WASHINGTON (dpa-AFX) - Funds managed by Warburg Pincus and Carlyle (CG) have entered into a definitive agreement to sell NEOGOV, a leading provider of HR and compliance software for U.S. public sector agencies, to EQT X fund and the Canada Pension Plan Investment Board - CPP Investments.

Founded in 2000 and based in El Segundo, California, NEOGOV offers cloud-native human capital management and public safety solutions tailored for nearly 10,000 public sector organizations across North America. Its platform supports the full employee lifecycle, from recruitment to performance and compliance management, while helping agencies stay aligned with local regulations and policies.

Brian Chang and Vishnu Menon, Managing Directors at Warburg Pincus, highlighted the company's strong growth, expanded product suite, and deepened public sector focus over the nine-year partnership. Carlyle Partner Steve Bailey added that NEOGOV plays a vital role in enabling government agencies to better serve their communities and praised its potential under new ownership.

NEOGOV CEO Shane Evangelist thanked both Warburg Pincus and Carlyle for their strategic support and credited them with helping drive the company's growth and impact.

The deal, subject to regulatory approvals, is expected to close in the coming months. Moelis & Company advised NEOGOV, with legal counsel from Willkie Farr & Gallagher. EQT and CPP Investments were advised by Jefferies and Ropes & Gray.

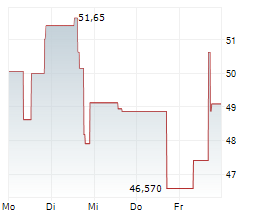

CG currently trades at $62.92, or 0.84% lower on the NasdaqGS.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News