Bittium Corporation

Interim report (Q1 and Q3)

Bittium Corporation's Business Review January-September 2025

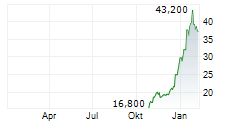

Bittium Corporation's Stock Exchange Release on 24 October 2025, at 8.00 am (CEST+1)

Bittium continued to grow in the third quarter: net sales and operating result increased significantly from previous year

Figures in parentheses refer to the corresponding period a year earlier, unless otherwise stated.

Summary July-September 2025

- Net sales grew 64.9 percent from the previous year and were EUR 23.1 million (EUR 14.0 million).

- Product-based net sales were EUR 15.8 million (EUR 7.0 million), representing 68.2 percent (50.1 percent) of total net sales.

- Service-based net sales were EUR 7.4 million (EUR 7.0 million), representing 31.8 percent (49.9 percent) of total net sales.

- EBITDA was EUR 4.6 million (EUR 1.3 million), representing 20.0 percent of net sales (9.2 percent).

- The operating result was EUR 2.5 million (EUR -0.3 million), representing 10.8 percent of net sales (-2.0 percent).

- The result for the period was EUR 2.3 million (EUR -0.6 million) and earnings per share were EUR 0.065 (EUR -0.016).

- Cash flow from operating activities was EUR 1.6 million (EUR 7.9 million).

- Net cash flow was EUR -2.4 million (EUR 5.9 million).

- Bittium Corporation's subsidiary Bittium Wireless Ltd and Indra Group signed a Letter of Intent concerning strategic cooperation related to tactical radio communication solutions.

- Bittium released the new secure Bittium Tough Mobile 3 phone and entered into a strategic partnership with HMD Secure Oy.

- The company updated its long-term financial targets and refined its strategy for 2026-2028.

Summary January-September 2025

- Net sales grew 25.7 percent from the previous year and were EUR 65.3 million (EUR 52.0 million).

- Product-based net sales were EUR 41.7 million (EUR 29.6 million), representing 63.8 percent (57.0 percent) of total net sales.

- Service-based net sales were EUR 23.7 million (EUR 22.3 million), representing 36.2 percent (43.0 percent) of total net sales.

- EBITDA was EUR 9.4 million (EUR 8.7 million), representing 14.4 percent of net sales (16.7 percent).

- The operating result was EUR 4.0 million (EUR 2.6 million), representing 6.2 percent of net sales (5.1 percent).

- The result for the period was EUR 3.8 million (EUR 1.7 million) and earnings per share were EUR 0.108 (EUR 0.048).

- Cash flow from operating activities was EUR 10.8 million (EUR 10.8 million).

- Net cash flow was EUR -2.5 million (EUR 3.0 million).

- Order backlog was EUR 33.0 million (EUR 39.4 million).

- Number of personnel at the end of the period was 527 (503).

| 7-9/2025 | 7-9/2024 | 1-9/2025 | 1-9/2024 | 1-12/2024 | |

| GROUP (MEUR) | 3 months | 3 months | 9 months | 9 months | 12 months |

| Net sales | 23.1 | 14.0 | 65.3 | 52.0 | 85.2 |

| Change of the net sales, % | 64.9 % | 0.8 % | 25.7 % | 4.9 % | 13.2% |

| EBITDA | 4.6 | 1.3 | 9.4 | 8.7 | 17.3 |

| EBITDA, % of net sales | 20.0 % | 9.2 % | 14.4% | 16.7% | 20.3 % |

| Operating profit / loss | 2.5 | -0.3 | 4.0 | 2.6 | 8.6 |

| Operating profit / loss, % of net sales | 10.8% | -2.0 % | 6.2 % | 5.1% | 10.1% |

| Result of the period | 2.3 | -0.6 | 3.8 | 1.7 | 7.3 |

| Earnings per share (EUR) | 0.065 | -0.016 | 0.108 | 0.048 | 0.205 |

| Total R&D expenses | 2.8 | 2.8 | 10.8 | 10.6 | 13.5 |

| R&D expenses, % from net sales | 12.3% | 19.8% | 16.6% | 20.4 % | 15.9% |

| Capitalized R&D expenses | 0.9 | 0.9 | 3.1 | 4.8 | 5.6 |

| Net cash from operating activities | 1.6 | 7.9 | 10.8 | 10.8 | 24.4 |

| Net cash from investing activities | -3.8 | -1.7 | -9.0 | -5.8 | -6.7 |

| Net cash from financing activities | -0.3 | -0.3 | -4.3 | -2.0 | -4.3 |

| Net change in cash and cash equivalents | -2.4 | 5.9 | -2.5 | 3.0 | 13.4 |

| Cash and other liquid assets | 19.3 | 11.4 | 19.3 | 11.4 | 21.8 |

| Net gearing (%) | 1.4% | 10.0% | 1.4% | 10.0% | -0.7 % |

| Equity ratio (%) | 69.6 % | 71.2% | 69.6 % | 71.2% | 69.9 % |

| Average personnel during the period | 527 | 500 | 527 | 506 | 507 |

| Personnel at the end of the period | 527 | 503 | 527 | 503 | 511 |

Bittium's CEO Petri Toljamo

The development of the net sales and operating result in the third quarter 2025 was excellent. Net sales grew 64.9 percent year-on-year to EUR 23.1 million. In January-September the net sales grew 25.7 percent year-on-year to EUR 65.3 million. The third quarter operating profit was EUR 2.5 million, representing 10.8 percent from net sales and in January-September EUR 4.0 million, representing 6.2 percent of net sales. The growth was mainly generated in the Defense & Security Business Segment, where third-quarter growth was 123.5 percent from last year and in January-September 45.3 percent. Bittium's January-September operating result was burdened by non-recurring costs in the Medical Business Segment during the second quarter due to change negotiations and other measures aimed at streamlining operations and processes. The order backlog remained at a good level. The development of the order backlog reflects the seasonal nature of the business and the timing of orders.

Driven by the strong growth in the defense market, we updated our long-term financial targets in September. We set an average annual revenue growth target of 20-30 percent and an annual operating profit level of 10-20 percent over the long term. The target includes both organic and inorganic growth potential. The revenue level will be affected by the company's measures to accelerate international growth, such as strengthening sales and expertise, and investments related to the scaling of operations.

To meet our long-term growth goals, we have refined our strategic focus areas, which are: 1) accelerating international sales and developing strategic partnerships to support growth, 2) ensuring technological leadership by strengthening software and AI capabilities, 3) expanding the business into new markets and verticals in the defense and security sector and exploring inorganic growth opportunities, and 4) transforming our operating model to be data-driven and scalable. As part of our growth strategy, we are also exploring inorganic growth opportunities across all of our Business Segments, particularly in the Defense & Security segment to expand our tactical communications product portfolio.

As part of our strategy, we will develop AI-based functionalities in our product families. To support this goal, we acquired approximately 25 percent of the share capital of Finnish MarshallAI (Kradient Intelligence Oy). The growth investment in MarshallAI will strengthen our capabilities with software-based AI-based solutions in all business areas, with a particular focus on defense and information security technology. According to the cooperation agreement, we license the AI tool developed by MarshallAI, which will help us develop new additional services in an agile manner and create business opportunities and customer value in our customer field.

We continued to invest in accelerating international sales by growing our own sales team and local presence close to our customers. The new office in London strengthens our collaboration with BAE Systems and supports our other sales efforts in the UK. We have continued to invest in scaling operations, including in production and testing, to prepare for future product deliveries.

The demand for Bittium solutions in the defense market is strong and we will continue to invest in growth and internationalization. We are committed to maintaining our position as a technological pioneer, which is reflected in our recent strategic activities and investments. The growth of the business is also reflected in the increase in the number of employees, especially in the Defense & Security Business Segment. We are at the beginning of our growth path and I am confident that we will be able to meet the strong market demand with reliable and sustainable Finnish solutions.

Defense & Security Business Segment

The third quarter 2025 net sales grew 123.5 percent year-on-year and was EUR 15.5 million. Operating profit was EUR 2.4 million, corresponding to 15.2 percent of net sales. January-September net sales grew 45.3 percent year-on-year and was EUR 40.6 million. Operating profit was EUR 4.4 million, corresponding to 10.9 percent of net sales. Order backlog decreased year-on-year as no new significant orders were scheduled for the third quarter.

The defense market continues to grow strongly and the development is reflected in the continued interest in our products. Our position as a supplier of advanced tactical communications solutions is highlighted in our interactions with the defence forces and authorities of various countries.

In July, we signed a Letter of Intent with the Spanish Indra Group to begin a strategic collaboration to develop a software-defined radio solution, a key technology in defense modernization. The purpose of the collaboration is to license Bittium's software-defined radio technology for tactical communications to Indra.

Cooperation with our existing customers has continued well both domestically and internationally. In the third quarter, we delivered Tough SDR radios and other tactical communications products to customers in Finland, Estonia and Croatia, as well as as to our European customer's providing air defense systems.

We further strengthened our competitiveness by introducing the new Bittium TAC WIN Smart Link 360 functionality for the waveform used in our tactical networks and radios. Smart Link 360 is the world's first solution with adaptive and fully automated directional antenna functionality that further enhances extreme immunity from interference and significantly improves performance for broadband tactical communications on the battlefield.

We will invest in developing our products, among other things, by using an artificial intelligence tool developed by MarshallAI. Their product and solution portfolio focuses on artificial intelligence-based signal processing solutions for defense and industrial needs. We will agilely develop new additional services and functionalities for our products, which will create significant value-add in our customer field.

In September, we made an important decision to continue our secure phone product family with a 5G phone and launched the new secure Bittium Tough Mobile 3 phone. The ever-increasing number of cyberattacks and the high computing power enabled by quantum computers have increased the need to develop even stronger, quantum-secure mobile security, which is what we plan to focus on in the future according to our strategy. The new Tough Mobile 3 will use a platform designed for security use by our partner HMD Secure Oy, and manufactured in cooperation with them at their factory in Europe. Our security software will make the Bittium Tough Mobile 3 the most secure phone on the market. The collaboration includes a licensing agreement regarding selected Bittium security features. We will receive license income from these resold security features in the future.

Medical Business Segment

The third quarter 2025 net sales grew 4.2 percent year-on-year and was EUR 4.3 million. Operating profit was EUR 0.5 million, corresponding to 12.3 percent of net sales. January-September net sales decreased 0.6 percent year-on-year and was EUR 13.7 million. Operating result was EUR -0.5 million, corresponding to -3.3 percent of net sales. The operating result was weakened by non-recurring costs in the second quarter, resulting from the change negotiations held in the Medical Business Segment's Finnish company, and other measures aimed at improving the efficiency of operations and processes. The order backlog decreased from the previous year, although the number of new orders in the third quarter increased from a year ago.

In September, we made an important decision for our growth strategy to focus on two business areas in the coming strategy period: Cardiac (measurement and diagnosis of the electrical activity of the heart) and Sleep (HSAT sleep apnea measurement). We will launch new ECG diagnostics product innovations and expand the market areas of the HSAT sleep apnea measurement device internationally. Focusing on two commercially mature product areas allows us to invest in strategically important activities that are key to building growth. These include, among others, clinical validation of products and strengthening strategic partnerships.

The cooperation with our US customer Boston Scientific Cardiac Diagnostics stayed strong and product deliveries to them have continued steadily. Sales of disposable ECG electrodes increased in the third quarter in Europe, but regarding the ECG measuring device sales, there haven't been any significant changes outside the US. Sales efforts for Respiro, used for diagnosing sleep apnea, continued in the European market and the commercial pilots of the solution progressed as planned.

New product development projects in the Cardiac business area are progressing according to the planned schedule. In line with our strategy, we will bring new innovations to the market for remote ECG monitoring in both the short and medium term. We are also developing Respiro based on feedback from customer pilots.

Engineering Services Business Segment

The third quarter 2025 net sales grew 11.5 percent year-on-year and was EUR 3.3 million. Operating profit was EUR 0.2 million, corresponding to 5.1 percent of net sales. January-September net sales grew 7.8 percent year-on-year and was EUR 11.1 million. Operating profit was EUR 0.6 million, corresponding to 5.4 percent of net sales. Order backlog decreased year-on-year.

As part of our strategy update, we launched a new Embedded AI offering that brings on-device AI solutions to the IoT and defense markets. This ensures that our end-to-end product development services leverage AI to deliver smarter, faster, and more evolving technology to our customers.

The launch of Embedded AI is an important step in our growth strategy. It combines expertise, technology and partnerships to enable both us and our customers to leverage intelligent, business-enabling solutions. These solutions will set the course for the next generation of innovation. As part of this, we have partnered with Edge Impulse, a US-based company, part of Qualcomm. Edge Impulse's industry-leading Edge AI tool chain simplifies data creation, model training and on-device deployment.

Cooperation with our long-term key customers continued to be good and we won follow-up projects for ongoing product development projects. In line with the updated strategy, we are focusing more strongly on offering our design services to the rapidly growing defense market, where our long-term industry expertise and market knowledge provide a good foundation for generating added value for our customers. The general market situation for product development services has continued to be challenging and we do not expect any changes in demand during this year.

Key Figures of the Reportable Segments

| DEFENSE & SECURITY BUSINESS SEGMENT, MEUR | 7-9/2025 3 months | 7-9/2024 3 months | 1-9/2025 9 months | 1-9/2024 9 months | 1-12/2024 12 months |

| Net sales | 15.5 | 7.0 | 40.6 | 27.9 | 51.6 |

| EBITDA | 3.6 | 0.5 | 7.5 | 5.4 | 13.6 |

| EBITDA, % of net sales | 23.4 % | 6.9 % | 18.6% | 19.2% | 26.4 % |

| Operating profit / Loss | 2.4 | -0.3 | 4.4 | 2.1 | 8.6 |

| Operating profit / loss, % of net sales | 15.2% | -4.4 % | 10.9% | 7.5 % | 16.7% |

| R&D expenses | 1.7 | 1.2 | 5.8 | 5.2 | 6.3 |

| Capitalized R&D expenses | -0.5 | -0.5 | -1.8 | -3.1 | -3.6 |

| New orders | 7.1 | 9.2 | 31.2 | 34.1 | 68.4 |

| Order backlog | 24.5 | 27.6 | 24.5 | 27.6 | 34.5 |

| Personnel at the end of the period | 267 | 230 | 267 | 230 | 233 |

| MEDICAL BUSINESS SEGMENT, MEUR | 7-9/2025 3 months | 7-9/2024 3 months | 1-9/2025 9 months | 1-9/2024 9 months | 1-12/2024 12 months |

| Net sales | 4.3 | 4.1 | 13.7 | 13.8 | 19.3 |

| EBITDA | 0.7 | -0.2 | 0.2 | 0.9 | 0.7 |

| EBITDA, % of net sales | 16.7% | -4.9 % | 1.7% | 6.8 % | 3.5 % |

| Operating profit / Loss | 0.5 | -0.5 | -0.5 | -0.2 | -0.9 |

| Operating profit / loss, % of net sales | 12.3% | -11.4% | -3.3 % | -1.7% | -4.5 % |

| R&D expenses | 0.9 | 1.2 | 4.4 | 3.9 | 5.3 |

| Capitalized R&D expenses | -0.4 | -0.3 | -1.3 | -1.3 | -1.4 |

| New orders | 5.8 | 4.1 | 13.8 | 13.9 | 19.9 |

| Order backlog | 4.9 | 5.6 | 4.9 | 5.6 | 6.1 |

| Personnel at the end of the period | 89 | 101 | 89 | 101 | 103 |

| ENGINEERING SERVICES BUSINESS SEGMENT, MEUR | 7-9/2025 3 months | 7-9/2024 3 months | 1-9/2025 9 months | 1-9/2024 9 months | 1-12/2024 12 months |

| Net sales | 3.3 | 3.0 | 11.1 | 10.3 | 14.3 |

| EBITDA | 0.2 | 0.0 | 0.6 | 0.5 | 1.2 |

| EBITDA, % of net sales | 5.8 % | 1.3% | 5.8 % | 5.0 % | 8.3 % |

| Operating profit / Loss | 0.2 | 0.0 | 0.6 | 0.5 | 1.2 |

| Operating profit / loss, % of net sales | 5.1% | 1.3% | 5.4 % | 4.9 % | 8.2 % |

| R&D expenses | 0.2 | 0.1 | 0.4 | 0.4 | 0.5 |

| Capitalized R&D expenses | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| New orders | 0.4 | 2.3 | 10.2 | 10.9 | 14.0 |

| Order backlog | 3.5 | 6.2 | 3.5 | 6.2 | 4.5 |

| Personnel at the end of the period | 120 | 125 | 120 | 125 | 129 |

| GROUP FUNCTIONS, MEUR | 7-9/2025 3 months | 7-9/2024 3 months | 1-9/2025 9 months | 1-9/2024 9 months | 1-12/2024 12 months |

| Net sales | |||||

| EBITDA | 0.1 | 1.0 | 1.0 | 1.9 | 1.8 |

| EBITDA, % of net sales | |||||

| Operating profit / Loss | -0.4 | 0.5 | -0.5 | 0.3 | -0.3 |

| Operating profit / loss, % of net sales | |||||

| R&D expenses | 0.0 | 0.3 | 0.2 | 1.1 | 1.5 |

| Capitalized R&D expenses | 0.0 | -0.1 | 0.0 | -0.4 | -0.6 |

| Personnel at the end of the period | 51 | 47 | 51 | 47 | 45 |

Outlook for 2025 (Unchanged)

Bittium expects the net sales in 2025 to be EUR 95 - 105 million (EUR 85.2 million in 2024) and the operating result to be EUR 10 - 13 million (EUR 8.6 million in 2024).

More information about Bittium's market outlook is presented in this report under the chapter describing the development of the Business Segments, as well as on the company's internet pages at www.bittium.com.

Risks and Uncertainties

Bittium has identified several business, market, and finance-related risk factors and uncertainties that can affect the level of sales and profits. Global geopolitical instability and recent political discussions regarding import tariffs between the United States and Europe cause various risks related to demand and supply and increased uncertainty.

Further information on risks and uncertainties is presented on the company's internet pages at www.bittium.com.

In Oulu, Finland, 24 October 2025

Bittium Corporation

The Board of Directors

Further Information:

Petri Toljamo

CEO

Tel. +358 40 344 2789 (group communications)

Karoliina Malmi

Vice President, Communications & Sustainability

Tel. +358 40 344 2789

Distribution:

Nasdaq Helsinki

Main media

Bittium

Bittium specializes in the development of reliable, secure communications and connectivity solutions leveraging its 40-year legacy of expertise in advanced radio communication technologies. Bittium provides innovative products and services, customized solutions based on its product platforms and R&D services. Complementing its communications and connectivity solutions, Bittium offers proven information security solutions for mobile devices and portable computers. Bittium also provides healthcare technology products and services for biosignal measuring in the areas of cardiology and neurophysiology. Net sales in 2024 were EUR 85.2 million and operating profit EUR 8.6 million. Bittium is listed on Nasdaq Helsinki. www.bittium.com