TAMPA, Fla., July 10, 2025 /PRNewswire/ -- Lazydays Holdings, Inc. ("Lazydays" or the "Company") (NasdaqCM: GORV) today announced that the Company's Board of Directors has approved the implementation of a reverse stock split (the "Reverse Stock Split") of the Company's issued and outstanding common stock, par value $0.0001 per share (the "Common Stock") by a ratio of 1-for-30. The Company will effect the Reverse Stock Split at a 1-for-30 ratio effective at 5:00 p.m. Eastern time on July 11, 2025. The Company's Common Stock is expected to begin trading on a Reverse Stock Split adjusted basis on The Nasdaq Capital Market at market open on July 14, 2025 under the existing symbol "GORV" and the new CUSIP number 52110H209.

At the Company's Annual Meeting of Stockholders held on July 3, 2025, the Company's stockholders approved a proposal to authorize a reverse stock split of the Common Stock by a ratio of at least 1-for-2 and up to 1-for-30, as determined by the Company's Board of Directors.

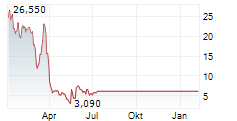

The Reverse Stock Split is primarily intended to increase the Company's per share market price of its Common Stock to seek to regain compliance with the minimum per share bid price requirement for continued listing on The Nasdaq Capital Market.

Ron Fleming, CEO of Lazydays, said, "This strategic initiative reflects our commitment to the long-term strength and stability of Lazydays. We are grateful for the continued support of our shareholders and remain focused on executing our operational turnaround plan."

As a result of the Reverse Stock Split, every 30 shares of the Common Stock will be automatically combined into one new share of Common Stock. No fractional shares will be issued in connection with the Reverse Stock Split. If the shares of Common Stock held by any holder of Common Stock immediately prior to the Reverse Stock Split are collectively reclassified pursuant to the Reverse Stock Split into a fractional number of shares of Common Stock, the Company will issue to such holder such fractions of a share of Common Stock as are necessary to round the number of shares of Common Stock held by such holder immediately following the Reverse Stock Split up to the nearest whole number of shares. The Reverse Stock Split will not alter stockholders' percentage ownership interest in the Company, except to the extent of any de minimis change due to rounding up as described above.

The Company's transfer agent, Continental Stock Transfer & Trust Company, will serve as the exchange agent for the Reverse Stock Split. Registered stockholders holding pre-reverse split shares of the Company's Common Stock electronically in book-entry form are not required to take any action to receive post-reverse split shares. Those stockholders who hold their shares in brokerage accounts or in "street name" will have their positions automatically adjusted to reflect the Reverse Stock Split, subject to each broker's particular processes, and will not be required to take any action in connection with the Reverse Stock Split. Any stockholder of record holding shares of the Company's Common Stock in certificate form will receive a transmittal letter from Continental Stock Transfer & Trust Company with instructions as soon as practicable after the Reverse Stock Split.

About Lazydays

Lazydays has been a prominent player in the RV industry since our inception in 1976, earning a stellar reputation for delivering exceptional RV sales, service, and ownership experiences. Our commitment to excellence has led to enduring relationships with RVers and their families who rely on us for all of their RV needs.

Our wide selection of RV brands from top manufacturers, state-of-the-art service facilities, and an extensive range of accessories and parts ensure that Lazydays is the go-to destination for RV enthusiasts seeking everything they need for their journeys on the road. Whether you're a seasoned RVer or just starting your adventure, our dedicated team is here to provide outstanding support and guidance, making your RV lifestyle truly extraordinary.

Lazydays is a publicly listed company on the Nasdaq stock exchange under the ticker "GORV."

Forward Looking Statements

This press release includes "forward-looking statements" within the meaning of the "Safe-Harbor" provisions of the Private Securities Litigation Reform Act of 1995. Forward looking statements include statements regarding our goals, plans, projections and guidance regarding our financial position, results of operations, market position, pending and potential future financing transactions and business strategy, and often contain words such as "will," "prospect," "future," "project," "outlook," "expect," "anticipate," "intend," "plan," "believe," "estimate," "may," "seek," "would," "should," "likely," "goal," "strategy," "future," "maintain," "continue," "remain," or "target" and similar references to future periods. Examples of forward-looking statements in this press release include, among others, that the Reverse Stock Split will occur in the future and statements regarding the Company's ability to regain compliance with Nasdaq's listing standards.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events that depend on circumstances that may or may not occur in the future. Forward-looking statements are not guarantees of future events (including the future closing of the Reverse Stock Split or the Company's ability to regain or thereafter maintain compliance with Nasdaq listing requirements). Actual future events and our results of operations, financial condition and liquidity and development of the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements in this press release. The risks and uncertainties that could cause actual events or results to differ materially from future events or estimated or projected results include, without limitation, future economic and financial conditions (both nationally and locally), changes in customer demand, our relationship with, and the financial and operational stability of, vehicle manufacturers and other suppliers, risks associated with our indebtedness (including our ability to obtain further waivers or amendments to credit agreements, the actions or inactions of our lenders, available borrowing capacity, our compliance with financial covenants and our ability to refinance or repay indebtedness on terms acceptable to us), acts of God or other incidents which may adversely impact our operations and financial performance, government regulations, legislation and others set forth throughout under the headers "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Risk Factors" and in the notes to our financial statements in our most recent Quarterly Report on Form 10-Q, Annual Report on Form 10-K and from time to time in our other filings with the U.S. Securities and Exchange Commission. We urge you to carefully consider this information and not place undue reliance on forward-looking statements. We undertake no duty to update our forward-looking statements, which are made as of the date of this release.

Contact:

[email protected]

SOURCE Lazydays RV