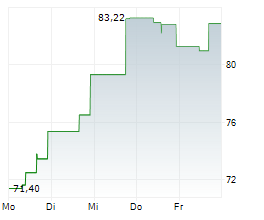

WASHINGTON (dpa-AFX) - Shares of Ingersoll Rand Inc. (IR) decreased around 4% in after-hours trading on Thursday after the air and gas compressor manufacturing company reported weak net income in its first quarter compared with the previous year, despite higher revenues. The company also trimmed its earnings forecast for fiscal 2025.

Looking ahead to the full year 2025, the company now expects adjusted earnings per share to range between $3.28 and $3.40, representing between flat and 3% increase compared to the prior year. The previous outlook was $3.38 and $3.50, representing an year-on-year increase of 3% to 6%.

Twelve Analysts, on average, expect the company to report full-year earnings at $3.39 per share. Analysts' estimates typically exclude special items.

Adjusted EBITDA is now expected to range between $2.07 billion and $2.13 billion, representing a 3% to 6% year-on-year growth. Previously, adjusted EBITDA was expected to range between $2.13 billion and $2.19 billion, representing an increase of 6% and 9%.

For the first quarter, net income attributable to Ingersoll declined to $186.5 million from $202.2 million last year.

Earnings per share were $0.46 versus $0.50 last year.

On the adjusted basis, net income declined to $291.3 million from $317.6 million in the previous year.

Adjusted earnings per share also declined by $0.72 versus $0.78 last year.

Analysts had expected the company to report $0.74 per share.

Adjusted EBITDA grew to $459.7 million from $458.5 million in the previous year's quarter.

Operating income increased to $302.5 million from $293.2 million in the previous year's quarter.

Revenue increased to $1.72 billion from $1.67 billion last year.

In the after-market hours on Thursday, the stock traded 4.54% lesser before ending the trade at $72.75, on the New York Stock Exchange.

In the pre-market trading, Ingersoll Rand is 4.21% lesser at $73.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News