TORONTO, ON / ACCESS Newswire / July 10, 2025 / TRU Precious Metals Corp. (TSXV:TRU)(FSE:706) ("TRU" or the "Company") is pleased to announce that it has formally exercised the Initial Option to acquire a 51% interest in the Staghorn Property pursuant to an option agreement between TRU and Quadro Resources Ltd. ("Quadro") dated June 15, 2022 as subsequently amended (the "Option Agreement"). The Company satisfied all of the requirements set forth in the Option Agreement for the Initial Option, including the completion of a minimum expenditure drill program. (see News Release June 16, 2022 and August 18, 2022). The Staghorn licenses represent approximately 11% of the total Golden Rose Project ("Golden Rose") licenses area strategically located along the gold deposit bearing Cape Ray - Valentine Lake Shear Zones in Central Newfoundland.

Pursuant to Section 3.3 of the Option Agreement, upon exercising the Initial Option, TRU has a 30-day period during which it can provide written notice of its intention to exercise the Additional Option which would enable TRU to acquire an additional 14% interest in the Staghorn Property. The exercise of the Additional Option would require the Company to pay $200,000 cash and incur $850,000 of exploration expenditures, including $510,000 of drilling activity on the Staghorn Property, within two years of exercising the Initial Option.

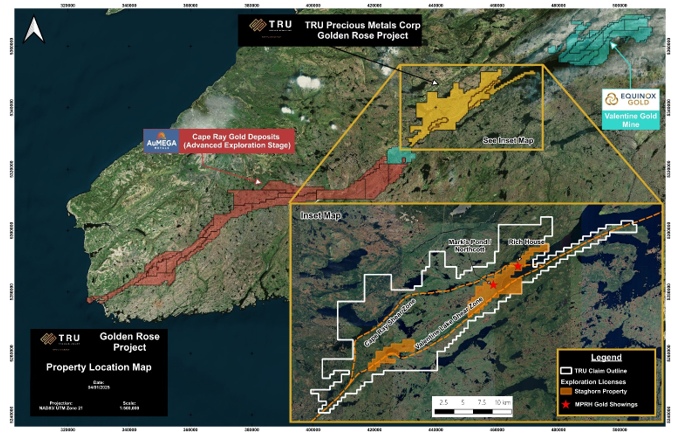

The Company also announces that it has completed a 1,988 metre diamond drill program at its Golden Rose Golden Rose Project ("Golden Rose"). The 2025 drilling program was focused upon a portion of the Mark's Pond to Rich House "exploration fairway" (see News Release dated April 03, 2025) which was selected based upon its interpreted prospectivity, and to comply with the minimum expenditure drilling commitments, as a portion of the Staghorn Property is located within the exploration fairway. (see Figure 1)

Assay results from the drill program are still pending and will be reported upon when received.

In the meantime, the Company's field crew will be following up with a focussed mapping and ground truthing program aimed at further refining the geological and structural site-wide model and expanding the pipeline of quality drill targets beyond the initial area of drilling focus.

About TRU Precious Metals Corp.

TRU (TSXV:TRU, OTCQB:TRUIF, FSE:706) is on a mission to build long-term shareholder value through prudent natural resource property development. The company's flagship project is the Golden Rose Project a regional-scale 297.50 km2 land package in Central Western Newfoundland (includes a 33.25 km2 package of claims over which TRU has a 51% interest and an option with TSX-listed Quadro Resources Ltd. to acquire an additional 14% ownership) which straddles a 45 km strike length along the gold deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Equinox Gold's Valentine Project and AuMEGA Metals' Cape Ray Gold Project. TRU is currently focused on efficiently discovering the full gold and copper potential at Golden Rose, targeting continuity along this proven gold bearing trend. The Golden Rose Project is currently subject to an Earn-In Agreement with TSX-listed Eldorado Gold Corporation ("Eldorado"), whereby Eldorado has the option to fund CAD15.25M in cash payments and exploration expenditures over 5 years to earn an 80%-interest in the Golden Rose project. Please refer to the July 30th, 2024 press release for further details of the agreement.

TRU is approximately 36%-owned by European strategic investor Ormonde Mining plc (AQSE:ORM).

For further information about TRU, please contact:

Steve NICOL

CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

X (formerly Twitter): https://x.com/metalstru

YouTube: https://www.youtube.com/@TruMetalsCorp

LinkedIn: https://www.linkedin.com/company/tru-precious-metals-corp/

Instagram: https://www.instagram.com/TRUMetals/

Facebook: https://www.facebook.com/TRUMetals/

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at Golden Rose.

Forward-Looking Statements

This press release contains certain forward-looking statements. These statements are based on numerous assumptions regarding Golden Rose, the Company's exploration programs and results, and commodities prices that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization at Golden Rose; risks inherent in mineral exploration activities; volatility in precious metals and base metals prices; volatility in economic conditions and financial markets; and those other risks described in the Company's continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

This press release is solely the responsibility of TRU, and Eldorado is not in any way responsible or liable for the contents hereof.

Neither TSXV nor its Regulation Services Provider (as that term is defined in policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: TRU Precious Metals Corp.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/tru-exercises-initial-option-to-acquire-51-interest-in-staghorn-property-1047478