Financial information of the First Quarter 2025

PAREF remains focused on its European growth

As at March 31, 2025, PAREF's consolidated revenue amounts to €5.9 million. The quarter was highlighted by:

Resilient management activity in a challenging market:

- Management fees increased by 2% compared to the same period in 2024, mainly thanks to fund management, illustrating the strength of this business;

- Subscription fees decreased by -21%, against a backdrop of still weak inflows in the market, but with ongoing initiatives to enter a new phase in 2025.

Gross rental income with decrease impacted by:

- Disposals carried out in 2024 and 2025, including the sale of the warehouse located in Aubergenville (78) in February 2025 as part of the disposal program, at a net selling price in line with the latest valuation,

- Rent-free period granted as part of the lease extension for Franklin Tower in La Défense,

- Ongoing leasing activity of Tempo asset in Paris.

This decrease in rental income is partially balanced by rental indexation.

The consolidation of the rental situation of the Franklin Tower, with the retention of a tenant on the 25th floor for more than 1,000 sqm under the same financial conditions, contributed to maintaining the WALB of the portfolio to 4.87 years, compared to 4.85 years at 2024 year end.

| Revenues (in € Mn ) | Q1 2024 | Q1 2025 | Variation in % |

| Gross rental income[1] | 2.2 | 1.3 | -39% |

| Commissions | 4.7 | 4.6 | -3% |

| -of which. management commissions | 3.8 | 3.9 | 2% |

| -of which subscription commissions | 0.9 | 0.7 | -21% |

| Total | 6.9 | 5.9 | -14% |

Development of the third-party asset management:

- Management of the strategic mandate signed with Parkway Life REIT at the end of 2024, for the acquisition and management of a portfolio of 11 nursing homes over a 5-year period;

- Building permit obtained for the NAU! project in Frankfurt, an iconic 34,800 sqm mixed-use urban concept reaffirming the responsible and long-term commitment of PAREF Group in the heart of one of European economic centers;

- PAREF Gestion has entered the "Excellent" category in 2025 ranking of the best SCPI management companies by Décideurs Magazine, reflecting the quality of its management.

PAREF Group is entering a phase of targeted investment and growth, strengthening our local expertise and diversifying our sources of income. In a fast-changing real estate landscape, we rely on three strategic pillars: solid fundamentals driven by disciplined operations, a long-term vision focused on sustainable and high-performance assets, and a dynamic European expansion through trusted local partnerships. Our ambition is clear: to position PAREF as a leading real estate asset manager in Europe, delivering responsible and lasting value.

Antoine Castro

President & CEO of PAREF

Despite the market environment, our funds have delivered solid and stable performances, confirming the relevance of our management decisions and the continued involvement of our teams. In 2025, we will continue to support our development operations in France and Europe, with a strong focus on sustainable, high-performance real estate in line with the evolving needs of users.

Anne Schwartz

Deputy Chief Executive Officer of PAREF and Chief Executive Officer of PAREF Gestion

Financial Agenda

May 22, 2025: Annual General Meeting of Shareholders

July 29, 2025: 2025 Half-Year results

About PAREF Group

PAREF is a leading European player in real estate management, with over 30 years of experience and the aim of being one of the market leaders in real estate management based on its proven expertise.

Today, the Group operates in France, Germany, Italy, and Switzerland and provides services across the entire value chain of real estate investment: investment, fund management, renovation and development project management, asset management, and property management. This 360° approach enables the Group to offer integrated and tailor-made services to institutional and retail investors.

The Group is committed to creating more value and sustainable growth and has put CSR concerns at the heart of its strategy. As at December 31, 2024, PAREF Group manages over €3 billion AUM.

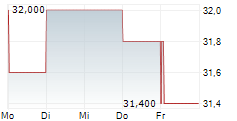

PAREF is a company listed on Euronext Paris, Compartment C, under ISIN FR0010263202 - Ticker PAR.

More information on www.paref.com

Press Contacts

| PAREF Group Samira Kadhi +33(7) 60 00 59 52 samira.kadhi@paref.com | Agence Shan Alexandre Daudin / Aliénor Kuentz +33(6) 34 92 46 15 / +33(6) 28 81 30 83 paref@shan.fr |

[1] Excluding reinvoiced rental charges

- SECURITY MASTER Key: yJiflZxmlmnHnXBtYZebZmhnmJuWmWjHbWiYlpOaZcfFbZ5hlmeXmJiWZnJimGZv

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-91319-press-release-paref-financial-information-q1-2025-vdef.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free