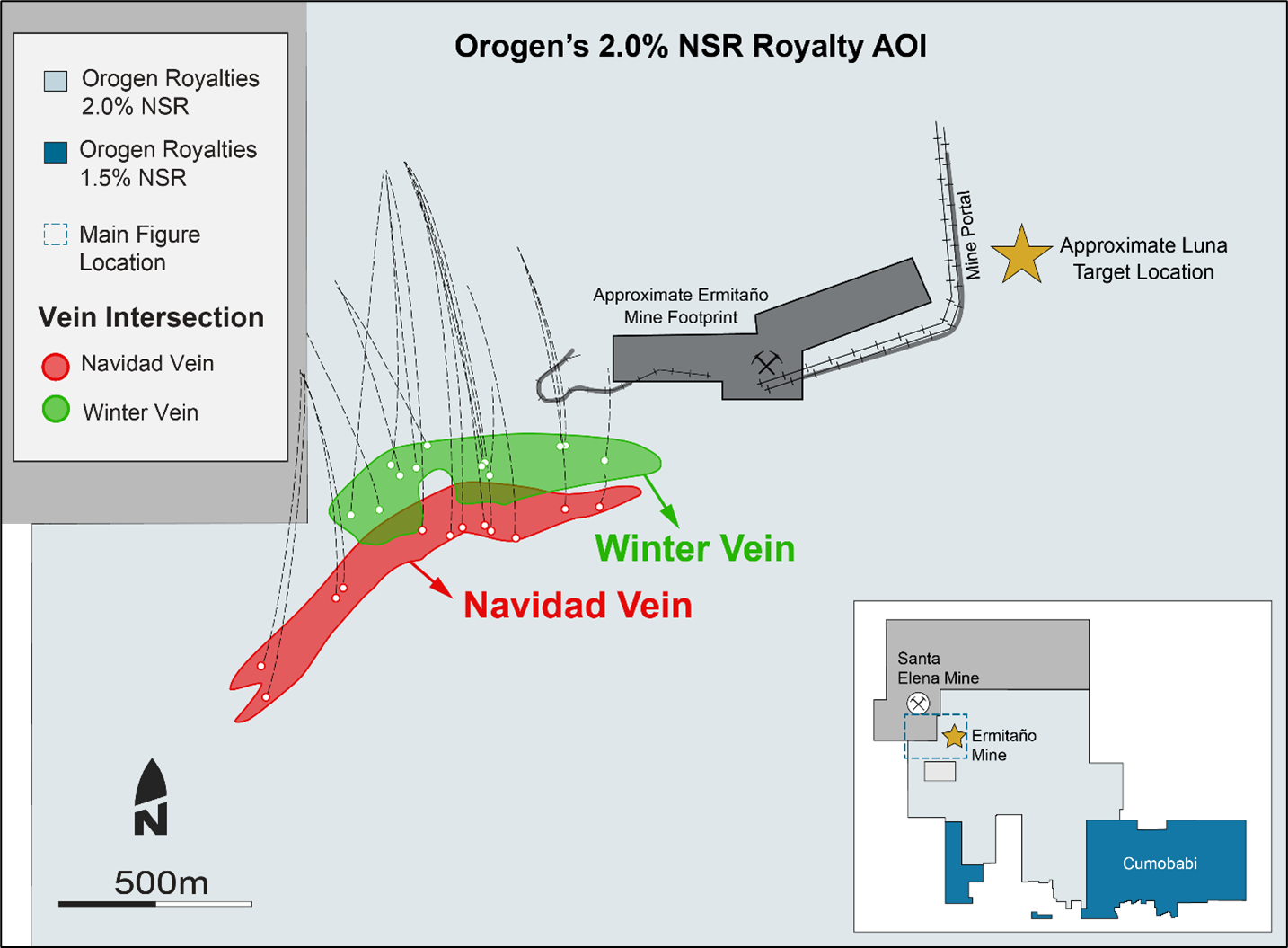

The 167 square-kilometre Ermitaño mining concession is located in Sonora, Mexico approximately 150 kilometres northeast of Hermosillo. Ermitaño is contiguous with the Santa Elena mining claims both owned and operated by First Majestic. (Figure 1).

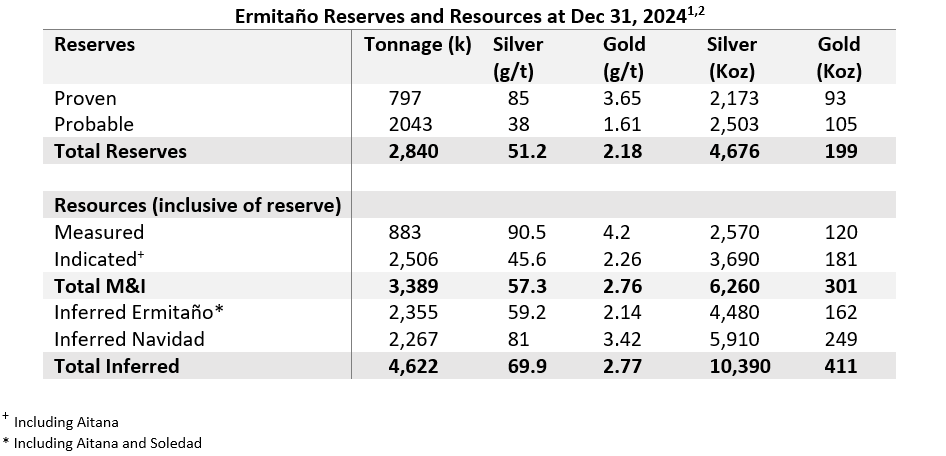

The Ermitaño vein was discovered in 2016 and developed into a producing underground mine at the end of 2021. Exploration drilling by First Majestic in 2021 identified the Luna vein to the east of the Ermitaño mine and, in 2023, the Navidad vein system to the west (Figure 1), both of which have been included in the 2024 resources. Current reserves and resources are as follow:

From December 31, 2023 to December 31, 2024, the Measured and Indicated resource estimate decreased by 41,000 ounces of contained gold and 6.4 million ounces of contained silver primarily due to mineral depletion, partially offset by infill drilling, changing metal prices, and metallurgical recoveries. The Inferred resource estimate increased by 2.57 million tonnes of ore, 257,000 ounces of contained gold and 6.11 million ounces of contained silver primarily related to discovery and first-time reporting of the Navidad resource.

Mineralization in the Luna vein remains open to the east and the Navidad and Winter veins remain open in multiple directions with several drill rigs active on the Ermitaño concession.

Mine complex and the Navidad and Winter vein system. 2

Qualified Person Statement

All new technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo., Vice President of Exploration for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

Certain technical disclosure in this release is a summary of previously released information and the Company is relying on the interpretation provided by the relevant company. Additional information can be found on the links in the footnotes or on SEDAR+ (www.sedarplus.ca).

About Orogen Royalties Inc.

Orogen Royalties is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver Mine in Sonora, Mexico (2.0% NSR royalty) operated by First Majestic Silver Corp. and the Expanded Silicon Project (1.0% NSR royalty) in Nevada, U.S.A, being advanced by AngloGold Ashanti NA. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President, Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

info@orogenroyalties.com

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Although the Company believe the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

https://www.firstmajestic.com/investors/news-releases/first-majestic-announces-2024-mineral-reserve-and-mineral-resource-estimates

https://www.firstmajestic.com/investors/presentation/

SOURCE: Orogen Royalties Inc.