Toronto, Ontario--(Newsfile Corp. - April 28, 2025) - Volta Metals Ltd. (CSE: VLTA) (FSE: D0W) ("Volta" or the "Company") is pleased to announce that, further to the press release issued on February 27, 2025, the Company is satisfied with its due diligence on the Springer-Lavergne Rare Earth and Gallium Project (the "Project") and expects to enter into a definite agreement for the acquisition Project (the "Definitive Agreement") before the end of May 2025. The Company has agreed to revised terms that will be reflected in the Definitive Agreement. The updated terms of the proposed acquisition of the Project (the "Acquisition") are as follows:

In order to earn-in an 80% interest in the Project, Volta must:

On closing of the Acquisition, make a cash payment of $100,000 and issue 10,000,000 common shares of Volta to the vendor, RZJ Capital Management LLC (the "Vendor"), and pay $220,400 (80% of the $275,500) to the surface rights owners of certain of the core Project claims ("Surface Right Owners"), as per the underlying option agreement (the "Underlying Agreement") to which the Vendor acquired an interest in a portion of the Project. The Vendor shall be obligated to pay $55,100 or 20% of the total to the Surface Rights Owner on closing;

on the first anniversary of the execution of the Definitive Agreement, pay $265,600 (80% of the $332,000) to the Surface Rights Owners and issue 2,500,000 common shares of Volta to the Vendor. The Vendor shall be obligated to pay $111,600 to the Surface Rights Owner on first anniversary of the execution of the Definitive Agreement; and

on the second anniversary of the execution of the Definitive Agreement, pay $265,600 (80% of the $332,000) to the Surface Rights Owners and issue 2,500,000 common shares of Volta to the Vendor and make a cash payment equal to the prior expenditures on the Project by the Vendor, estimated to be approximately $200,000. The Vendor shall be obligated to pay $111,600 to the Surface Rights Owner on second anniversary of the execution of the Definitive Agreement.

The payments of Volta and the Vendor to the Surface Rights Owners as detailed above will satisfy the payments owed to the Surface Rights Owners under the Underlying Agreement.

Volta shall have the right to acquire the remaining 20% interest in the Project at any time prior to 90 days following a feasibility on the Project for the fair market value of such remaining interest.

Certain claims which comprise the Project are subject to a 2.85% net smelter returns royalty, with one-third of such royalty (0.95%) purchasable for $950,000. In addition, Volta will grant a 2% net smelter returns royalty in favour of the Vendor on the claims not owned by the Surface Rights Owners, with a 1% buyback at Volta's option for $1,000,000.

The Project consists of 5,000 hectares of patented and non-patented claims, and contains a historic NI 43-101 mineral resource for Total Rare Earth Oxides ("TREO") of 4.167mt at 1.073% TREO indicated resource using a 0.9% cutoff and 12.73mt at 1.119% TREO in the inferred category at a cut off of 0.9%.

Project Highlights

- Advanced Rare Earth Project with associated high-grade Gallium, near Sturgeon Falls, Ontario (see Figure 1 below).

- 5,000 Ha property with patented claims covering the known deposit, and unpatented claims covering potential extensions to the east and west.

- Paved road access (1 hour from Sudbury) with advanced infrastructure (rail, road, hydroelectric power).

- Multiple wide, shallow intercepts of +100m at >1% TREO, including 12m at 5% TREO in one of the final drill holes, which remains open at depth and along strike.

- Consistent elevated Gallium intercepts ranging from 57 to 120 ppm, over thick intervals, including 87.5m at 76.4 ppm and 88m at 62 ppm gallium.

- Historic initial laboratory scale metallurgical test work indicating the potential to produce an upgraded Light Rare Earth concentrate.

- Geophysics defines several large anomalies, that were never tested.

The mineral resource, based on 22 diamond drill holes, was estimated by the Ordinary Kriging interpolation method on uncapped grades for all 15 Rare Earth Oxides (TREO). The TREO% is a sum of the 15 individual interpolations of the REOs. The resource estimate was prepared using a single interpreted domain using a grade shell of 0.31 TREO%. A cut-off grade of 0.9 TREO% was chosen for the deposit resource estimate based on comparable deposits at the time. No recoveries have been applied to the interpolated estimates. Volta Metals is unaware of any other work having been completed on the project since the 2012 mineral resource estimate.

The resource estimate presented for the Springer-Lavergne Project is historic in nature. Volta's qualified person has not completed sufficient work to confirm the results of the historical resource. Volta is not treating this as a current mineral resource but is considering it relevant as a guide to future exploration and is included for reference purposes only, however Volta has no reason to believe that the mineral resources estimate contained is not relevant or reliable as of the date hereof. Further drilling will be required by Volta to verify the historic estimate as current mineral resources.

There is no certainty that the parties will be able to conclude the agreement on the Project. The existing letter of intent is non-binding and neither the Company nor the vendor is under any obligation to enter into, or continue negotiations regarding, the definitive agreement or to proceed with the transaction. There can be no assurances that any component of the transaction will proceed, nor can there be any assurance as to the final definitive terms thereof.

Figure 1. Location of Springer-Lavergne Rare Earth Project in Ontario

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9598/250047_5721d0520439bb23_001full.jpg

On April 4, China's Ministry of Commerce imposed export restrictions on seven rare earth elements (REEs) and magnets used in the defense, energy, and automotive sectors in response to U.S. President Donald Trump's tariff increases on Chinese products. The new restrictions apply to 7 of 17 REEs-samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium.

Financing Update

Volta's private placement, as previously announced on January 30, 2025 and February 27, 2025 (the "Offering") is now expected to close by or around the end of May, concurrent with the signing of the Definitive Agreement. The Offering will be comprised of the issuance of units of the Company (each, a "Unit"), at a subscription price of $0.05 per Unit. Each Unit will be comprised of one common share of the Company (each, a "Share") and one-half of one common share purchase warrant of the Company (each whole warrant, a "Warrant"), with each Warrant entitling the holder thereof to purchase an additional Share of the Company (a "Warrant Share") at an exercise price of $0.10 per Warrant Share for a period of 24 months from the closing of the Offering.

The Offering is subject to certain closing conditions including, but not limited to, the receipt of all necessary approvals, including the acceptance of the CSE.

The securities issued under the Offering will be subject to a statutory hold period in Canada of four months and a day from the date of issuance in accordance with applicable securities laws.

Claims Option

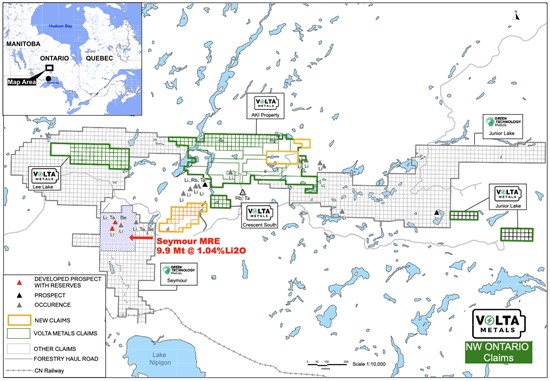

The Company is pleased to announce that it has acquired additional mineral claims strategically located along the Seymour-Caribou Lithium trend along its Aki Project in northwestern Ontario (Figure 2) (the "Claims"). The Claims will be acquired pursuant to an Option Agreement between Volta and the Optionors (the "Claims Vendor") dated April 27, 2025 (the "Claims Acquisition"). The newly acquired Claims account for a total surface area of 1,642 hectares and are partly contiguous to the Company's Aki Critical Minerals project, resulting in one larger land package within the Seymour-Falcon Lithium Belt. Upon closing of the Claims Acquisition, the Company will own a 100% interest of these newly acquired Claims and will grant the vendors a 1.5% net smelter returns royalty, which the Vendor, may purchase half a percent of the Royalty (or 0.5%) at any time in consideration of a cash payment of $400,000 to the Vendor.

Figure 2. Newly optioned claims in relation to Company's claims

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9598/250047_5721d0520439bb23_002full.jpg

The Company will pay $58,000 in cash over 4 years and issue 400,000 common shares in its capital to the Claims Vendor of the newly acquired claims. Company will pay $12,000 in cash on closing, and issue 400,000 shares to the vendors. The rest will be paid on each year anniversary, $12,000, $14,000 and $20,000 respectively. This will provide the Company with additional ground to explore within the highly prospective greenstone belt. The common shares will be subject to a four-month hold period under applicable securities laws in Canada.

Qualified Person

The technical content of this news release has been reviewed and approved by Andrew Tims, P.Geo., who is an independent Qualified Person (QP) as defined in National Instrument 43-101, Standards of Disclosure for Mineral Projects. The QP and the Company have not completed sufficient work to verify the historical information mentioned in this news release.

For more information about the Company, view Volta's website at www.voltametals.ca.

ABOUT VOLTA METALS LTD.

Volta Metals Ltd. (CSE: VLTA) (FSE: D0W) is a mineral exploration company based in Toronto, Ontario, focused on gallium, lithium, cesium, and tantalum. It has optioned and is currently exploring a critical minerals portfolio of lithium, cesium, and tantalum projects in northwestern Ontario, considered one of the world's most prolific, emerging hard-rock lithium districts. To learn more about Volta and its flagship Aki Project, please visit www.voltametals.ca.

ON BEHALF OF THE BOARD

For further information, contact:

Kerem Usenmez, President & CEO

Tel: 416.919.9060

Email: info@voltametals.ca

Website: www.voltametals.ca

Neither the CSE nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements relating to product development, plans, strategies, and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects" and similar expressions. All statements other than statements of historical fact included in this news release are forward-looking statements that involve risks and uncertainties. Forward-looking information in this news release includes, but is not limited to, the timing and anticipated completion of the Acquisition, the entering into of the Definitive Agreement, regulatory approvals for the Acquisition, that the Acquisition is transformative for Volta, statements regarding the Acquisition and Offering, including the maximum size of the Offering, the expected timing to complete the Offering and Acquisition, the ability to complete the Offering or the Acquisition on the terms provided herein or at all, the anticipated use of the net proceeds from the Offering, the receipt of all necessary approvals, the Company's planned exploration activities and the Company's aim to prevent and minimize impacts on the First Nations through a variety of mitigation measures and offsetting benefits. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include: that the Company may not enter into the Definitive Agreement, that due diligence with respect to the Acquisition will not be favourable, that the Acquisition may not be consummated, the risks detailed from time to time in the filings made by the Company with securities regulators; the fact that Volta's interests in the Property are options only and there are no guarantee that such interest, if earned, will be certain; the future prices and demand for lithium; and delays or the inability of the Company to obtain any necessary approvals, permits and authorizations required to carry out its business plans. The reader is cautioned that assumptions used in the preparation of any forward-looking statements may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking statements. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, other than as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/250047

SOURCE: Volta Metals Ltd.