TORONTO, ON / ACCESS Newswire / May 21, 2025 / Grid Metals Corp. (TSXV:GRDM)(OTCQB:MSMGF) ("Grid" or the "Company") announced drill results from the remaining 19 drill holes at the Eagle gabbro and the completion of new geophysical surveys at the Mayville copper/nickel project in southeastern Manitoba. The drilling confirmed a 2 km mineralized trend at the eastern part of the Mayville Complex. Newly completed airborne geophysics has provided multiple targets for new discoveries and resource expansion.

The next planned Grid drill program in the Bird River area is at the Makwa nickel/copper property. Permitting for exploration drilling is well advanced and an ongoing field program at Makwa is focused on the highest priority geophysical targets from the recently completed Geotech Ltd. VTEM MAX electromagnetic survey. The Makwa property is subject to an option and joint venture agreement currently funded by Teck Resources Limited.

The Company is also in the process of permitting exploration drilling at the Falcon West property for cesium. The most recent drilling at the Lucy pegmatite (Q1 2024) by Grid intersected 3.20m of 4.6% Cs2O in a >100-metre-long cesium-enrichment trend. The drill target at Lucy is a near-surface, flat-lying cesium and lithium-enriched portion of the larger Lucy Pegmatite in which most of the cesium is believed to be associated with the primary cesium ore mineral, pollucite. Pollucite is the preferred feedstock to the cesium chemicals industry, including the nearby Tantalum Mining Corporation of Canada Ltd.'s cesium chemical plant. The next phase of drilling at the Lucy Pegmatite will be designed to test the distribution of pollucite within this specific target area.

Eagle Gabbro Exploration Highlights

The Eagle gabbro drill program intersected disseminated copper/nickel sulfide mineralization at three locations along 2 km of strike length at the Eagle gabbro on the eastern end of the Mayville copper/nickel project. Highlights from the remaining holes include:

70.8m at 0.85% CuEq1 from 105.2m in hole EAG24-07, including 13.8m at 1.50% CuEq from 110.0m (New Manitoba deposit3 area)

8.9m at 0.90% CuEq from 149.6m in hole EAG24-09

19.7m at 0.82% CuEq from 145.0m in hole EAG24-16

22.3m at 0.75% CuEq from 172.0m in hole EAG24-17

6.5m at 1.07% CuEq from 84.4m in hole EAG24-22

New airborne EM surveys completed in Q4 2024 have defined numerous, strong EM anomalies at the Mayville project that could reflect massive magmatic sulfide accumulations.

Dr. Dave Peck, P.Geo., Grid's Vice President of Exploration, stated "The new drill results confirm the mineralized nature at the Eagle gabbro, which is located ~10 km from Grid's existing 32 Mt indicated open-pit, copper-rich Mayville deposit2. We are now looking at a ~20 km long mineralized mafic-ultramafic complex having demonstrated potential to expand on the Mayville resource. Moreover, the results from the recent, deep penetrating EM surveys have highlighted the potential for high-grade massive sulfide deposits on the Property. In the future, adding new high-grade resources to the known near-surface disseminated sulfide deposits is seen as the best path forward for this project."

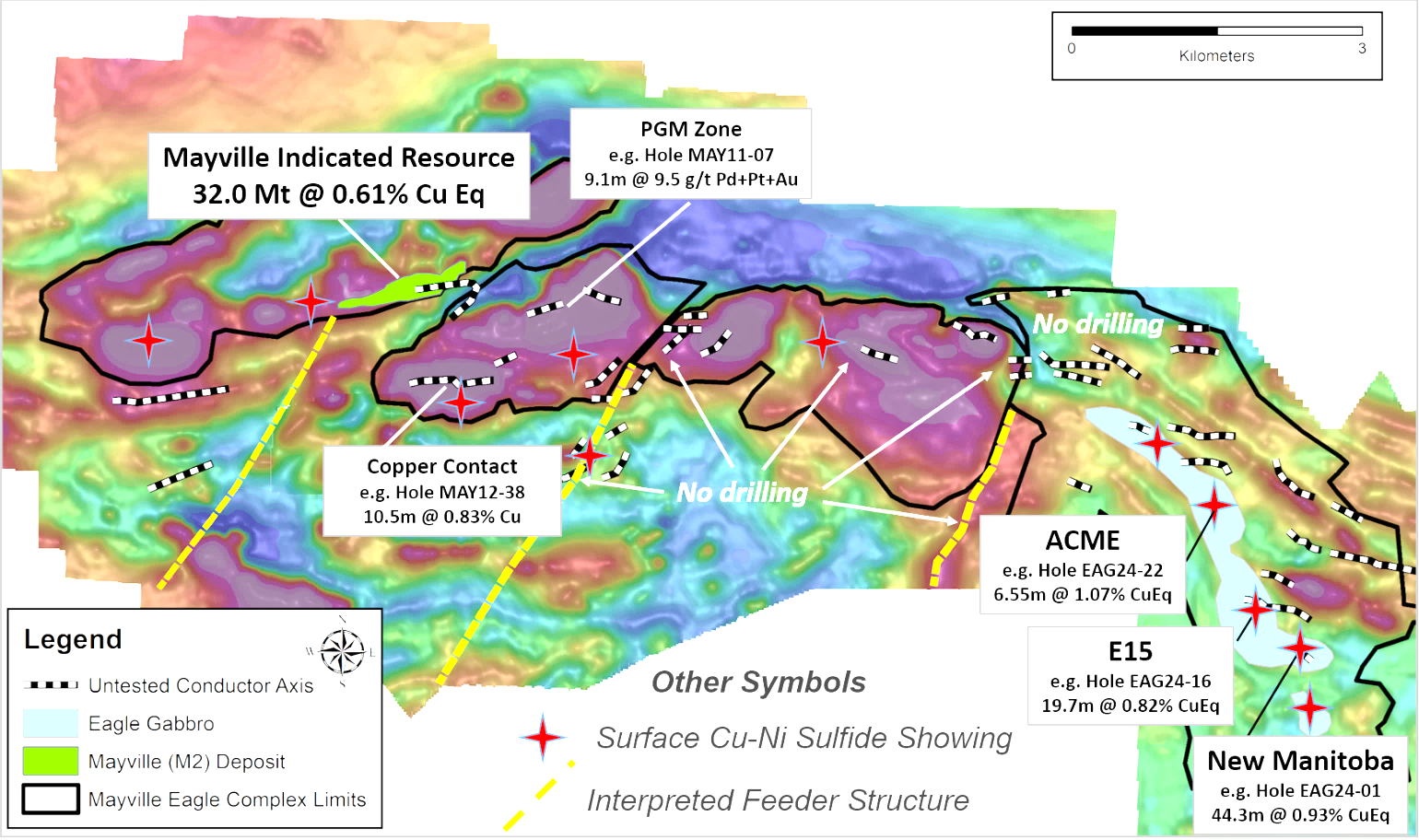

Figure 1. Location of the 1) Mayville Deposit (yellow); 2) the top-ranked and untested conductor anomalies potentially associated with massive Cu-Ni sulfide mineralization at the Mayville project; and 3) the Eagle gabbro area. The map shows the interpreted limits of the Mayville-Eagle Complex (black outline) on a tilt derivative total magnetic intensity background image.

1 The Mayville deposit is located ~10 km to the west of the Eagle gabbro and is estimated to contain 32.0 million tonnes of indicated resources averaging 0.40% Cu and 0.16% Ni (see the Company's May 6, 2024 news release for details)

2 Cu Eq is the copper equivalent grade, calculated as follows: CuEq (%) = Cu% + ((Ni% x NiR x NiP) + (Co% x CoR x CoP) + (Pt g/t x PtR x PtP) + (Pd g/t x PdR x PdP) + (Au g/t x AuR x AuP))/(CuR x CuP) where R = metal recovery and P = metal price. The following fixed metallurgical recoveries were assumed, guided by metallurgical test results reported by Micon International in the current Technical Report for the property (June 2024 - see Company website for details): Cu - 85%; Ni and Co - 60%; Pd, Pt and Au - 70%. The following long-term metal prices in US dollar amounts were assumed: Cu - $4.00/lb; Ni - $9.00/lb; Co - $22.50/lb; Pd - $1,100/oz; Pt - $1,100/oz; Au - $2,200/oz.

3 The New Manitoba deposit has a historical resource estimate of 2.0 million short tons averaging 0.75% Cu and 0.33% Ni (Manitoba Mineral Inventory Card #217). The Company has not been able to verify the historical estimate as relevant and the historical estimate should not be relied on.

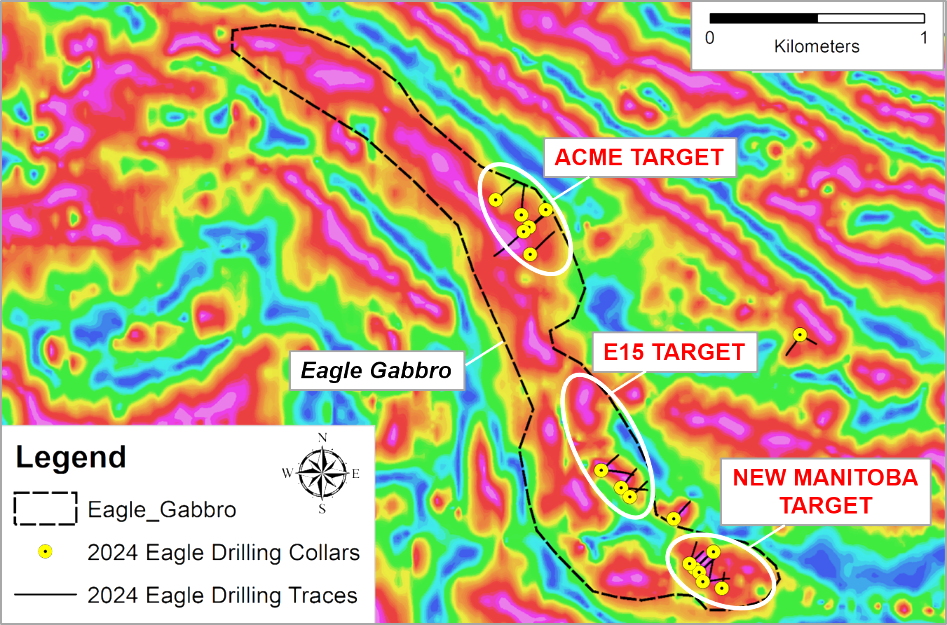

Figure 2. Hole locations for the Q4 2024 Eagle gabbro drilling program. The map shows the interpreted position of the 4 km-long Eagle gabbro (black dotted outline), which is the host to the New Manitoba deposit, on a tilt derivative total magnetic intensity background image. Magnetic high anomalies are indicated by warmer colours.

Drill Program and Detailed Results

A total of 4,132 metres were drilled in 25 holes during the Q4 2024 drill program at the Eagle gabbro (Figure 1). Three discrete targets were tested along a ~2 km segment of the Eagle gabbro. These included 11 holes targeting the historical New Manitoba deposit in the south (holes EAG24-01 to 11); 4 holes at a linear magnetic anomaly located ~500m north of the New Manitoba deposit ('E15' target; holes EAG24-13, 14, 16 and 17); and 6 holes at a previously untested disseminated sulfide occurrence at the Acme target area, located 1.2 km north of E15 (holes EAG24-20-25). Two holes were drilled on a conductor (EAG24-016) and a flanking magnetic anomaly (EAG24-17) located ~1 km east of the Eagle gabbro. One hole tested an unmapped magnetic anomaly located along the east side of the Eagle gabbro (EAG24-12). One hole was abandoned (EAG24-15).

All but one of the holes that intersected the Eagle gabbro encountered a steeply-dipping, several metre- to ~40-metre-thick interval of Cu-rich disseminated sulfide mineralization (the 'Eagle Cu Zone'). The average grades and metal tenors for the Eagle Cu Zone closely resemble those characterizing the Mayville deposit. Most of these new drill intersections are shallow (<100 metres vertical depth) and the disseminated sulfide mineralization remains open at depth and along strike across the 4 km extent of the Eagle gabbro. As previously reported, 3 holes at the New Manitoba target also encountered a narrow (<1 metre thick) nickel-rich semi-massive sulfide interval in the approximate middle portion of the Eagle Cu Zone, with nickel grades of up to 2.37%. Table 1 provides highlights for all of the 2024 drill holes that intersected the Eagle gabbro.

Table 1. Highlights for the Q4 2024 Eagle drilling program. The true thickness of the drill intersections reported here are estimated to represent 40 - 90% of the interval lengths. Results for drill holes EAG24-01 to 06 were previously reported (see the Company's Dec. 2, 2024 news release).

From | To | Interval | Cu | Ni | Co | Pd | Pt | Au | S | Cu Eq | Target | |

EAG24-01 | 45.50 | 87.15 | 41.65 | 0.35 | 0.10 | 0.01 | 0.05 | 0.01 | 0.03 | 1.44 | 0.58 | E15 |

inc. | 63.75 | 79.00 | 15.25 | 0.65 | 0.11 | 0.01 | 0.07 | 0.02 | 0.05 | 1.87 | 0.92 | |

with | 75.90 | 77.00 | 1.10 | 3.43 | 0.11 | 0.01 | 0.01 | 0.00 | 0.09 | 4.53 | 3.70 | |

and inc. | 86.50 | 87.15 | 0.65 | 0.30 | 1.40 | 0.07 | 0.43 | 0.06 | 0.01 | 17.9 | 2.95 | |

EAG24-02 | 53.00 | 90.00 | 37.00 | 0.41 | 0.12 | 0.01 | 0.06 | 0.02 | 0.04 | 1.69 | 0.69 | E15 |

inc. | 69.00 | 89.00 | 20.00 | 0.61 | 0.16 | 0.01 | 0.08 | 0.03 | 0.06 | 2.46 | 0.99 | |

EAG24-03 | 56.00 | 93.90 | 37.90 | 0.38 | 0.17 | 0.01 | 0.07 | 0.02 | 0.03 | 2.46 | 0.74 | New Manitoba |

inc. | 82.00 | 88.00 | 6.00 | 0.49 | 0.45 | 0.03 | 0.11 | 0.04 | 0.04 | 7.03 | 1.41 | |

with | 86.35 | 87.05 | 0.70 | 0.28 | 1.28 | 0.09 | 0.21 | 0.12 | 0.07 | 18.77 | 2.81 | |

EAG24-04 | 62.00 | 82.00 | 20.00 | 0.45 | 0.21 | 0.02 | 0.05 | 0.02 | 0.03 | 3.36 | 0.90 | New Manitoba |

inc. | 69.00 | 73.00 | 4.00 | 0.87 | 0.58 | 0.04 | 0.06 | 0.03 | 0.05 | 9.20 | 2.03 | |

EAG24-05 | 55.00 | 101.0 | 46.00 | 0.58 | 0.15 | 0.01 | 0.09 | 0.03 | 0.05 | 2.79 | 0.95 | New Manitoba |

inc. | 71.55 | 98.00 | 26.45 | 0.78 | 0.16 | 0.01 | 0.13 | 0.05 | 0.07 | 3.03 | 1.19 | |

EAG24-06 | 50.00 | 94.30 | 44.30 | 0.46 | 0.21 | 0.02 | 0.09 | 0.03 | 0.04 | 3.03 | 0.93 | New Manitoba |

inc. | 63.00 | 88.00 | 25.00 | 0.72 | 0.35 | 0.03 | 0.13 | 0.05 | 0.05 | 5.05 | 1.47 | |

with | 71.25 | 86.00 | 14.75 | 0.87 | 0.47 | 0.03 | 0.16 | 0.06 | 0.06 | 6.43 | 1.86 | |

and inc. | 71.25 | 72.00 | 0.75 | 0.20 | 2.37 | 0.16 | 0.58 | 0.38 | 0.01 | 9.44 | 4.92 | |

EAG24-07 | 105.2 | 176.0 | 70.8 | 0.49 | 0.15 | 0.01 | 0.08 | 0.03 | 0.05 | 2.36 | 0.85 | New Manitoba |

inc. | 106.0 | 139.6 | 33.6 | 0.69 | 0.21 | 0.02 | 0.13 | 0.05 | 0.08 | 3.47 | 1.20 | |

with | 111.0 | 124.8 | 13.8 | 0.90 | 0.25 | 0.02 | 0.16 | 0.06 | 0.10 | 4.27 | 1.50 | |

EAG24-09 | 149.6 | 158.5 | 8.90 | 0.63 | 0.11 | 0.01 | 0.07 | 0.02 | 0.03 | 2.05 | 0.90 | New Manitoba |

EAG24-10 | 86.00 | 102.2 | 16.25 | 0.57 | 0.21 | 0.02 | 0.09 | 0.03 | 0.05 | 3.60 | 1.04 | New Manitoba |

EAG24-16 | 145.0 | 181.0 | 36.00 | 0.37 | 0.12 | 0.01 | 0.06 | 0.02 | 0.03 | 1.51 | 0.66 | E15 |

inc. | 160.2 | 180.0 | 19.75 | 0.48 | 0.15 | 0.01 | 0.08 | 0.02 | 0.04 | 1.85 | 0.82 | |

EAG24-17 | 172.0 | 194.3 | 22.30 | 0.41 | 0.15 | 0.01 | 0.03 | 0.07 | 0.02 | 1.90 | 0.75 | E15 |

inc. | 173.0 | 182.0 | 9.00 | 0.53 | 0.17 | 0.01 | 0.05 | 0.08 | 0.03 | 2.18 | 0.91 | |

EAG24-21 | 74.00 | 77.00 | 3.00 | 0.56 | 0.15 | 0.01 | 0.10 | 0.03 | 0.05 | 1.40 | 0.92 | Acme |

inc. | 91.00 | 97.75 | 6.75 | 0.43 | 0.10 | 0.01 | 0.07 | 0.03 | 0.09 | 0.93 | 0.70 | |

EAG24-22 | 84.45 | 105.0 | 20.55 | 0.27 | 0.08 | 0.01 | 0.04 | 0.02 | 0.11 | 1.16 | 0.52 | Acme |

inc. | 84.45 | 91.00 | 6.55 | 0.56 | 0.15 | 0.01 | 0.09 | 0.03 | 0.30 | 1.66 | 1.07 | |

EAG24-23 | 114.0 | 118.2 | 4.20 | 0.42 | 0.13 | 0.01 | 0.06 | 0.02 | 0.05 | 1.23 | 0.72 | Acme |

Geophysical Surveys

Two new airborne EM surveys were completed during the fall and winter of 2024 at the Mayville project area. Geotech Ltd. completed a 143 line km time domain VTEM MAX survey over a 3.3 by 4.5 km area at a nominal line spacing of 100 metres and covering the Eagle gabbro in the eastern part of the project area. Geotech also completed a 258 line km deep-penetrating frequency domain EM survey over an 6.8 by 10.4 km area at a nominal 300 metre line spacing covering the central and eastern part of the Mayville-Eagle project area using their proprietary heli-borne ZTEM system. Preliminary modeling of the new survey results has identified several strongly conductive anomalies coincident with mapped or interpreted (from magnetics) parts of the 20 km long Mayville-Eagle Complex and with interpreted northeast-striking feeder structures to the complex.

A 5-line pole-dipole IP survey was also completed during the past winter over an area of ~800 metres x 900 metres that covers the historical New Manitoba deposit. The results of the survey highlight a large chargeability anomaly associated with the deposit but extending east and north beyond the known limits of the deposit. The new results highlight an opportunity to expand the historical resources estimated at New Manitoba.

Quality Assurance and Quality Control

Grid Metals applies best practice quality assurance and quality control ("QAQC") protocols in all of its exploration programs. For the current Eagle drilling program, core was logged and sampled at the Company's core facility located on the Makwa property. Standard 1.0 metre sample lengths were used. Samples were bagged and tagged and then transported by secure carrier to the Actlabs (Thunder Bay) laboratory for sample preparation and analysis for nickel, copper, cobalt and selected major and trace element abundances using a multi-acid digestion method followed by ICP-OES analysis. Samples were also analyzed for Pd, Pt and Au using a lead collection 30 g fire assay method followed by ICP-OES analysis. The Company is using several different certified reference materials ("CRMs") and one analytical blank for the Makwa program to monitor analytical accuracy and check for cross contamination between samples. The analytical results for the CRMs and the blank for the new analytical results reported here did not show any significant bias compared to the certified values and the fell within the acceptable limits of variability.

For more information about the Company, please see the Company website at www.gridmetalscorp.com or contact:

Robin Dunbar - President, CEO & Director Telephone: 416-955-4773 Email: rd@gridmetalscorp.com

Brandon Smith - Chief Development Officer - bsmith@gridmetalscorp.com

David Black - Investor Relations Email - info@gridmetalscorp.com

Qualified Persons Statements

Dr. Dave Peck, P.Geo., the VP Exploration of Grid, is the Qualified Person for purposes of National Instrument 43-101 and has reviewed and approved the technical content of this release.

About Grid Metals Corp.

Grid Metals is focused on exploration and development in southeastern Manitoba with four key projects in the Bird River area.

The Makwa Property (Ni-Cu-PGM-Co), which is subject to an Option and Joint Venture Agreement with Teck Resources Limited ("Teck"). Teck can earn up to a 70% interest in Makwa by incurring a total of CAD$17.3 million, comprising project expenditures (CAD$15.7 million) and cash payments or equity participation (CAD$1.6 million) with Grid. Makwa is located on the south arm of the Bird River Greenstone Belt.

The Mayville Property (Cu-Ni) is located on the north arm of the Bird River Greenstone Belt. The property is owned subject to a minority interest.

The Donner Property (Li-Cs) is adjacent to the Mayville Property, and Grid owns 75% of the project. Grid announced a cesium purchase agreement with Tanco on February 18, 2025.

The Falcon West Property (Li-Cs) is located 110 km east of Winnipeg along the Trans-Canada highway and contains highly anomalous cesium values in a number of historical drill holes including 2.2 m at 15.0% Cs2O and 3.2 m at 4.6% Cs2O.

All of the Company's southeastern Manitoba projects are located on the ancestral lands of the Sagkeeng First Nation with whom the Company maintains an Exploration Agreement.

We seek safe harbour. This news release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of the Securities Act (Ontario) (together, "forward-looking statements"). Such forward-looking statements include the Company's closing of the proposed financial transactions, sale of royalty and property interests. the overall economic potential of its properties, the availability of adequate financing and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements expressed or implied by such forward-looking statements to be materially different. Such factors include, among others, risks and uncertainties relating to potential political risk, uncertainty of production and capital costs estimates and the potential for unexpected costs and expenses, physical risks inherent in mining operations, metallurgical risk, currency fluctuations, fluctuations in the price of nickel, cobalt, copper and other metals, completion of economic evaluations, changes in project parameters as plans continue to be refined, the inability or failure to obtain adequate financing on a timely basis, and other risks and uncertainties, including those described in the Company's Management Discussion and Analysis for the most recent financial period and Material Change Reports filed with the Canadian Securities Administrators and available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Appendix: Drill hole specifications for all holes completed during the Q4 2024 Eagle gabbro drilling program. Collar coordinates are based on a NAD83 UTM Zone 15N projection.

Hole ID | Target | Easting | Northing | Azimuth | Dip | Elevation (m) | Length (m) |

EAG24-01 | E15 | 324019 | 5609052 | 45 | -45 | 310 | 159 |

EAG24-02 | E15 | 324019 | 5609052 | 90 | -45 | 310 | 174 |

EAG24-03 | New Manitoba | 324361 | 5608676 | 45 | -45 | 315 | 150 |

EAG24-04 | New Manitoba | 324361 | 5608676 | 45 | -60 | 315 | 150 |

EAG24-05 | New Manitoba | 324383 | 5608658 | 45 | -60 | 316 | 153 |

EAG24-06 | New Manitoba | 324383 | 5608658 | 45 | -45 | 316 | 150 |

EAG24-07 | New Manitoba | 324450 | 5608753 | 190 | -45 | 316 | 186 |

EAG24-08 | New Manitoba | 324489 | 5608583 | 7 | -60 | 314 | 150 |

EAG24-09 | New Manitoba | 324400 | 5608614 | 80 | -45 | 314 | 174 |

EAG24-10 | New Manitoba | 324338 | 5608698 | 45 | -45 | 314 | 120 |

EAG24-11 | New Manitoba | 324338 | 5608698 | 15 | -45 | 314 | 150 |

EAG24-12 | E15 | 324265 | 5608908 | 40 | -45 | 314 | 150 |

EAG24-13 | E15 | 324060 | 5609010 | 45 | -45 | 314 | 151 |

EAG24-14 | E15 | 323926 | 5609134 | 45 | -45 | 314 | 150 |

EAG24-15 | E15 (abandoned) | 323926 | 5609134 | 45 | -60 | 314 | 9 |

EAG24-16 | E15 | 323926 | 5609134 | 90 | -45 | 314 | 205 |

EAG24-17 | E15 | 323926 | 5609134 | 90 | -60 | 314 | 213 |

EAG24-18 | EM Anomaly | 324854 | 5609767 | 210 | -50 | 326 | 180 |

EAG24-19 | Mag Anomaly | 324854 | 5609767 | 45 | -45 | 326 | 120 |

EAG24-20 | Acme | 323595 | 5610143 | 45 | -45 | 216 | 216 |

EAG24-21 | Acme | 323668 | 5610351 | 225 | -45 | 318 | 213 |

EAG24-22 | Acme | 323589 | 5610269 | 45 | -45 | 318 | 174 |

EAG24-23 | Acme | 323553 | 5610327 | 0 | -45 | 318 | 201 |

EAG24-24 | Acme | 323433 | 5610397 | 45 | -45 | 318 | 180 |

EAG24-25 | Acme | 323564 | 5610248 | 225 | -45 | 318 | 249 |

SOURCE: Grid Metals Corp.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/grid-metals-corp.-provides-update-on-eagle-copper-exploration-program-and-upcomin-1030132