Done.ai Group AB ("Done.ai"), has signed a Letter of Intent (LOI) to acquire Exaccta Servicios Digitales, a Spanish software firm specializing in mobile-first expense management.

The acquisition marks Done.ai's sixth strategic transaction in 2025, reinforcing its ongoing build-and-buy strategy to create its leading AI-native business platform. Since the beginning of the year, Done.ai has scaled rapidly, from 20 to over 200 employees and from SEK 30 million to more than SEK 300 million in annual pro forma revenue and operational EBITDA profitability.

Done.ai has significantly expanded the breadth of its platform, product offering, talent base, and investment infrastructure, positioning itself as an active consolidator in the Nordic fintech and business automation space. With significant liquidity on the balance sheet, Done.ai is well-positioned to continue executing its strategic growth agenda.

Mobile-first strength with European and Latin American reach

Exaccta provides a user-friendly, mobile-first solution for expense capture and automation, targeting SMEs and larger enterprises across Spain and Latin America. Its position within expense management complements Done.ai's growing fintech and automation portfolio.

Exaccta has a proven technology platform with 220 customers and 12,700 active users, supported by a cost-efficient, specialized development team with deep domain expertise in expense and spend management. This team, together with the broader Done.ai organization, will help accelerate the expansion of Done.ai's AI-driven finance platform. Exaccta generates approximately MEUR 1.1 in annual revenue and is expected to operate around breakeven in 2025.

By integrating Exaccta with Accountabl, Done.ai will be able to offer a comprehensive, full-service spend management solution that spans expense tracking, approval workflows, card payments, and reporting. This enhances Done.ai's ability to unlock commercial synergies across its rapidly growing SME client base in the Nordics, the UK, and wider Europe. In addition, the acquisition provides Done.ai with a first entry point into Spain and Latin America, supported by Exaccta's established customer relationships and localized product-market fit.

"Exaccta's mobile-first platform complements our spend management solution, Accountabl, and enables us to deliver a differentiated, standalone expense solution with international reach," says Staffan Herbst, CEO of Done.ai. "We appreciate the constructive dialogue with Exaccta's team and their shared belief in what we can build together," Herbst adds.

Transaction Structure

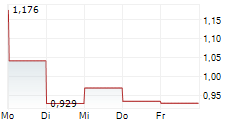

The proposed transaction values Exaccta at MEUR 2.9, of which MEUR 2.0 will be converted into shares in Done.ai Group AB at SEK 14 per share, the same valuation as Done.ai's recently completed MSEK 80 directed share issue. The remaining MEUR 0.9 would be paid in cash at closing.

The deal is subject to due diligence, final board approval, and a definitive share purchase agreement and expected to close within the coming 3 months.

Growing market relevance and strategic alignment

The transaction comes amid accelerating consolidation in the global expense automation sector. In May 2025, Visma completed its first Latin American acquisition, acquiring Chile-based Rindegastos, a mobile-first expense management platform used by over 4,500 companies across the region. The deal highlights the growing strategic value of localized, compliance-ready solutions tailored to SMEs operating in diverse regulatory environments.

For further information please contact:

Staffan Herbst, CEO

Tel: +46 10 490 07 00, ir@done.ai

Certified Adviser

The Certified Adviser to Done.ai Group AB on Nasdaq First North Growth Market is Partner Fondkommission.

Address: Smålandsgatan 10, 111 46 Stockholm

Telephone: +46 (0)8-598 422 30

Website: partnerfk.com

About Done.ai

Done.ai has entered a new chapter marking its transformation from a traditional ERP vendor into a one-stop shop for modern businesses, offering an integrated suite of AI-powered tools that span the full operational workflow. With a modular, API-first architecture, businesses can manage their entire value chain, from first customer touchpoint to back-end accounting, fully integrated in one automated, end-to-end platform.

Through the integration of embedded financial services such as automated treasury management, payment solutions, spend management, and open banking, Done.ai aims to redefine how businesses manage liquidity and financial operations. These services will initially be launched through an exclusive three-year distribution agreement to 24SevenOffice's extensive customer base, ensuring rapid rollout and adoption.

Combining deep technological expertise, strategic partnerships, and AI-driven automation, Done.ai delivers real-time financial control, operational efficiency, and unmatched scalability, positioning the company as a leading AI-native fintech platform for the business sector.

Done.ai is headquartered in Sweden and listed on Nasdaq First North Growth Market under the ticker DONE.