Bridge financing through the issuance of convertible bonds to Vester Finance and European investors for €1.8m

Immediate receipt of the entire financing upon signing

Cash runway extended to November 2025, providing sufficient financial visibility to complete the safeguard process

Structuring of a financing plan with long-term strategic investors underway to support the future development of the Company

Regulatory News:

Mauna Kea Technologies (Euronext Growth: ALMKT), inventor of Cellvizio, the multidisciplinary probe and needle-based confocal laser endomicroscopy (p/nCLE) platform, today announces that it has secured a bridge financing through the issuance of convertible bonds to European investors, including Vester Finance, a Company's shareholder and long-term financing partner.

This financing immediately extends Mauna Kea Technologies' financial visibility through November 2025, beyond the timeframe of the ongoing safeguard procedure. It provides the Company with the flexibility needed to complete its financial restructuring and finalize the presentation of its safeguard plan. Mauna Kea Technologies is also working on structuring a bridge financing intended to ensure business continuity during the observation period.

In parallel, the Company is actively structuring a long-term financing plan with strategic investors and family offices to sustainably support Mauna Kea Technologies' operational development.

Sacha Loiseau, Ph.D., Chief Executive Officer of Mauna Kea Technologies, stated: "I would like to sincerely thank the investors for their valuable support, as well as Vester Finance, a long-standing partner of the Company, for reiterating its support and confidence. With a deliberately targeted amount, this bridge financing is perfectly suited to our current needs, extending our cash runway for the time required to finalize our recovery plan with all stakeholders, while preserving maximum options for the future."

Key Terms of the Convertible Bond Issuance

The issuance of convertible bonds was carried out based on the delegation granted by the Company's shareholders during the General Meeting held on June 5, 2025, under the 12th resolution1. This issue was carried out on the basis of Article L. 225-138 of the French Commercial Code, with the removal of preferential subscription rights in favor of a category of investors meeting the characteristics determined by the General Meeting2

The convertible bonds, with a nominal unit value of €10 and a total nominal value of €1,956,510 were subscribed at 92% of their nominal value, for a total subscription price of €1,799,989.20 paid in full on the day of subscription. The bonds will bear no interest.

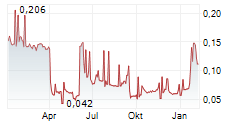

The conversion price will be determined based on the stock market price3 at the time of conversion, in accordance with pricing rules and the ceiling set by the shareholders' meeting.

The proceeds will fund the Company's operating and investment needs (excluding any repayment of existing financial debt), extending its cash visibility until November 2025. Unconverted bonds will be redeemed at maturity at 100% of their nominal value 24 months after issuance. Bonds may be converted at any time from the issue date until maturity. This transaction was advised by Vester Finance, which is also a subscriber to OC0727.

For illustrative purposes, if all convertible bonds were converted based on the Mauna Kea stock closing price on July 9, 2025, a shareholder holding 1% of the capital prior to the issuance and conversion would hold 0.82% of the capital on a non-diluted basis and 0.69% on a fully diluted basis. The new shares issued from conversion will be fully fungible with existing ordinary shares and will carry the same rights.

Risk Factors

Risk factors affecting the Company are detailed in Chapter 2 of the 2024 Annual Report, published on April 30, 2025, and available on the Mauna Kea Technologies Company's website (https://www.maunakeatech.com/fr/finances/).

As previously stated by the Company in its press releases regarding the ongoing safeguard procedure, Mauna Kea Technologies' financial situation remains fragile. The bond financing described above is a first step but does not in itself guarantee business continuity. The Company continues to actively seek additional funding and is negotiating its financial liabilities. Updates will be provided regularly to the market regarding the safeguard procedure and the financial status of Mauna Kea.

Since the bond conversion price is linked to the Company's share price, the exact number of shares to be issued upon conversion cannot be determined at the time of issuance, and such conversion may significantly dilute existing shareholders.

A sensitivity table (provided for illustrative purposes only) outlines potential dilution scenarios based on share price changes.

Sensitivity Table

| |||

-10% | Current* | +10% | |

Shares issued | 19,369,449 | 17,412,939 | 15,847,731 |

Dilution of existing share capital | 19.61% | 17.99% | 16.64% |

Impact on 1% stake | 0.80% | 0.82% | 0.83% |

Closing price on July 9, 2025, i.e. €0.12

Prospectus Admission to trading

The bonds will not be subject to any application for admission to trading on Euronext Growth. This issue does not give rise to the preparation of a prospectus subject to the approval of the Autorité des marchés financiers (AMF).

About Mauna Kea Technologies

Mauna Kea Technologies is a global medical device company that manufactures and sells Cellvizio, the real-time in vivo cellular imaging platform. This technology uniquely delivers in vivo cellular visualization which enables physicians to monitor the progression of disease over time, assess point-in-time reactions as they happen in real time, classify indeterminate areas of concern, and guide surgical interventions. The Cellvizio platform is used globally across a wide range of medical specialties and is making a transformative change in the way physicians diagnose and treat patients. For more information, visit www.maunakeatech.com.

Disclaimer

This press release contains forward-looking statements about Mauna Kea Technologies and its business. All statements other than statements of historical fact included in this press release, including, but not limited to, statements regarding Mauna Kea Technologies' financial condition, business, strategies, plans and objectives for future operations are forward-looking statements. Mauna Kea Technologies believes that these forward-looking statements are based on reasonable assumptions. However, no assurance can be given that the expectations expressed in these forward-looking statements will be achieved. These forward-looking statements are subject to numerous risks and uncertainties, including those described in Chapter 2 of Mauna Kea Technologies' 2024 Annual Report filed with the Autorité des marchés financiers (AMF) on April 30, 2025, which is available on the Company's website (www.maunakeatech.fr), as well as the risks associated with changes in economic conditions, financial markets and the markets in which Mauna Kea Technologies operates. The forward-looking statements contained in this press release are also subject to risks that are unknown to Mauna Kea Technologies or that Mauna Kea Technologies does not currently consider material. The occurrence of some or all of these risks could cause the actual results, financial condition, performance or achievements of Mauna Kea Technologies to differ materially from those expressed in the forward-looking statements. This press release and the information contained herein do not constitute an offer to sell or subscribe for, or the solicitation of an order to buy or subscribe for, shares of Mauna Kea Technologies in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The distribution of this press release may be restricted in certain jurisdictions by local law. Persons into whose possession this document comes are required to comply with all local regulations applicable to this document.

________________________________

1 Delegation of authority, with removal of the preferential subscription right reserved for members of a category of persons, to decide on the issuance of common shares, financial securities, or any securities that may give rise to one or more increases in share capital for a maximum nominal amount of €4,212,127.

2 Namely, under the terms of the 12 resolution of the General Meeting: "any natural or legal person, including companies, trusts, investment funds, or other investment vehicles of any kind, whether governed by French or foreign law, that regularly invests in the pharmaceutical or medical technology sector."

3 At least equal to the lower of (i) €0.17 and (ii) 94% of the lowest of the volume-weighted average daily prices over a 10-day period preceding each conversion request.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250710432929/en/

Contacts:

Mauna Kea Technologies

investors@maunakeatech.com

NewCap Investor Relations

Aurélie Manavarere Thomas Grojean

+33 (0)1 44 71 94 94

maunakea@newcap.eu