Séché Environnement announces the completion of a tap of its Green Bond issued in March 2025, for an amount of €70 million.

The proceeds from this additional issue will strengthen the Group's cash position to support its sustained development.

Regulatory News:

On July 30, 2025, Séché Environnement (Paris:SCHP) issued €70 million in principal amount of additional bonds, which will be fungible with its €400 million green bond issued on March 19, 2025 (the "Green Bond")1

This bond issue was subscribed by leading international investors.

Except for the issue price, the new bonds have the same terms as the March 2025 issue, namely a coupon of 4.50% and a maturity date of March 25, 2030.

Also rated BB by Standard Poor's and Fitch Ratings, the new bonds will be fully fungible with the bonds issued in March 2025 after 40 days of the settlement date of the transaction and will be listed on Euronext Dublin.

The net proceeds from this issue will be used (i) for the Group's general corporate purposes, which may include investments in certain Eligible Projects in accordance with the Issuer's sustainability framework ("Green Bond Framework"), as well as to finance its continued growth, including certain acquisitions, and (ii) to pay the costs and expenses related to the placement of the additional bonds.

Upcoming events

Consolidated results as of June 30, 2025: September 10, 2025, after market close

About Séché Environnement

Séché Environnement is a leading player in waste management, including the most complex and hazardous types, and environmental services, particularly in the event of environmental emergencies. Thanks to its expertise in creating circular economy loops, decarbonization, and hazard control, and its cutting-edge technologies developed by its R&D department, Séché Environnement has been contributing for nearly 40 years to the ecological transition of industries and territories, as well as to the protection of life. A French family-owned industrial group, Séché Environnement supports its customers through its subsidiaries in nine strategic countries and more than 120 locations worldwide, including around 50 industrial sites in France. With around 7,300 employees, including approximately 3,000 in France, Séché Environnement generated revenue of €1,110.4 million in 2024, of which approximately 32% was generated internationally.

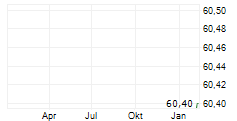

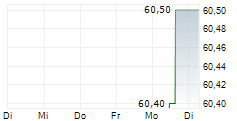

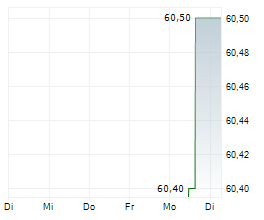

Séché Environnement has been listed on the Euronext Eurolist (compartment B) since November 27, 1997. The stock is included in the CAC Mid&Small, EnterNext Tech 40 and EnterNext PEA-PME 150 indices. ISIN: FR 0000039139 Bloomberg: SCHP.FP Reuters: CCHE.PA

For more information: www.groupe-seche.com

Cautionary statement

The notes will be offered only outside the United States to non-U.S. persons in offshore transactions pursuant to Regulation S under the U.S. Securities Act of 1933, as amended (the "Securities Act"), subject to prevailing market and other conditions. There is no assurance that the offering will be completed or, if completed, as to the terms on which it is completed. The notes to be offered have not been registered under the Securities Act or the securities laws of any other jurisdiction and may not be offered or sold in the United States absent registration or unless pursuant to an applicable exemption from the registration requirements of the Securities Act and any other applicable securities laws. This press release does not constitute an offer to sell or the solicitation of an offer to buy the notes, nor shall it constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale would be unlawful.

The notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area ("EEA"). For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, "MiFID II"); or (ii) a customer within the meaning of Directive (EU) 2016/97 (as amended), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in Regulation (EU) 2017/1129 (as amended, the "Prospectus Regulation").

The notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor (as defined above) in the United Kingdom. The expression "retail investor" in relation to the United Kingdom means a person who is one (or more) of the following: (i) a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (the "EUWA"); (ii) a customer within the meaning of the provisions of the Financial Services and Markets Act 2000 and any rules or regulations made thereunder to implement Directive (EU) 2016/97, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law by virtue of the EUWA; or (iii) not a qualified investor as defined in Article 2 of Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the EUWA.

This announcement does not constitute and shall not, in any circumstances, constitute a public offering nor an invitation to the public in connection with any offer within the meaning of the Prospectus Regulation or otherwise.

The offer and sale of the notes will be made pursuant to an exemption under the Prospectus Regulation from the requirement to produce a prospectus for offers of securities.

In the United Kingdom, this announcement is directed only at (i) persons having professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the "Order"), or (ii) high net worth entities falling within Article 49(2)(a) to (d) of the Order, or (iii) persons to whom it would otherwise be lawful to distribute them, all such persons together being referred to as "Relevant Persons." The notes are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such notes will be engaged in only with, Relevant Persons.

MiFID II professionals/ECPs-only/ No PRIIPs KID Manufacturer target market (MIFID II product governance) is eligible counterparties and professional clients only (all distribution channels). No PRIIPs key information document (KID) has been prepared as not available to retail investors in EEA.

UK MIFIR professionals/ECPs-only/ No UK PRIIPS KID Manufacturer target market (UK MIFIR product governance) is eligible counterparties and professional clients only (all distribution channels). No UK PRIIPs key information document (KID) has been prepared as not available to retail investors in the United Kingdom.

Neither the content of Séché Environnement's website nor any website accessible by hyperlinks on Séché Environnement's website is incorporated in, or forms part of, this announcement. The distribution of this announcement into certain jurisdictions may be restricted by law. Persons into whose possession this announcement comes should inform themselves about and observe any such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction.

1 See press release dated March 19, 2025.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250730149509/en/

Contacts:

SÉCHÉ ENVIRONNEMENT

Analyst Investor Relations

Manuel ANDERSEN

Head of Investor Relations

m.andersen@groupe-seche.com

+33 (0)1 53 21 53 60

Media Relations

Anna JAEGY

Head of Communication

a.jaegy@groupe-seche.com

+33 (0)1 53 21 53 53