On Constant Currency Basis (CER), U.S. sales up +17% Y/Y in H1 and +23% in Q2

Record U.S. sales productivity despite ongoing safeguard procedure

Total revenue down 5% amid weaker EMEA and ROW sales results

Further steps taken to improve Mauna Kea Technologies' financial strength

Regulatory News:

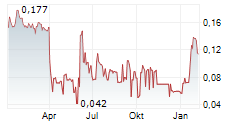

Mauna Kea Technologies (Euronext Growth: ALMKT), inventor of Cellvizio®, the multidisciplinary probe and needle-based confocal laser endomicroscopy (p/nCLE) platform, today announced its revenue for the first half and the first two quarters of 2025, ended June 30, 2025.

First Half of 2025 Performance Summary

Total revenue for the first half of 2025 amounted to €3.7m, representing a slight decline of 5% compared to H1 2024.

U.S. revenue for the first half of 2025 grew by +14% as reported and +17% in constant currency, with a significant dollar depreciation against the euro, especially in Q2 2025. U.S. operations remained robust, with accelerated growth in Q2 2025: sales rose +23% at constant currency vs. Q2 2024, and up +11% in Q1 2025 vs. Q1 2024, boosted by the expansion of the sales team.

Growth in the U.S. was primarily driven by system and probe sales, particularly in the pancreatic cysts indication, more than offsetting a decline in PPU revenue due to the gradual impact of lower Medicare reimbursement rates starting in 2024.

In Europe, business activity was gradually impacted by the Company's financial context. However, this decline was almost entirely offset by strong performances in other regions.

Sacha Loiseau, Ph.D., Chairman and CEO of Mauna Kea Technologies, stated:

"This first half confirms the relevance of our strategic decisions in our primary market, the United States, where we are seeing continued and sustained sales growth. This momentum is all the more noteworthy given that it was achieved with a reduced sales force, reflecting a strong increase in sales productivity per representative, now at a record level of over $900K, compared to just $200K in 2021.

We are also observing increased usage of Cellvizio and growing interest from new centers, particularly for indications such as pancreatic cysts and food intolerances. Pay-per-use procedure volumes have remained stable at over 800 per quarter for the past year, despite the reduction in Medicare reimbursement. The signing of three new hospitals at the end of H1 gives us confidence in a rebound in volumes going forward.

In Europe and the rest of the world, where our approach remains more opportunistic due to the lack of reimbursement, our activity was impacted by the financial environment. We are currently restructuring the organization to quickly improve efficiency in the coming months, including geographic expansion into high-potential markets such as Australia, which we recently announced.

The financial situation currently faced by Mauna Kea has, of course, had an impact on the Company's operations. However, the slight decline in revenue for the first half reflects the resilience of our business model. During this period of focus on restructuring efforts, we view the revenue level achieved in H1 as a solid performance."

Update on Safeguard Procedure

On July 10, 2025, Mauna Kea Technologies received court approval to initiate a "classes of affected parties" procedure, a framework introduced by the 2021 reform of France's business insolvency law. This process groups creditors into different classes to vote on a comprehensive restructuring plan.

In this framework, Mauna Kea Technologies will present a plan in the coming weeks, aimed at significantly reducing its debt, to be submitted to the vote by the various creditor classes.

As a reminder, the Company's current cash runway extends through November 2025. Discussions are underway, as part of this safeguard procedure, with strategic investors and family offices to secure long-term financing to support its sustainable development plan toward profitability.

Key Highlights for the First Half 2025

- U.S. Commercial Productivity

U.S. Commercial Productivity | 2021 | 2022 | 2023 | 2024 | Q1 2025 | Q2 2025 |

Revenue per sales rep (in $K)1 | 281 | 551 | 629 | 626 | 832 | 913 |

Avg. number of sales reps (over the period) | 17 | 8 | 8 | 6 | 4 | 6 |

As of January 1st, 2025, the U.S. sales team had 4 representatives, down from 8 at the beginning of 2024. Despite this reduction, the revenue increased significantly over the half year period.

Since mid-2024, new initiatives have been implemented, both in terms of sales tactics in response to Medicare reimbursement cuts and sales organization effectiveness, with the promotion of two representatives to national leadership roles. These actions have led to a significant increase in per-rep productivity, reaching historic levels of around $800K to $900K in annual sales per representative.

This positive momentum also supported the hiring of two new sales representatives during the first half of 2025, who quickly became operational.

- Pay-Per-Use (PPU) Procedure Volumes

U.S. Pay-per-Use | 2022 | 2023 | 2024 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 |

Procedure volume | 2,566 | 3,954 | 3,708 | 1,017 | 1,062 | 888 | 831 | 802 | 823 |

PPU procedure volume, which had gradually slowed in 2024 due to Medicare reimbursement cuts, has stabilized at over 800 procedures per quarter.

At the end of Q2 2025, three new PPU accounts were signed, marking the first new contracts since Q3 2024. This recovery signals renewed commercial momentum and indicates potential for volume rebound.

Furthermore, the Company is actively working toward a reimbursement reclassification, notably by correcting hospital-submitted reporting data and collaborating closely with physician associations and Medicare authorities.

Revenue by Geography H1 2025

| (in €K) IFRS | H1 2025 | H1 2024 | Change | Change CC | |||

Reported | CC | Q1 2025 | Q2 2025 | ||||

United States | 1,981 | 1,736 | +14% | +17% | +11% | +23% | |

EMEA RoW | 201 | 1,082 | -81% | -81% | -67% | -88% | |

Asia Pacific | 121 | 54 | +125% | +125% | -92% | n.a. | |

License revenue | 1,361 | 1,004 | +36% | +37% | +0% | +75% | |

Total revenue | 3,664 | 3,875 | -5% | -4% | -12% | +3% | |

By geography, business was mainly driven by the U.S., where the Company recorded a +14% growth as reported and +17% at constant currency (CC), with a dollar depreciation against the euro, especially in Q2 2025. This growth was primarily driven by system and probe sales, particularly in the pancreatic cysts indication, offsetting a decline in PPU revenue due to the gradual impact of lower Medicare reimbursement rates starting in 2024.

In Europe, business activity was gradually impacted by the Company's financial context. However, this decline was almost entirely offset by strong performances in other regions.

Revenue by Category H1 2025

| (in €K) IFRS | H1 2025 | H1 2024 | Change | Change CC | |||

Reported | CC | Q1 2025 | Q2 2025 | ||||

Systems | 689 | 584 | +18% | +23% | +195% | -1% | |

Consumables | 1,128 | 1,686 | -33% | -32% | -40% | -22% | |

Services | 486 | 602 | -19% | -19% | +5% | -32% | |

License revenue | 1,361 | 1,004 | +36% | +37% | +0% | +75% | |

Total revenue | 3,664 | 3,875 | -5% | -4% | -12% | +3% | |

"We remain fully committed to ensuring that the safeguard procedure results in a situation that allows Mauna Kea Technologies to achieve financial stability. At the same time, we are actively structuring the financial resources necessary to execute our development plan, with the aim of transforming Mauna Kea into a Company that delivers both growth and profitability", concluded Sacha Loiseau

Appendix Details of Revenue for Q1 and Q2 2025

| (in K€) IFRS | Q1 2025 | Q2 2025 | H1 2025 | Q1 2024 | Q2 2024 | H1 2024 |

United States | 850 | 1,130 | 1,981 | 754 | 982 | 1,736 |

EMEA RoW | 116 | 85 | 201 | 349 | 732 | 1,082 |

Asia Pacific | 4 | 117 | 121 | 54 | 54 | |

License revenue | 514 | 847 | 1,361 | 501 | 503 | 1,004 |

Total revenue | 1,484 | 2,179 | 3,664 | 1,658 | 2,217 | 3,875 |

About Mauna Kea Technologies

Mauna Kea Technologies is a global medical device company that manufactures and sells Cellvizio®, the real-time in vivo cellular imaging platform. This technology uniquely delivers in vivo cellular visualization which enables physicians to monitor the progression of disease over time, assess point-in-time reactions as they happen in real time, classify indeterminate areas of concern, and guide surgical interventions. The Cellvizio® platform is used globally across a wide range of medical specialties and is making a transformative change in the way physicians diagnose and treat patients. For more information, visit www.maunakeatech.com.

Disclaimer

This press release contains forward-looking statements about Mauna Kea Technologies and its business. All statements other than statements of historical fact included in this press release, including, but not limited to, statements regarding Mauna Kea Technologies' financial condition, business, strategies, plans and objectives for future operations are forward-looking statements. Mauna Kea Technologies believes that these forward-looking statements are based on reasonable assumptions. However, no assurance can be given that the expectations expressed in these forward-looking statements will be achieved. These forward-looking statements are subject to numerous risks and uncertainties, including those described in Chapter 2 of Mauna Kea Technologies' 2024 Annual Report filed with the Autorité des marchés financiers (AMF) on April 30, 2025, which is available on the Company's website (www.maunakeatech.fr), as well as the risks associated with changes in economic conditions, financial markets and the markets in which Mauna Kea Technologies operates. The forward-looking statements contained in this press release are also subject to risks that are unknown to Mauna Kea Technologies or that Mauna Kea Technologies does not currently consider material. The occurrence of some or all of these risks could cause the actual results, financial condition, performance or achievements of Mauna Kea Technologies to differ materially from those expressed in the forward-looking statements. This press release and the information contained herein do not constitute an offer to sell or subscribe for, or the solicitation of an order to buy or subscribe for, shares of Mauna Kea Technologies in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The distribution of this press release may be restricted in certain jurisdictions by local law. Persons into whose possession this document comes are required to comply with all local regulations applicable to this document.

1 Annualized sales for the first and second quarters of 2025

View source version on businesswire.com: https://www.businesswire.com/news/home/20250728813705/en/

Contacts:

Mauna Kea Technologies

investors@maunakeatech.com

NewCap Investor Relations

Aurélie Manavarere Thomas Grojean

+33 (0)1 44 71 94 94

maunakea@newcap.eu