Reinet Investments SCA / Key word(s): Quarter Results The Board of Directors of Reinet Investments Manager S.A. announces the results of Reinet Investments S.C.A. for the quarter ended 30 June 2025.

Key financial data

BUSINESS OVERVIEW

All investments are held, either directly or indirectly, by Reinet Fund.

Information relating to current key investments AT 30 JUNE 2025

PERFORMANCE The NAV comprises total assets less total liabilities, and equates to total equity under International Financial Reporting Standards. The decrease in the NAV of € 316 million during the quarter reflects decreases in the estimated fair value on certain investments including Pension Insurance Corporation Group Limited ('Pension Corporation'), other listed investments, Trilantic Capital Partners, TruArc Partners, Coatue funds and United States land development and mortgages together with expenses in respect of management and performance fees, offset by dividends received from Pension Corporation. Details of the Company's NAV and details of movements in key investments can be found on pages 2 and 3 of this report.

Reinet records its assets and liabilities in euro; the weakening of sterling and the US dollar against the euro has resulted in an overall decrease in the value of certain assets and liabilities in euro terms. Applying current quarter-end exchange rates to the March 2025 assets and liabilities would have resulted in a decrease in the March 2025 NAV of some € 279 million.

SHARE BUYBACK PROGRAMME As at 30 June 2025, there was no share buyback programme in progress.

The Company repurchased 14 151 395 ordinary shares between November 2018 and May 2022 under five share buyback programmes. The cost of the ordinary shares repurchased amounted to € 222 million, plus transaction costs.

All ordinary shares repurchased are held as treasury shares.

NET ASSET VALUE PER SHARE The NAV per share of the Company is calculated by dividing the NAV by the number of shares outstanding (excluding treasury shares) of 181 790 891 (31 March 2025: 181 790 891).

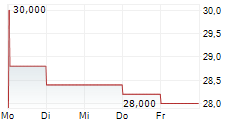

SHARE PRICE The Company's indicative share price as quoted on the Luxembourg Stock Exchange increased by 20.0 per cent in the quarter from € 23.00 at 31 March 2025 to € 27.60 at 30 June 2025. The total shareholder return since inception (taking into account the initial price of € 7.1945 and including dividends paid) is 9.1 per cent per annum. The growth in NAV, including dividends paid, reflects an 8.6 per cent compounded increase since March 2009. The Company's ordinary shares are listed on the Luxembourg Stock Exchange, Euronext Amsterdam and the Johannesburg Stock Exchange; the listing on the Johannesburg Stock Exchange is a secondary listing.

Share prices as at 30 June 2025 and 31 March 2025 were as follows:

GLOBAL MARKETS BACKDROP As 2025 progresses, geo-political tensions and economic risks remain heightened and market uncertainty continues to be impacted by the ongoing Ukraine crisis, turmoil in the Middle East and ongoing global trade tariff negotiations. Whilst inflation and interest rates are slowly trending downwards, there remains a risk that they may increase again. The extent and impact of these ongoing world-wide factors remain highly uncertain.

Reinet has no direct exposure to Russia, Ukraine or the Middle East through its underlying investments or banking relationships and has not experienced any significant direct impacts in respect of interest rate fluctuations or inflation.

Reinet recognises the importance of cash reserves in uncertain times, it maintains relationships with numerous highly rated banking institutions, and has a well-diversified approach to cash and liquidity management.

Reinet continues to value its investments in line with the International Private Equity and Venture Capital Valuation ('IPEV') guidelines and its approved valuation procedures and methodologies. All investment valuations have been prepared using latest available data, including exchange rates and listed share prices as at 30 June 2025. Discussions have taken place with fund managers and investee companies to determine any significant changes in value and any impacts related to the various geo-political areas of conflict, volatility in stock and currency markets, interest rates, inflation and exposure to certain financial institutions. Future valuations will take into account any new impacts of the above, which could affect the valuation of underlying investments.

INVESTMENTS Reinet seeks, through a range of investment structures, to build partnerships with other investors, specialised fund managers and entrepreneurs to find and develop opportunities for long-term value creation for its shareholders.

Since its formation in 2008, Reinet has invested some € 3.8 billion and at 30 June 2025 committed to provide further funding of € 657 million to its current investments. New commitments during the quarter under review amounted to € 293 million, and a total of € 21 million was funded during the quarter.

UNLISTED INVESTMENTS Unlisted investments are carried at their estimated fair value. In determining fair value, Reinet Fund Manager S.A. relies on audited and unaudited financial statements of investee companies, management reports and valuations provided by third party experts. Valuation methodologies applied are in line with International Financial Reporting Standards and include the NAV of investment funds, discounted cash flow models and comparable valuation multiples, as appropriate.

PENSION INSURANCE CORPORATION GROUP LIMITED Pension Corporation's wholly owned subsidiary, Pension Insurance Corporation plc, is a leading provider in the UK pension risk transfer market.

In March 2025, the shareholders of Pension Corporation approved a final dividend of 12.0 pence per ordinary share and a special dividend of 15.0 pence per ordinary share. Reinet's share of the dividend amounting to some € 212 million (£ 178 million) was received and recorded in May 2025.

Reinet has been engaged in discussions with Athora Holding UK Limited, a subsidiary of Athora Holding Ltd (together 'Athora'), regarding a potential sale of its total shareholding in Pension Corporation with a share purchase agreement concluded on 3 July 2025. This acquisition by Athora forms part of a broader transaction structure involving the sale of all the shares in Pension Corporation held by entities controlled by the Abu Dhabi Investment Authority, CVC Capital Partners, and HPS Investment Partners, as well as employees and other shareholders.

Reinet's announcement of 3 July 2025 stated that the agreed transaction mechanism provides for consideration payable for 100 per cent of the fully diluted share capital of Pension Corporation of approximately £ 5.7 billion as at 3 July 2025, which is expected to accrue to approximately £ 5.9 billion, including expected dividends, ahead of closing.

The transaction is subject to regulatory approval.

The transaction mechanism provides for a base value which increases at a fixed daily rate until closing. Adjustments to this value relate primarily to the various impacts of the proposed transaction on Pension Corporation's staff incentive schemes, transaction related costs and dividends paid to current shareholders between signing and closing. These adjustments are subject to variation until closing.

Reinet's shareholding in Pension Corporation remained at 49.5 per cent in the quarter under review.

Reinet's investment in Pension Corporation is carried at an estimated fair value of € 3 432 million (£ 2 945 million) at 30 June 2025 (31 March 2025: € 3 715 million (£ 3 110 million)). The fair value is based on the expected sales proceeds per the share purchase agreement, including expected dividends and closing adjustments. For this fair value determination the transaction closing is assumed to occur on 31 December 2025 with proceeds to be received in early 2026.

Total proceeds to be received from 31 March 2025 up to closing comprise £ 178 million in respect of the dividend received in May 2025 and £ 2 945 million being Reinet's share of the estimated transaction consideration, including expected dividends, based on a 31 December 2025 closing date. These amounts total some £ 3 123 million.

The estimated fair value of the investment in Pension Corporation decreased by € 283 million in the quarter which includes an adjustment of € 212 million in respect of dividends received in May 2025 (as noted above) together with the impact of the weakening of sterling against the euro amounting to € 87 million, offset by a € 16 million increase in respect of the estimated consideration value calculated under the agreed transaction mechanism.

Reinet first invested in Pension Corporation in 2012 by way of an initial £ 400 million commitment. Through participation in subsequent primary and secondary share purchases Reinet's investment totals some £ 1.1 billion. To date, Reinet has received £ 426 million in dividends from Pension Corporation.

The investment in Pension Corporation represents some 52.0 per cent of Reinet's NAV at 30 June 2025, compared to 53.7 per cent at 31 March 2025.

Further information on Pension Corporation is available at www.pensioncorporation.com

PRIVATE EQUITY AND RELATED PARTNERSHIPS TRILANTIC CAPITAL PARTNERSReinet is invested as a limited partner in five Trilantic Capital Partners' funds and related general partners.

Reinet's investment in Trilantic Management and the above funds is carried at the estimated fair value of € 353 million at 30 June 2025 (31 March 2025: € 424 million) of which € 3 million (31 March 2025: € 3 million) is attributable to the minority partner. The estimated fair value is based on unaudited valuation data provided by Trilantic Management at 31 March 2025 adjusted for changes in the value of listed investments included in the portfolios and cash movements up to 30 June 2025.

The decrease in the estimated fair value is due to distributions of € 25 million together with decreases in the estimated fair values of underlying investments and the weakening of the US dollar against the euro in the quarter, offset by capital contributions of € 7 million.

Further information on Trilantic is available at www.trilantic.com

TRUARC PARTNERS FUNDS, CO-INVESTMENT OPPORTUNITY AND MANAGEMENT COMPANY Reinet is invested in Snow Phipps II, Snow Phipps III, TruArc Fund IV, in one co-investment opportunity alongside Snow Phipps III, and in the management company.

During the quarter Reinet committed to invest € 293 million ($ 345 million) in TruArc Fund V, LP. At 30 June 2025, no capital was funded in respect of this investment.

Reinet's investment is carried at an estimated fair value of € 290 million at 30 June 2025 (31 March 2025: € 354 million), based on the unaudited valuation data provided by TruArc at 31 March 2025 adjusted for cash movements up to 30 June 2025.

The decrease in the estimated fair value reflects distributions of € 24 million together with decreases in the estimated fair values of underlying investments and the weakening of the US dollar against the euro in the quarter, offset by capital contributions of € 3 million.

Further information on TruArc Partners is available at www.truarcpartners.com

COATUE FUNDS Reinet is invested in Coatue Structured Offshore Feeder Fund LP and Coatue Tactical Solutions CT Offshore Fund B LP.

Reinet's investment is carried at an estimated fair value of € 182 million at 30 June 2025 (31 March 2025: € 198 million), based on the unaudited valuation data provided by Coatue at 31 March 2025 adjusted for cash movements up to 30 June 2025.

The decrease in the estimated fair value reflects decreases in the value of underlying investments and the weakening of the US dollar against the euro in the quarter, offset by capital contributions of € 7 million.

Further information on Coatue is available at www.coatue.com

UNITED STATES LAND DEVELOPMENT AND MORTGAGES Reinet has invested in certain real estate development projects and related businesses located in the United States (including Florida, North Carolina and South Carolina). Reinet has also purchased mortgage debt associated with such developments from financial institutions, usually at significant discounts to face value.

The investment is carried at the estimated fair value of € 20 million as at 30 June 2025 (31 March 2025: € 30 million). The current valuation is based on audited and unaudited financial statements as at 31 December 2024 adjusted for cash movements up to 30 June 2025.

The decrease in the estimated fair value reflects repayments received during the quarter of € 8 million together with the weakening of the US dollar against the euro.

Further information on Reinet's investments may be found in the Reinet 2025 annual report which is available at www.reinet/investor-relations/reports.html.

CASH AND LIQUID FUNDS Reinet holds cash on deposit principally in European-based banks and in liquidity funds holding highly rated short-term instruments.

Reinet's cash and liquid funds increased from € 1 819 million at 31 March 2025 to € 1 941 million at 30 June 2025. During the quarter dividends received amounted to some € 212 million, distributions from underlying investments amounted to some € 35 million and interest received from banks and liquidity funds amounted to some € 16 million. Payments were made of some € 25 million in respect of underlying investments, some € 28 million to Reinet Investment Advisors Limited in respect of management and performance fees which were accrued as at 31 March 2025 and other expenses amounted to some € 8 million. Decreases due the weakening of sterling and the US dollar against the euro amounted to some € 80 million.

OTHER LIABILITIES Minority interest, fees payable and other liabilities, net of other assets comprise:

The minority interest liability is in respect of a minority partner's share in the gains and losses not yet distributed arising from the estimated fair value movement of investments in which they have interests.

A management fee of € 7 million was accrued in respect of the current quarter.

A provision of € 23 million has been made for the current quarter in respect of the proportionate potential performance fee as at 30 June 2025 based on the indicative closing price of the Company's shares of € 27.60. In order for a performance fee to be payable at 31 March 2026, the volume weighted average market price of the Company's share determined by taking into account volume and price information on the Luxembourg Stock Exchange, Euronext Amsterdam and the Johannesburg Stock Exchange over the last 20 trading days of the current financial year needs to exceed € 22.84.

The performance fee (if applicable) and management fee are payable to Reinet Investment Advisors Limited.

Tax provisions relate to realised and unrealised gains arising from the investments in Trilantic Capital Partners together with withholding and corporate taxes relating to the investment in United States land development and mortgages.

CAPITAL STRUCTURE As at 30 June 2025 and 31 March 2025, there were 195 941 286 ordinary shares and 1 000 management shares in issue.

As at 30 June 2025 and 31 March 2025, the Company held 14 151 395 ordinary shares as treasury shares. The voting and dividend rights attached to the treasury shares are suspended. Therefore, the total number of voting rights at 30 June 2025 and 31 March 2025 was 181 790 891.

SHARE INFORMATION The Company's ordinary shares are listed and traded on the Luxembourg Stock Exchange (symbol 'REINI', LSEG code REIT.LU), on Euronext Amsterdam (symbol 'REINA', LSEG code REIT.AS) and on the Johannesburg Stock Exchange (symbol 'RNI', LSEG code RNIJ.J) with the ISIN number LU0383812293; the listing on the Johannesburg Stock Exchange is a secondary listing. The Company's ordinary shares are included in the 'LuxX' index of the principal shares traded on the Luxembourg Stock Exchange.

DATA PROTECTION The Data Protection Information Notice is available on the Company's website (www.reinet.com/investor-relations/data-protection.html), which is intended to provide investors with detailed information regarding the processing of their personal data, as well as the Privacy Policy (www.reinet.com/privacy-policy.html), which is intended to provide users of the Company's website with information regarding the processing of their personal data resulting from the use of the Company's website and/or from requests made via the Company's website.

Reinet Investments Manager S.A. General Partner For and on behalf of Reinet Investments S.C.A.

Website: www.reinet.com Reinet Investments S.C.A. (the 'Company') is a partnership limited by shares incorporated in the Grand Duchy of Luxembourg and having its registered office at 35, boulevard Prince Henri, L-1724 Luxembourg. It is governed by the Luxembourg law on securitisation and in this capacity allows its shareholders to participate indirectly in the portfolio of assets held by its wholly-owned subsidiary Reinet Fund S.C.A., F.I.S. ('Reinet Fund'), a specialised investment fund also incorporated in Luxembourg. The Company's ordinary shares are listed on the Luxembourg Stock Exchange, Euronext Amsterdam and the Johannesburg Stock Exchange; the listing on the Johannesburg Stock Exchange is a secondary listing. The Company's ordinary shares are included in the 'LuxX' index of the principal shares traded on the Luxembourg Stock Exchange. The Company and Reinet Fund together with Reinet Fund's subsidiaries are referred to as 'Reinet'. Cautionary statement regarding forward-looking statements Reinet Investments S.C.A. End of Inside Information | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Language: | English |

| Company: | Reinet Investments SCA |

| 35, Boulevard Prince Henri | |

| 1724 Luxemburg | |

| Luxemburg | |

| Phone: | +352 22 72 53 |

| E-mail: | info@reinet.com |

| ISIN: | LU0383812293 |

| Valor: | 4503016 |

| Listed: | Regulated Unofficial Market in Berlin, Frankfurt, Munich |

| EQS News ID: | 2172704 |

| End of Announcement | EQS News Service |

2172704 22-Jul-2025 CET/CEST