LONDON (dpa-AFX) - Residential developer Taylor Wimpey plc (TW.L) reported Wednesday a loss in its first half, compared to prior year's profit, hurt by charges, despite higher revenues. Further, the firm triimed its interim dividend, and reduced fiscal 2025 outlook for operating profit. The outlook is unchanged on an underlying basis.

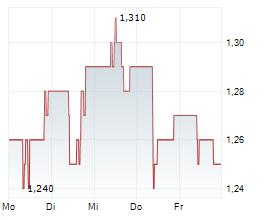

On the London Stock Exchange, Taylor Wimpey shares were losing around 5 percent to trade at 101.85 pence.

In the first half, the company's loss before tax was 92.1 million pounds, compared to prior year's profit of 99.7 million pounds. Bsic loss per share was 1.7 pence, compared to prior year's profit of 2.1 pence per share.

Profit before tax and exceptional items for the period dropped 21.1 percent to 148.1 million pounds from 187.7 million pounds last year. Adjusted basic earnings per share were 3.2 pence, down 15.8 percent from 3.8 pence a year ago.

Revenue, however, grew 9 percent to 1.655 billion pounds from 1.518 billion pounds a year ago.

Group completions (including Jvs) increased 11 percent to 5,264 homes from 4,728 homes last year.

Further, the company announced 2025 interim dividend of 4.67 pence per share, down from last year's 4.80 pence per share. The dividend is to be paid on November 14 to shareholders on the register at the close of business on October 10.

Looking ahead for the second half, the company expects an underlying improvement in operating profit margin compared to the first half.

For fiscal 2025, the Group now expects to deliver operating profit of around 424 million pounds, reflecting a 20.0 million pounds additional charge in the first half. The company previously expected Group operating profit to be 444 million pounds.

Further, the firm continues to expect full-year UK completions, excluding JVs, to be 10,400 to 10,800.

For more earnings news, earnings calendar, and earnings for stocks, visit rttnews.com.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News