WASHINGTON (dpa-AFX) - OpenAI on Wednesday distanced itself from Robinhood's rollout of tokenized shares tied to OpenAI and SpaceX, cautioning investors that these tokens do not represent actual equity in the company.

'These 'OpenAI tokens' are not OpenAI equity,' the company stated on X. 'We did not partner with Robinhood, were not involved in this, and do not endorse it. Any transfer of OpenAI equity requires our approval we did not approve any transfer. Please be careful.'

Robinhood introduced its new tokenized equity products during a showcase in Cannes, France, as part of a broader push to expand its crypto offerings and blockchain infrastructure.

The trading platform offered eligible European users 5 euros worth of OpenAI and SpaceX tokens for signing up before July 7. Robinhood claims the tokens provide indirect exposure to private markets through its ownership stake in a special purpose vehicle.

'These tokens give retail investors access to private markets,' said Johann Kerbrat, Robinhood's SVP and GM of crypto. CEO Vlad Tenev acknowledged that while the tokens do not technically represent equity, they offer a form of exposure to private assets.

OpenAI's sharp rebuke underscores growing concerns about the legitimacy and investor protections around tokenized securities. The company warned that any genuine transfer of its equity must receive its explicit approval, which Robinhood's offering lacked.

U.S. investors are barred from accessing these tokens due to stricter domestic regulations.

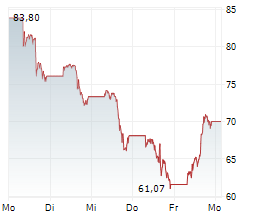

Robinhood shares initially surged past $100 on the product announcement but later slipped, reflecting investor caution over regulatory and legal challenges.

The episode highlights tensions between crypto-driven financial innovation and the rights of companies whose names and valuations are being leveraged without formal endorsement or oversight.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News