TEMPE, AZ / ACCESS Newswire / May 29, 2025 / New GoDaddy research shows entrepreneurs remain focused on growth despite rising concern

Originally published on GoDaddy Newsroom

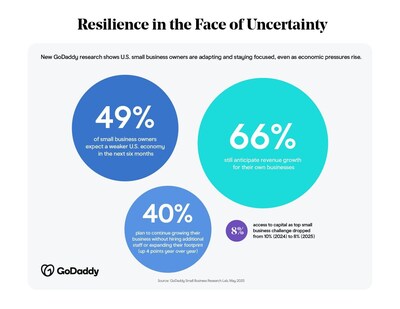

Nearly half of U.S. small and microbusiness owners expect the national economy to weaken in the coming months. Despite the outlook, most still believe their own businesses will grow, according to new survey data released today by GoDaddy.

In the latest findings from the GoDaddy Small Business Research Lab, formerly known as Venture Forward, 49% of 2,100 U.S. microbusiness owners* surveyed predict a weaker economy in the next six months. That is up 17 points from 2024. Even so, 66% of respondents have positive revenue expectations, and only 9% forecast a sales decline.

"Small business owners are realistic about the economy, but they believe in themselves," said GoDaddy CEO Aman Bhutani. "GoDaddy's research shows they remain intent on pushing their small businesses forward."

The GoDaddy Small Business Research Lab findings reflect a steady shift over time. In 2023, 73% of microbusiness owners said they expected to grow revenue in the first 6 months of the year. Now in 2025, it stands at 66%. Most respondents still expect growth, clearly, but the trend indicates weakening optimism.

Entrepreneurs are also adjusting their long-term goals. 40% now say they plan to remain solo entrepreneurs - up from 36% last year - versus aspiring to build mid-size or corporate enterprises. This points to a growing interest in right-sized businesses that match owners' lifestyles and risk tolerance.

Rising Costs Put Pressure on Small Business Margins

While optimism holds, cost pressures are rising and showing up not just in what small businesses pay, but what they can charge. Over half (52%) of respondents cited limited cash flow as their biggest financial barrier, but existing expenses (34%) and pricing pressure on goods and services (33%) ranked highest among specific cost challenges.

These pricing pressures are especially acute among Construction & Home Trades (40%) and Creative-Media businesses (36%), with solo operators and small teams reporting they are feeling the pinch of existing operating costs the most. For businesses with 5-9 employees, wages emerged as the top cost barrier (45%), reflecting a shift toward labor-related pressure once headcount rises.

One in three owners (33%) also named financial strain as their primary source of stress-ranking it above challenges like adopting new technology, managing vendors, or finding and retaining customers.

Access to capital, often a major hurdle for new businesses, appears to be improving. Only 8% of owners say it is their top challenge, down from 10% the year before.

Sharing their perspective on the results, Victor W. Hwang, founder and CEO of Right to Start, a nonprofit that promotes U.S. small business growth, added: "The results of this GoDaddy survey demonstrate quantitatively the drive and resilience of entrepreneurs all across the United States. Their commitment to their enterprises is relentless and innovative. America's entrepreneurs are an extraordinary resource for strengthening the U.S. economy and growing new businesses and jobs nationwide."

Commenting on the findings, small business owner Leo Lopez owner of San Jose-based La Fenice Pizza said: "The economy is definitely uncertain right now, but as a small business owner, you learn to live with that. I've had to adjust, simplify, and focus on what really works, and that's helped me grow stronger. For me, resilience isn't about being unaffected. It's about finding a way to keep going, even when things get unpredictable. That's how I've built my business, and I think a lot of us are doing the same."

"Entrepreneurs are planning for what is ahead," Bhutani added. "They are navigating these times by staying focused and determined. At GoDaddy, our job is to make sure they have the tools they need to succeed."

For more insights from GoDaddy's latest small business research, visit the full report here:

https://www.godaddy.com/ventureforward/the-future-of-entrepreneurship-is-leaner-smarter-and-more-resilient

About GoDaddy

GoDaddy helps millions of entrepreneurs globally start, grow, and scale their businesses. People come to GoDaddy to name their idea, build a website and logo, sell their products and services and accept payments. GoDaddy Airo®, the company's AI-powered experience, makes growing a small business faster and easier by helping them to get their idea online in minutes, drive traffic and boost sales. GoDaddy's expert guides are available 24/7 to provide assistance. To learn more about the company, visit www.GoDaddy.com.

* Microbusinesses are small businesses that typically employ fewer than 10 employees.

Source: GoDaddy Inc.

View additional multimedia and more ESG storytelling from GoDaddy on 3blmedia.com.

Contact Info:

Spokesperson: GoDaddy

Website: https://www.3blmedia.com/profiles/godaddy

Email: info@3blmedia.com

SOURCE: GoDaddy

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/telecommunications/small-businesses-stay-confident-amid-u.s.-economic-uncertainty-1033285