BRUSSELS (dpa-AFX) - UK stocks are down in negative territory on Wednesday, snapping a four-session winning streak, due to renewed trade tensions following U.S. restrictions on Nvidia chip exports to China.

Some disappointing updates, including from ASML, Nvidia and Bunzl are also weighing on sentiment.

Data showing a smaller than expected increase in U.K.'s consumer price inflation in March is limiting market's downside.

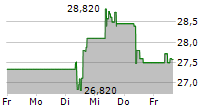

The benchmark FTSE 100 was down marginally by 14.74 points or 0.18% at 8,234.38 a little while ago. The index was down more than 70 points at 8,176.11 earlier in the session.

Bunzl Plc shares are plunging nearly 25%. The specialist distribution and services Group reported significantly lower adjusted operating profit in its first quarter, despite slightly higher revenues. The first-quarter profit was below expectations, and the company reduced its fiscal 2025 guidance.

In its update on trading for the period since December 31, the company reported that Group revenue in the first quarter increased 0.8% on a reported basis and 2.6% at constant exchange rates. Meanwhile, underlying revenue declined 0.9%.

Adjusted operating profit was down significantly year-on-year in the first quarter, reflective of an operating margin decline driven by performance in North America and Continental Europe, the company said.

Informa, Intermediate Capital Group, Diploma, Intercontinental Hotels, WPP, JD Sports Fashion, Rolls-Royce Holdings, IMI and Rentokil Initial are down 2 to 4%.

WH Smith shares are down more than 3%. The group posted a first-half loss before tax of 42 million pounds compared to profit of 28 million pounds, last year. Loss per share was 33.6 pence compared to profit of 13.0 pence.

Anglo American Plc, Standard Chartered, Smith & Nephew, Ashtead Group and Spirax Group are also notably lower.

Endeavour Mining is gaining nearly 7%. Coca-Cola Europacific Partners, Fresnillo, Vodafone Group, Coca-Cola HBC, Barrat Redrow, Associated British Foods, Centrica, Severn Trent and BP are gaining 1.3 to 2.4%.

In economic news, data from the Offie for National Statistics said UK consumer price inflation weakened more than expected to a three-month low in March ahead of an increase in energy bills in April.

Consumer prices registered an annual growth of 2.6%, slower than the 2.8% increase in February. Prices were forecast to climb 2.7%.

Core inflation that excludes prices of energy, food, alcohol and tobacco, weakened to 3.4%, in line with expectations, from 3.5% in the previous month.

On a monthly basis, the consumer price index rose 0.3% in March compared with an increase of 0.4% in February. Inflation was seen unchanged at 0.4%.

The fall in CPI inflation in March won't be sustained for long, with inflation set to rise to around 3.5 percent in the coming months, Capital Economics economist Ruth Gregory said.

But a weak economy will quash inflation eventually and that the tariff shock has tilted the balance of risks towards lower inflation and faster falls in interest rates, the economist noted.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News