TORONTO, July 07, 2025 (GLOBE NEWSWIRE) -- Inventus Mining Corp. (TSXV: IVS) ("Inventus" or the "Company") is pleased to announce final assays from grade-control drilling of the 10,000-tonne Trench 1 Bulk Sample Site on its 100%-owned Pardo Gold Project, located 65 km northeast of Sudbury, Ontario.

Highlights

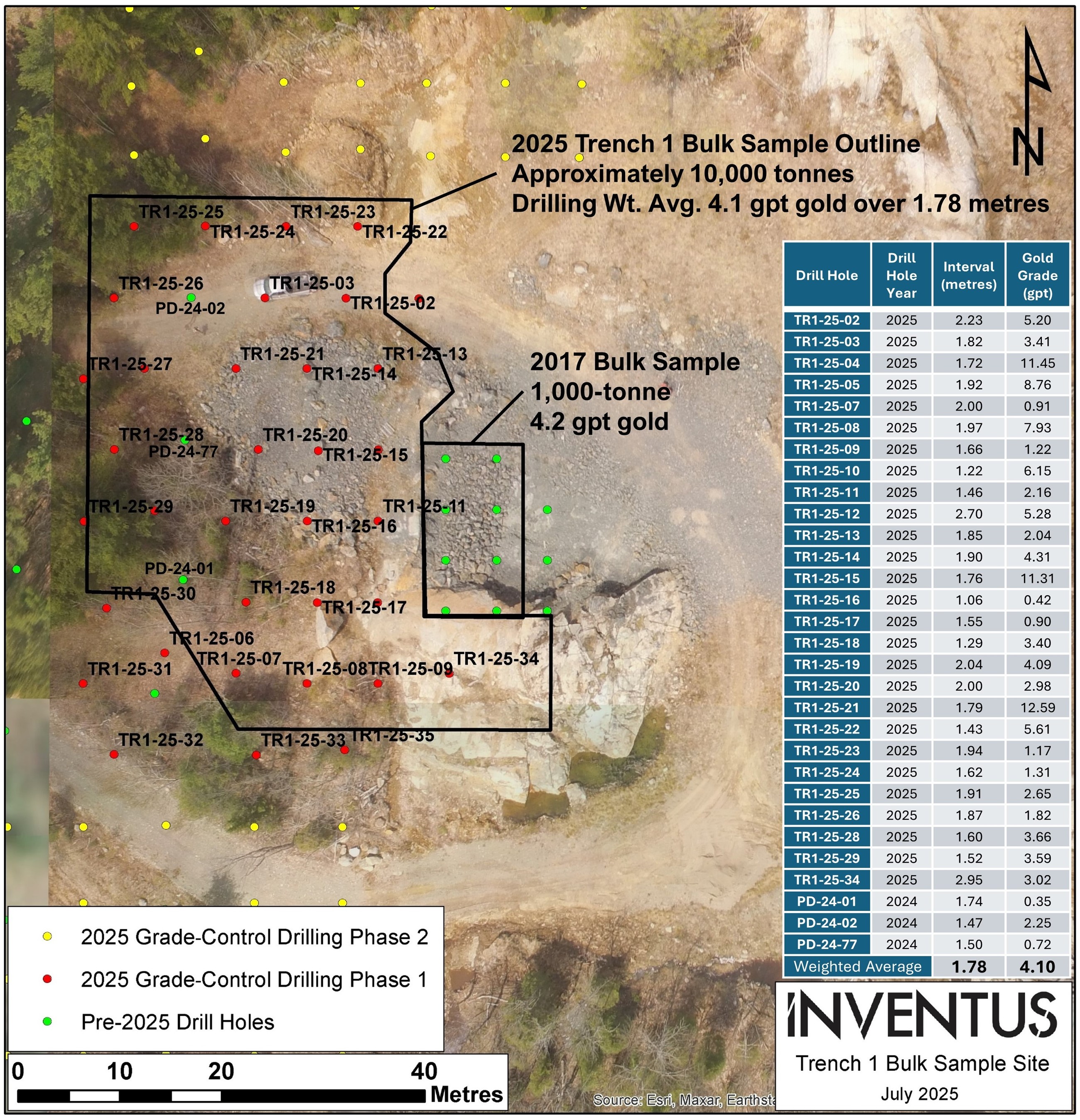

- Assay results from grade-control drilling at the Trench 1 bulk sample site have identified approximately 10,000 tonnes within 6 metres of surface and returned a weighted average grade and thickness of 4.10 gpt gold and 1.78 metres.

- The top 10 drill intercepts from the Trench 1 Bulk Sample Site include:

12.59 gpt gold over 1.79 metres

11.31 gpt gold over 1.76 metres

11.45 gpt gold over 1.72 metres

8.76 gpt gold over 1.92 metres

7.93 gpt gold over 1.97 metres

5.28 gpt gold over 2.70 metres

5.20 gpt gold over 2.23 metres

3.02 gpt gold over 2.95 metres

4.09 gpt gold over 2.04 metres

4.31 gpt gold over 1.90 metres

Trench 1 Grade-Control Drilling

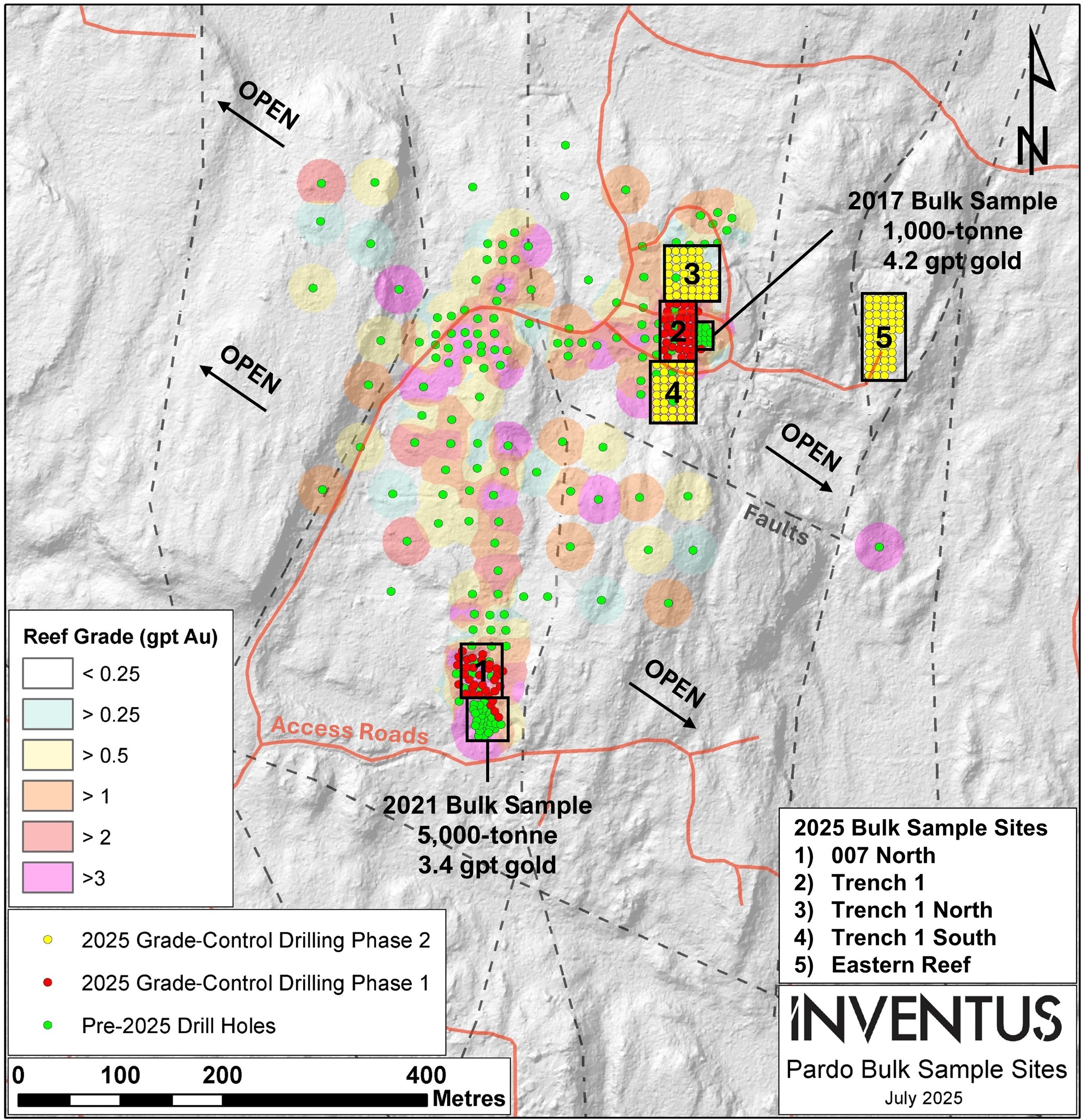

Grade-control drilling at the Trench 1 Site consisted of 35 shallow holes targeting the flat-lying gold mineralization within 6 metres of surface (Figure 1 and Table 1). Holes were drilled at 7.5-metre centres to identify approximately 10,000 tonnes for the second planned bulk sample site. Final assay results within the planned pit area had a weighted average grade and thickness of 4.10 gpt gold and 1.78 metres (see Figure 2 and Table 2).

Drilling Update

Grade-control drilling is at the Trench 1 North Bulk Sample Site, consisting of 42 holes to outline an additional 10,000+ tonnes north of Trench 1 site reported in this release, is now complete (Figure 1). Results from this drilling will be released once they become available. The drill has now moved to the Trench 1 South Bulk Sample Site to define an additional 10,000 tonnes before moving to Eastern Reef where our last planned 10,000-tonne bulk sample will be located. Following the completion of the grade-control drilling, the drill will commence Phase 2 resource drilling, which is part of the Company's larger plan to extend the gold mineralization in preparation for a maiden resource estimate on the property.

Bulk Sample Update

The bulk sampling program is on schedule with the first bulk sample from 007 North (5,000-tonne) having an expected processing date in late July. This will be followed by the Trench 1 Bulk Sample (10,000-tonne) from late August until early September. Additional updates and results of the program will be provided as the program advances.

Wesley Whymark, President and Head of Exploration comments: "When we launched this bulk sample program, our target was 3 gpt gold. With results from our second bulk sample site now in hand, it's clear we've exceeded those expectations. Having now secured a processing path through McEwen Mining's Stock Mill, we're more confident than ever in the potential of the Pardo Project. This program is a major step toward de-risking the project and showcasing the strong economics of surface mining our near-surface gold mineralization."

For further information visit www.inventusmining.com, or contact:

Mr. Wesley Whymark

President and Head of Exploration

Inventus Mining Corp.

E-mail: wesley@inventusmining.com

Phone: 705-822-3005

Social Media Accounts

X

About Inventus Mining Corp.

Inventus is a mineral exploration and development company focused on the world-class mining district of Sudbury, Ontario. Our principal assets are a 100% interest in the Pardo Paleoplacer Gold Project and the Sudbury 2.0 Critical Mineral Project located northeast of Sudbury. Pardo is the first important paleoplacer gold discovery found in North America. Inventus has approximately 203 million common shares outstanding.

Qualified Person

The Qualified Person responsible for the technical content of this news release is Inventus' President and Head of Exploration, Wesley Whymark, P.Geo., who has reviewed and approved the technical disclosure in this news release on behalf of the Company.

Technical Information

Drill core samples collected by Inventus and described in this news release were subject to a variety of QA/QC protocols. PQ Size drill core was placed in core boxes by the contracted drill crew and then transported by Inventus personnel to a secure processing facility in Sudbury, Ontario. The core was then reviewed with core metreage blocks checked to verify core integrity, recovery and geologically logged with samples marked. Whole core samples were then photographed and inserted into a clean plastic bag with a sample tag. Certified reference materials were inserted into the sample stream at a rate of no less than 10%. Samples were then transported in secure sealed bags with security tags for preparation by Agat Labs in Thunder Bay, Ontario. All samples reported were crushed in their entirety to 80% passing 2 mm. A subsample comprising 2 kg was riffle split and pulverized to 80% 75 microns (-200 mesh) and one 300- to 500-g subsample was riffle split into a jar. The Jar was then shipped to Paragon Geochemical in Nevada, USA for gold analysis by PhotonAssay. Both Agat Labs and Paragon Geochemical are ISO 17025:2017 accredited geochemical testing laboratories.

Forward-Looking Statements

This News Release includes certain "forward-looking statements" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "if", "yet", "potential", "undetermined", "objective", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to the failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDAR+. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Table 1. Trench 1 Grade-Control Drilling Assay Highlights.

| Drill Hole | From (metres) | To (metres) | Interval1 (metres) | Gold Grade (gpt) |

| TR1-25-01 | Zone Eroded | |||

| TR1-25-02 | 2.00 | 4.23 | 2.23 | 5.20 |

| Including | 2.00 | 2.50 | 0.50 | 20.59 |

| TR1-25-03 | 3.03 | 4.85 | 1.82 | 3.41 |

| Including | 3.59 | 3.93 | 0.34 | 17.13 |

| TR1-25-04 | 5.47 | 7.19 | 1.72 | 11.45 |

| Including | 6.28 | 6.74 | 0.46 | 40.90 |

| TR1-25-05 | 4.00 | 5.92 | 1.92 | 8.76 |

| Including | 4.84 | 5.15 | 0.31 | 52.79 |

| TR1-25-06 | 5.16 | 6.82 | 1.66 | 3.46 |

| Including | 6.04 | 6.54 | 0.50 | 6.80 |

| TR1-25-07 | 3.50 | 5.50 | 2.00 | 0.91 |

| Including | 3.50 | 4.00 | 0.50 | 2.64 |

| TR1-25-08 | 2.83 | 4.80 | 1.97 | 7.93 |

| Including | 3.22 | 3.64 | 0.42 | 30.63 |

| TR1-25-09 | 3.49 | 5.15 | 1.66 | 1.22 |

| Including | 4.33 | 4.65 | 0.32 | 4.72 |

| TR1-25-10 | 2.75 | 3.97 | 1.22 | 6.15 |

| Including | 2.75 | 3.25 | 0.50 | 11.29 |

| TR1-25-11 | 2.69 | 4.15 | 1.46 | 2.16 |

| Including | 2.69 | 3.15 | 0.46 | 4.91 |

| TR1-25-12 | 2.65 | 5.35 | 2.70 | 5.28 |

| Including | 2.65 | 3.12 | 0.47 | 18.97 |

| TR1-25-13 | 2.55 | 4.40 | 1.85 | 2.04 |

| Including | 2.55 | 3.04 | 0.49 | 5.15 |

| TR1-25-14 | 1.50 | 3.40 | 1.90 | 4.31 |

| Including | 2.18 | 2.51 | 0.33 | 19.31 |

| TR1-25-15 | 2.94 | 4.70 | 1.76 | 11.31 |

| Including | 2.94 | 3.49 | 0.55 | 35.70 |

| TR1-25-16 | 3.50 | 4.56 | 1.06 | 0.42 |

| TR1-25-17 | 3.40 | 4.95 | 1.55 | 0.90 |

| TR1-25-18 | 3.21 | 4.50 | 1.29 | 3.40 |

| Including | 3.21 | 3.51 | 0.30 | 13.18 |

| TR1-25-19 | 2.36 | 4.40 | 2.04 | 4.09 |

| Including | 3.14 | 3.55 | 0.41 | 10.04 |

| TR1-25-20 | 2.32 | 4.32 | 2.00 | 2.98 |

| Including | 2.32 | 2.82 | 0.50 | 10.37 |

| TR1-25-21 | 3.21 | 5.00 | 1.79 | 12.51 |

| Including | 3.21 | 3.63 | 0.42 | 52.55 |

| TR1-25-22 | 1.57 | 3.00 | 1.43 | 5.61 |

| Including | 2.07 | 2.54 | 0.47 | 13.63 |

| TR1-25-23 | 3.06 | 5.00 | 1.94 | 1.17 |

| TR1-25-24 | 4.88 | 6.50 | 1.62 | 1.31 |

| TR1-25-25 | 5.90 | 7.81 | 1.91 | 2.65 |

| Including | 7.31 | 7.81 | 0.50 | 8.69 |

| TR1-25-26 | 6.53 | 8.40 | 1.87 | 1.82 |

| TR1-25-27 | 6.00 | 7.87 | 1.87 | 0.76 |

| TR1-25-28 | 5.97 | 7.57 | 1.60 | 3.66 |

| Including | 6.32 | 6.78 | 0.46 | 8.29 |

| TR1-25-29 | 6.18 | 7.70 | 1.52 | 3.59 |

| Including | 6.70 | 7.20 | 0.50 | 9.67 |

| TR1-25-30 | 6.67 | 8.65 | 1.98 | 0.36 |

| TR1-25-31 | 5.65 | 7.65 | 2.00 | 0.64 |

| TR1-25-32 | 6.13 | 7.87 | 1.74 | 0.93 |

| TR1-25-33 | 4.02 | 6.02 | 2.00 | 0.37 |

| TR1-25-34 | 2.78 | 5.73 | 2.95 | 3.02 |

| Including | 2.78 | 3.27 | 0.49 | 8.56 |

| TR1-25-35 | 2.95 | 5.14 | 2.19 | 0.35 |

| 1Interval width is approximate true thickness. Mineralization has a flat to 5-degree dip and all holes were drilled vertically with an inclination of -90 degrees. | ||||

Table 2. Pit-Constrained Trench 1 Grade-Control Drilling Assays.

| Drill Hole | Drill Hole Year | Interval1 (metres) | Gold Grade (gpt) |

| TR1-25-02 | 2025 | 2.23 | 5.20 |

| TR1-25-03 | 2025 | 1.82 | 3.41 |

| TR1-25-04 | 2025 | 1.72 | 11.45 |

| TR1-25-05 | 2025 | 1.92 | 8.76 |

| TR1-25-07 | 2025 | 2.00 | 0.91 |

| TR1-25-08 | 2025 | 1.97 | 7.93 |

| TR1-25-09 | 2025 | 1.66 | 1.22 |

| TR1-25-10 | 2025 | 1.22 | 6.15 |

| TR1-25-11 | 2025 | 1.46 | 2.16 |

| TR1-25-12 | 2025 | 2.70 | 5.28 |

| TR1-25-13 | 2025 | 1.85 | 2.04 |

| TR1-25-14 | 2025 | 1.90 | 4.31 |

| TR1-25-15 | 2025 | 1.76 | 11.31 |

| TR1-25-16 | 2025 | 1.06 | 0.42 |

| TR1-25-17 | 2025 | 1.55 | 0.90 |

| TR1-25-18 | 2025 | 1.29 | 3.40 |

| TR1-25-19 | 2025 | 2.04 | 4.09 |

| TR1-25-20 | 2025 | 2.00 | 2.98 |

| TR1-25-21 | 2025 | 1.79 | 12.59 |

| TR1-25-22 | 2025 | 1.43 | 5.61 |

| TR1-25-23 | 2025 | 1.94 | 1.17 |

| TR1-25-24 | 2025 | 1.62 | 1.31 |

| TR1-25-25 | 2025 | 1.91 | 2.65 |

| TR1-25-26 | 2025 | 1.87 | 1.82 |

| TR1-25-28 | 2025 | 1.60 | 3.66 |

| TR1-25-29 | 2025 | 1.52 | 3.59 |

| TR1-25-34 | 2025 | 2.95 | 3.02 |

| PD-24-01 | 2024 | 1.74 | 0.35 |

| PD-24-02 | 2024 | 1.47 | 2.25 |

| PD-24-77 | 2024 | 1.50 | 0.72 |

| Weighted Average | 1.78 | 4.02 | |

| 1Interval width is approximate true thickness. Mineralization has a flat to 5-degree dip and all holes were drilled vertically with an inclination of -90 degrees. | |||

Table 3. Details of grade-control drill hole locations reported in this press release.

| Drill Hole | Inclination (Degrees) | Length (metres) | Easting (UTM) | Northing (UTM) |

| TR1-25-01 | -90 | 5.00 | 556390 | 5183368 |

| TR1-25-02 | -90 | 6.50 | 556383 | 5183368 |

| TR1-25-03 | -90 | 8.00 | 556375 | 5183368 |

| TR1-25-04 | -90 | 8.00 | 556363 | 5183361 |

| TR1-25-05 | -90 | 9.50 | 556364 | 5183347 |

| TR1-25-06 | -90 | 9.50 | 556365 | 5183333 |

| TR1-25-07 | -90 | 9.50 | 556372 | 5183331 |

| TR1-25-08 | -90 | 8.00 | 556379 | 5183330 |

| TR1-25-09 | -90 | 9.50 | 556386 | 5183330 |

| TR1-25-10 | -90 | 9.50 | 556386 | 5183338 |

| TR1-25-11 | -90 | 9.00 | 556386 | 5183346 |

| TR1-25-12 | -90 | 8.00 | 556386 | 5183353 |

| TR1-25-13 | -90 | 5.00 | 556386 | 5183361 |

| TR1-25-14 | -90 | 8.00 | 556378 | 5183361 |

| TR1-25-15 | -90 | 8.00 | 556380 | 5183353 |

| TR1-25-16 | -90 | 8.00 | 556379 | 5183346 |

| TR1-25-17 | -90 | 8.00 | 556380 | 5183338 |

| TR1-25-18 | -90 | 8.00 | 556373 | 5183338 |

| TR1-25-19 | -90 | 8.20 | 556371 | 5183346 |

| TR1-25-20 | -90 | 9.50 | 556374 | 5183353 |

| TR1-25-21 | -90 | 8.00 | 556372 | 5183361 |

| TR1-25-22 | -90 | 5.00 | 556384 | 5183375 |

| TR1-25-23 | -90 | 6.50 | 556377 | 5183375 |

| TR1-25-24 | -90 | 8.00 | 556369 | 5183375 |

| TR1-25-25 | -90 | 9.50 | 556362 | 5183375 |

| TR1-25-26 | -90 | 9.50 | 556360 | 5183368 |

| TR1-25-27 | -90 | 11.00 | 556357 | 5183360 |

| TR1-25-28 | -90 | 9.50 | 556360 | 5183353 |

| TR1-25-29 | -90 | 11.00 | 556357 | 5183346 |

| TR1-25-30 | -90 | 11.00 | 556359 | 5183337 |

| TR1-25-31 | -90 | 9.50 | 556357 | 5183330 |

| TR1-25-32 | -90 | 9.50 | 556356 | 5183323 |

| TR1-25-33 | -90 | 9.50 | 556374 | 5183323 |

| TR1-25-34 | -90 | 8.00 | 556393 | 5183331 |

| TR1-25-35 | -90 | 8.00 | 556383 | 5183323 |

Figure 1. Plan map illustrating the gold grade (gpt Au) of the approximately 2-metre-thick gold-bearing reef at the Pardo project with Lidar background. Locations of the planned and previous bulk sampling sites outlined with black boxes.

Figure 2. Plan map illustrating the gold grade (gpt Au) and thickness (metre) at the Trench 1 Bulk Sample Site with aerial drone photo background.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e0b813f0-cc43-4912-b768-4766586615e7

https://www.globenewswire.com/NewsRoom/AttachmentNg/4896dd8c-4657-4836-a15f-8be449ccc5e5