WASHINGTON (dpa-AFX) - SL Green Realty Corp. (SLG), Manhattan's largest office landlord, has exceeded its $1 billion target for the SLG Opportunistic Debt Fund.

The fund is backed by prominent global institutional investors, including public pension funds, insurance firms, and high-net-worth platforms. Over $500 million in new commitments were secured this week alone, with further closings expected soon.

Chief Investment Officer Harrison Sitomer noted that both domestic and international investors are eager to partner with SL Green in New York City, viewing it as a timely investment opportunity. He highlighted the fund's milestone as a key step in expanding SL Green's asset management platform, strengthened by the support of existing and new investor relationships.

Launched in 2024, the fund aims to leverage the gap between improving leasing conditions and a gradually recovering debt market. It targets high-quality assets in NYC where conventional financing remains limited, offering adaptable capital solutions to borrowers and lenders.

Senior Vice President Young Hahn said the strong investor demand reflects market confidence in SL Green's ability to identify and execute high-value investments in NYC. He added that the team is now focused on deploying capital into a robust investment pipeline.

The fund will invest through established sponsor and lender relationships and SL Green's proprietary sourcing networks. It aims to generate current income and capital gains through structured debt investments, including new loan originations, loan purchases, portfolios, and controlling positions in CMBS securities-all while emphasizing downside protection.

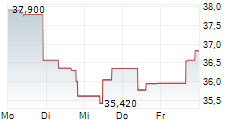

Thursday, SLG closed at $61.3, or 4.08% lower on the NYSE.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News