Back to growth with Q4 revenue up 1.7%, ABEO stabilizes its 2024/25 revenue, driven by strong international momentum despite pressure on the French market.

Order intake up 6.1% at 31/03/25 confirms robust organic business growth.

ABEO, a leading global supplier of sports and leisure equipment, today announces its revenue and order intake for the 2024/25 financial year (from 1 April 2024 to 31 March 2025).

| €m Unaudited | 2024/2025 | 2023/20241 | Change | Change LFL2 |

| Q4 revenue | 65.3 | 64.2 | +1.7% | +1.1% |

| Sports | 37.0 | 36.6 | +1.1% | +0.8% |

| Sportainment & Climbing | 12.2 | 11.2 | +9.1% | +7.3% |

| Changing Rooms | 16.1 | 16.4 | -2.2% | -2.6% |

| YTD revenue | 248.7 | 248.4 | +0.1% | -0.3% |

| Sports | 137.8 | 134.9 | +2.1% | +1.9% |

| Sportainment & Climbing | 45.7 | 48.0 | -4.8% | -5.6% |

| Changing Rooms | 65.2 | 65.5 | -0.4% | -0.8% |

| YTD order intake (31/03) 3 | 263.2 | 248.1 | +6.1% | +5.7% |

- 2023/24 revenue as presented and commented upon herein has been restated for the impact of the disposal of ABEO's stake in Vogoscope, in accordance with IFRS 5

- refers to the change in revenue over a comparable period and at constant consolidation scope, excluding the impact of currency fluctuations.

- non-financial data - to measure the sales momentum of its business activities, the Group uses the quantified amount of its order intake over a given period, inter alia. The sales momentum indicator represents the aggregate value of all orders booked over the relevant period, as compared to the same period for the previous financial year

After a slowdown in the 3rd quarter, ABEO returned to growth in the 4th quarter of 2024/25. The Group posted Q4 consolidated revenue of €65.3m, up 1.7% (up 1.1% like-for-like) versus Q4 2023/24. The currency loss was 0.6%.

The Sports division posted Q4 2024/25 revenue of €37.0m, up 1.1% (up 0.8% like-for-like), mainly driven by a strong performance in the Benelux region, which offset delays in some gymnastics projects in France. The division achieved a solid performance for the full year 2024/25, posting revenue of €137.8m, up 2.1% (up 1.9% like-for-like), despite a slowdown in public spending and investment in the domestic market.

The Sportainment & Climbing division confirmed the positive momentum initiated in the previous quarter, posting Q4 2024/2025 revenue up 9.1% to €12.2m (up 7.3% like-for-like). This performance, primarily driven by the sharp upswing in Fun Spot sales in the United States, up 112% year-on-year, largely made up for a sluggish first half. As a result, the division limited the decline in full-year 2024/25 revenue, down just 4.8% (down 5.6% like-for-like) to €45.7m. Fun Spot's US business confirmed its recovery (up 31.8% in 2024/25). However, the recreational and sports climbing wall businesses (down 12.3%) are suffering from a temporary slowdown due to customer caution and postponed investments, particularly in France. This does not jeopardise development potential in this segment underpinned by solid market fundamentals.

The Changing Rooms division posted a slight decline in Q4 2024/25 sales, down 2.2% as reported (down 2.6% like-for-like). Full-year revenue nevertheless remained stable, with strong European markets making up for the weakness in the domestic market.

As a result, ABEO posted stable consolidated revenue of €248.7m for the 2024/25 financial year, demonstrating resilience in an environment still marked by uncertainty likely to delay customer projects. This stability was however marked by geographical divergences affecting all divisions, with a lack of buoyancy in the domestic market in terms of public funding and investment projects contrasting with more dynamic international markets.

Finally, for the full year ended 31 March 2025, the Group expects to generate an operating performance slightly lower than in the first half, despite a sharp improvement in free cash flow.

Trends and outlook

Business activity remained buoyant throughout the year, both in France and abroad, with order intake reaching €263.2m, up 6.1% versus FY 2023/24 (up 5.7% like-for-like). This sustained momentum will drive the Group's organic growth ambitions for the 2025/26 financial year.

Upcoming event

3 June 2025 - 2024/25 FY results (after close of trading)

Find more at www.abeo-bourse.com

| ABOUT ABEO |

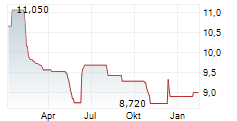

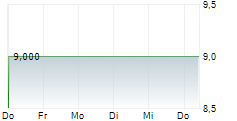

| ABEO is a major player in the sports and leisure market. The Group posted revenue of € 248.7 million for the year ended 31 March 2025, 75% of which was generated outside France, and has 1,443 employees. ABEO is a designer, manufacturer and distributor of sports and leisure equipment. It also provides assistance in implementing projects for professional customers in the following sectors: specialised sports halls and clubs, leisure centres, education, local authorities, construction professionals, etc. ABEO has a unique global offering, and operates in a wide variety of market segments, including gymnastics apparatus and landing mats, team sports equipment, physical education, climbing walls, leisure equipment and changing room fittings. The Group has a portfolio of strong brands which partner sports federations and are featured at major sporting events, including the Olympic Games. ABEO (ISIN code: FR0013185857, ABEO) is listed on Euronext Paris - Compartment C. |

Contacts

For any questions relating to this press release or the ABEO Group, please contact ACTUS finance & communication

Investor relations - Corinne Puissant investor@beo.fr Tel: +33 (0)1 53 67 36 77

Press relations - Serena Boni presse@beo.fr Tel: +33 (0)4 72 18 04 92

- SECURITY MASTER Key: mWlqYMdrY2yVnm1uZsqXmZKYb5lqxJSdmJfKyWFpZcebZ3KRxWeTbsicZnJim21u

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-91688-13052025_abeo_t4_24_25_vdef_uk.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free