DJ Exit and Portfolio Update

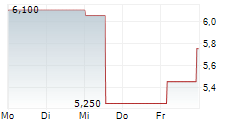

Molten Ventures Plc (GROW; GRW)

Exit and Portfolio Update

09-Apr-2025 / 08:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

Molten Ventures plc

("Molten Ventures", "Molten", "the "Group" or the "Company")

Exit and Portfolio Update

Molten Ventures (LSE: GROW, Euronext Dublin: GRW), a leading venture capital firm investing in and developing

high-growth digital technology businesses, notes the announcement that ZOZO, Inc., which operates the leading fashion

e-commerce platform in Japan, has acquired portfolio company Lyst, a leading global fashion shopping platform.

Molten first invested in Lyst's Series A in 2012, with follow-on investments in 2014, 2015 and 2021 during its Series

B, C and E funding rounds. Lyst has entered into a definitive agreement to be acquired by ZOZO, Inc. for USD154 million.

The transaction is expected to complete before the end of April 2025, delivering expected proceeds of c.GBP9 million to

Molten, 7% above the last reported Net Asset Value (NAV).

In addition, the previously announced sale of Freetrade completed in the new financial year on 1 April 2025 following

regulatory approval. The closing of these two transactions ensures Molten starts FY26 with good momentum and a combined

c.GBP30 million of realisation proceeds from exits above the latest reported NAV in both Lyst and Freetrade.

Total realisation proceeds for FY25 equated to c.GBP135 million (excluding Freetrade as the proceeds were received in

FY26). These realisations were delivered at an average Multiple on Invested Capital of 1.8x, inclusive of exits from

M-Files, Endomag, Perkbox, Graphcore and a partial realisation of Revolut, the latter of which generated proceeds of

c.GBP7 million as part of a company-led secondary transaction at a headline valuation of USD45 billion, 25% above the last

reported NAV.

The strong level of realisations, comfortably exceeding the original guidance provided of GBP100 million, has enabled the

Group to complete a GBP15 million buyback in FY25 and to extend that programme by a further GBP15 million, significantly

exceeding the initial guidance of a minimum of 10% of realisation proceeds being allocated toward share buybacks.

The Group will continue to review capital allocation, balancing the pipeline of new investment opportunities with the

ability to drive returns to shareholders through share buyback programmes, while maintaining sufficient reserves.

Molten will release its full year trading update for the 12 months ended 31 March 2025 (FY25) on 24 April 2025, which

will include an updated Gross Portfolio Value (unaudited) and commentary on recent portfolio developments.

Ben Wilkinson, Chief Executive Officer of Molten Ventures, commented:

"We have a strong portfolio of assets and we actively manage the growth of our portfolio alongside a robust realisation

process. Turning investment value to cash at the right time demonstrates our diligent portfolio management and aligns

with our strategy of preserving a strong balance sheet while providing liquidity.

We've worked closely with the team at Lyst since 2012, helping the company evolve into a leader in fashion technology.

Along with the completion of the Freetrade exit this marks a strong start to realisations in FY26, building on the

positive momentum of exits at or above NAV in FY25."

-ENDS-

Enquiries

Molten Ventures plc

+44 (0)20 7931 8800

Ben Wilkinson (Chief Executive Officer)

ir@molten.vc

Andrew Zimmermann (Chief Financial Officer)

Deutsche Numis

Joint Financial Adviser and Corporate Broker

Simon Willis +44 (0)20 7260 1000

Jamie Loughborough

Iqra Amin

Goodbody Stockbrokers

Joint Financial Adviser and Corporate Broker

Don Harrington +44 (0) 20 3841 6202

Tom Nicholson

William Hall

Sodali

+44 (0)7970 246 725/

Public relations

+44 (0)771 324 6126

Elly Williamson

molten@sodali.com

Jane Glover About Molten Ventures

Molten Ventures is a leading venture capital firm in Europe, developing and investing in high growth technology companies.

It invests across four sectors: Enterprise & SaaS; AI, Deeptech & Hardware; Consumer; and Digital Health & Wellness with highly experienced partners constantly looking for new opportunities in each.

Listed on the London Stock Exchange and Euronext Dublin, Molten Ventures provides a unique opportunity for public market investors to access these fast-growing tech businesses, without having to commit to long term investments with limited liquidity. Since the IPO in June 2016, Molten has deployed over GBP1bn capital into fast growing tech companies and has realised over GBP600m to 30 September 2024.

For more information, go to https://investors.moltenventures.com/investor-relations/plc

----------------------------------------------------------------------------------------------------------------------- Dissemination of a Regulatory Announcement, transmitted by EQS Group. The issuer is solely responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BY7QYJ50 Category Code: MSCU TIDM: GROW; GRW LEI Code: 213800IPCR3SAYJWSW10 OAM Categories: 3.1. Additional regulated information required to be disclosed under the laws of a Member State Sequence No.: 381554 EQS News ID: 2113582 End of Announcement EQS News Service =------------------------------------------------------------------------------------

Image link: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=2113582&application_name=news&site_id=dow_jones%7e%7e%7ef1066a31-ca00-4e1a-b0a4-374bd7d0face

(END) Dow Jones Newswires

April 09, 2025 03:00 ET (07:00 GMT)