Bittium Corporation

Half Year financial report

Bittium Corporation's Half-Year Financial Report January-June 2025

Bittium Corporation's Stock Exchange Release on 8 August 2025, at 8.00 am (CEST+1)

Net sales increased and the order backlog improved significantly in the first half of the year.

Figures in parentheses refer to the corresponding period a year earlier, unless otherwise stated.

Summary April-June 2025

- Net sales grew 15.6 percent from the previous year and were EUR 22.9 million (EUR 19.8 million).

- Product-based net sales were EUR 15.1 million (EUR 11.9 million), representing 66.0 percent (60.1 percent) of total net sales.

- Service-based net sales were EUR 7.8 million (EUR 7.9 million), representing 34.0 percent (39.9 percent) of total net sales.

- In the second quarter, a total of approximately EUR 0.9 million non-recurring costs, affecting EBITDA, operating result and result for the period, were recorded in the second quarter income statement, resulting from change negotiations held in the Finnish company of the Medical Business Segment and other measures aimed at streamlining operations and processes.

- EBITDA was EUR 2.9 million (EUR 4.2 million), representing 12.6 percent of net sales (21.2 percent).

- The operating result was EUR 1.1 million (EUR 1.9 million), representing 4.9 percent of net sales (9.6 percent).

- The result for the period was EUR 1.1 million (EUR 1.6 million) and earnings per share were EUR 0.032 (EUR 0.045).

- Cash flow from operating activities was EUR 0,0 million (EUR -2,3 million).

- Net cash flow was EUR -6,1 million (EUR -5,7 million).

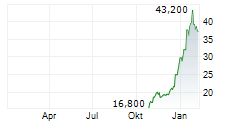

- Order backlog was EUR 43,1 million (EUR 33,8 million).

- Number of personnel at the end of the period was 538 (502).

- The Annual General Meeting held on 7 May 2025 decided, in accordance with the Board of Directors' proposal, that a dividend of EUR 0.10 per share be distributed based on the approved balance sheet for the financial period January 1-December 31, 2024.

- Petri Toljamo started as the new CEO of Bittium Corporation on 1 April 2025. The previous CEO, Johan Westermarck, resigned from his position on 18 February 2025.

- Niina Huikuri was appointed as Senior Vice President, Medical Business Segment and a member of the Management Group as of 1 May 2025.

- Teemu Hannula was appointed as Vice President, Operations and a member of the Management Group as of 1 June 2025.

- The Board of Directors of Bittium Corporation decided on a one-time additional share program for the CEO and a new program in Bittium Corporation's management share-based incentive system.

- As a result of the change negotiations held at Bittium Biosignals Oy, the Finnish company of the Medical Business Segment, the company dismissed 18 employees for financial, production and operational restructuring reasons. If the dismissals are fully implemented and other measures aimed at improving the efficiency of operations and processes are taken the company estimates that it will achieve annual savings of approximately EUR 2.0 million. As a result of the decisions and measures taken, the company will record non-recurring expenses totaling approximately EUR 0.9 million in the income statement for the second quarter of 2025, which will burden the Medical Business Segment's operating result in that period.

- Bittium signed a new agreement to supply ECG monitoring devices to the US-based Boston Scientific.

- Bittium received an order from the Finnish Defence Forces for tactical software-based radio system products and accessories, as well as a new European customer for its tactical communication solutions.

- After the review period, Bittium and the Spanish Indra Group signed a letter of intent regarding strategic cooperation related to tactical radio communication solutions.

- Investments in implementing the growth strategy and delivery capability continued.

- The global geopolitical situation is causing general uncertainty and changes in the operating environment.

Summary January-June 2025

- Net sales were EUR 42.2 million (EUR 37.9 million, representing 11.3 percent increase from last year.

- The share of product-based net sales was 61.4 percent (59.6 percent), totaling to EUR 25.9 million (EUR 22.6 million).

- The share of service-based net sales was 38.6 percent (40.4 percent), totaling to EUR 16.3 million (EUR 15.3 million).

- In the second quarter, a total of approximately EUR 0.9 million non-recurring costs, affecting EBITDA, operating result and result for the period, were recorded in the second quarter income statement, resulting from change negotiations held in the Finnish company of the Medical Business Segment and other measures aimed at streamlining operations and processes.

- EBITDA was EUR 4.8 million (EUR 7.4 million).

- Operating result was EUR 1.5 million (EUR 2.9 million), representing 3.6 percent of net sales (7.7 percent).

- Result of the period was EUR 1.5 million (EUR 2.3 million) and earnings per share were EUR 0.043 (EUR 0.064).

- Operating cash flow was EUR 9.2 million (EUR 3.0 million).

- Net cash flow was EUR 0.0 million (EUR -2.8 million).

- Order backlog was EUR 43.1 million (EUR 33.8 million).

- Personnel at the end of the period was 538 (502).

| GROUP (MEUR) | 2Q/2025 | 2Q/2024 | 1H/2025 | 1H/2024 |

| 3 months | 3 months | 6 months | 6 months | |

| Net sales | 22.9 | 19.8 | 42.2 | 37.9 |

| Change of net sales. % | 15.6 % | -4.4 % | 11.3 % | 6.5 % |

| EBITDA | 2.9 | 4.2 | 4.8 | 7.4 |

| EBITDA, % of net sales | 12.6 % | 21.2 % | 11.4 % | 19.5 % |

| Operating profit / loss | 1.1 | 1.9 | 1.5 | 2.9 |

| Operating profit / loss, % of net sales | 4.9 % | 9.6 % | 3.6 % | 7.7 % |

| Result of the period | 1.1 | 1.6 | 1.5 | 2.3 |

| Cash and other liquid assets | 21.7 | 5.5 | 21.7 | 5.5 |

| Equity ratio (%) | 70.7 % | 70.3 % | 70.7 % | 70.3 % |

| Earnings per share (EUR) | 0.032 | 0.045 | 0.043 | 0.064 |

Bittium's CEO Petri Toljamo

Net sales for the second quarter of 2025 increased by 15.6 percent year-on-year to EUR 22,9 million. The growth was mainly driven by the Defense & Security Business Segment. Net sales in the Medical and Engineering Services Business Segments also increased slightly. The operating result for the second quarter was EUR 1.1 million, which corresponds to 4.9 percent of net sales. The operating result was impacted by investments made to enable future growth and non-recurring costs of EUR 0.9 million due to change negotiations held in the Finnish company of the Medical Business Segment and other measures aimed at improving the efficiency of operations and processes. The order backlog increased by 27.5 percent year-on-year to EUR 43.1 million.

Net sales for the first half of the year increased by 11.3 percent from the previous year and were EUR 42.2 million. The increase in net sales was mainly generated in the Defense & Security Business Segment. Net sales in the Engineering Services Business Segment increased slightly from the previous year. Medical Business Segment's net sales fell slightly from the previous year due to the exceptionally high net sales in the comparison period. Operating profit for the first half of the year was EUR 1.5 million, corresponding to 3.6 percent of net sales. The accumulation of operating profit was affected by investments in future growth and non-recurring costs recorded in the second quarter.

We continued to invest in accelerating international sales and in increasing customer focus across the organization. Our efforts are reflected in, among other things, a significant increase in the order book, especially in the Defense & Security Business Segment. We have renewed our organization to ensure the right capabilities to execute our strategy across all Business Segments. We established a subsidiary in London. A local presence in United Kingdom strengthens our position in tenders and supports our collaboration with our partner BAE Systems, a global defense industry operator.

We have continued to invest in strengthening our production capabilities and scalability. We are aiming for significant international growth and production scalability is key to building growth for us. We have, among other things, strengthened our organization, increased production testing capacity and expanded the number of potential manufacturing partners.

Each Business Segment has its own growth strategy. Common themes for all are developing international sales, renewing the offering and improving operational efficiency. We will update our growth strategy in the autumn and share more about the company's operations, market developments and long-term growth opportunities at the Capital Markets Day on 23 September 2025.

In the Defense & Security Business Segment, our demand is driven by the continued growth of the defense market due to increased defense funds. Our international customer portfolio expanded when we received an order for tactical radios from a new European country. The products ordered are being used for trial use by the special forces of the country's defense forces. After the review period, we signed a letter of intent with the Spanish defense industry operator Indra Group to start a strategic cooperation in the field of tactical software-defined radios. Indra is a familiar partner to us from the European ESSOR waveform development consortium.

Cooperation with the Finnish Defence Forces continued strong in the implementation of the Partnership Agreement, and product deliveries of tactical communication system products and radios have continued as planned. We demonstrated a future hybrid network to the Defence Forces in cooperation with Nokia, where several 4G/5G bubbles were connected to our tactical communication network, enabling communication also with other authorities within the tactical network.

We expanded our tactical service portfolio with lifecycle services for our systems and products. A comprehensive range of lifecycle services for our tactical communication solutions enables training for defense sector customers, local maintenance and repair capabilities, and maximizes the operational runtime and performance of existing tactical communication solutions. Especially in military crisis situations, carrying out maintenance and repair measures locally is of great importance.

We will continue to strongly enhance international sales in order to be able to seize growth opportunities, especially in the European market. In addition, we will continue to invest in the scalability of production and delivery capabilities.

In the Medical Business Segment, we have not been able to grow our business despite operating in a growing market. We have taken measures to improve the situation and continue to work systematically to renew our product portfolio and increase our customer portfolio and market shares.

We have continued to renew our organization so that we have the right capabilities to implement our growth strategy. We held change negotiations in our Medical Business Segment's Finnish Company, as a result of which we laid off 18 employees. We are now focusing on reorganizing the segment and increasing industry expertise and focusing product development to strengthen competitiveness. The sales focus is on commercially competitive products and those market areas where growth enablers such as reimbursability and clinical practices, support success.

The cooperation with our significant customer Boston Scientific Cardiac Diagnostics strengthened and we signed a new agreement for the supply of ECG monitoring devices for the next three years. The total value of the new agreement is approximately USD 30-45 million, depending on the final order volumes. Our collaboration will also continue in the development of customized ECG technologies.

As the population ages, the most common arrhythmias, such as atrial fibrillation, are increasing significantly. Atrial fibrillation accounts for almost 70 percent of all arrhythmias, making it the most significant growth driver in the ECG diagnostics market. As atrial fibrillation becomes more common, the demand for ECG monitoring devices is also increasing, and we will focus our sales and product development efforts significantly on this product area in the coming years.

We have continued our sales efforts for the Respiro, used for diagnosing sleep apnea, in the European market and delivered small quantities of devices to our customers for commercial use. Our measuring device is particularly suitable for diagnosing obstructive sleep apnea, the prevalence of which has increased significantly. Today, 30 percent of the elderly suffer from sleep apnea, and the market for home sleep apnea monitoring devices is expected to grow in the future. We are now focusing on building sales channels and selecting strategic partners for the commercialization of Respiro.

We will continue to improve the competitiveness of our products and focus our operations on developing products and services that will bring us business in the near future. Our goal is to grow profitable international business. We will refine our strategy for the Medical Business Segment during the autumn.

In the Engineering Services Business Segment, co-operation with our customers continued well and we received follow-up orders for existing projects. The demand for R&D services has been affected by changes caused by geopolitical uncertainty for some time now and we do not expect the situation to change during the current year. Despite this, we managed to open new customer accounts, for example from the manufacturing industry markets, and the number of new orders increased significantly in the second quarter of the year. In line with our strategy, we also progressed in the defense industry markets and won our first development projects.

Earlier this year, we told about a customer project in which we were involved in designing a prototype of a next-generation satellite terminal. The project continued in the second quarter of the year when we received an order for the next development phase, which will enable direct satellite connection to mobile devices. The solution allows ordinary smartphones to establish a direct connection to satellites for, for example, text messages, chat, voice and email. The 3GPP-standardized 5G NTN technology used in the satellite terminal enables a major change in the satellite communications segment, enabling mainstream technological solutions for both the network and terminal side. This change can bring new players into the market, also expanding our customer potential.

Outlook for 2025 (Unchanged)

Bittium expects the net sales in 2025 to be EUR 95 - 105 million (EUR 85.2 million in 2024) and the operating result to be EUR 10 - 13 million (EUR 8.6 million in 2024).

More information about Bittium's market outlook is presented in this report under the chapter describing the development of the Business Segments, as well as on the company's internet pages at www.bittium.com.

Invitation to a Press Conference

Bittium will organize a webcast of the half-year report for the press, analysts and institutional investors on Friday, 8 August 2025 at 9:00 am. The conference will be held in English.

Link to the webcast: https://bittium.videosync.fi/q2-2025

Recording the webcast and the presentation will be available after the conference on Bittium's website at www.bittium.com/investors.

In Oulu, Finland, 8 August 2025

Bittium Corporation

The Board of Directors

Further Information:

Petri Toljamo

CEO

Tel. +358 40 344 2789 (group communications)

Karoliina Malmi

Vice President, Communications & Sustainability

Tel. +358 40 344 2789

Distribution

NASDAQ Helsinki

Main media

Bittium

Bittium specializes in the development of reliable, secure communications and connectivity solutions leveraging its 40-year legacy of expertise in advanced radio communication technologies. Bittium provides innovative products and services, customized solutions based on its product platforms and R&D services. Complementing its communications and connectivity solutions, Bittium offers proven information security solutions for mobile devices and portable computers. Bittium also provides healthcare technology products and services for biosignal measuring in the areas of cardiology and neurophysiology. Net sales in 2024 were EUR 85.2 million and operating profit EUR 8.6 million. Bittium is listed on Nasdaq Helsinki. www.bittium.com