APRIL - JUNE 2025

- Net revenue amounted to MSEK 3.2 (4.7), a decrease of 32 percent, and a decrease of 26 percent in comparable currency.

- EBITDA amounted to MSEK 0.3 MSEK (0.2).

- Operating result, EBIT, amounted to MSEK -2.8 (-2.7).

- Result for the quarter amounted to MSEK -2.8 (-2.7).

- Earnings per share were SEK -0.13 (-0.21) before and after dilution.

- Cash flow from operating activities was MSEK 0.7 (1.8).

- Cash and cash equivalents amounted to MSEK 3.2 (8.8).

- Average Revenue Per Daily Active User (ARPDAU) amounted to USD 0.085 (0.100), a decrease of 15 percent compared to the previous year.

- Unique Monthly Active Users (MAU) during the quarter amounted to 0.5 million (0.8).

- The number of outstanding shares at the end of the period was 22 238 211. There were no subscription warrants issued at the end of the period.

JANUARY - JUNE 2025

- Net revenue amounted to MSEK 6.9 (9.4), a decrease of 26 percent, and a decrease of 24 percent in comparable currency.

- EBITDA amounted to MSEK 1.0 MSEK (-1.0).

- Operating result, EBIT, amounted to MSEK -5.1 (-6.6).

- Result for the period amounted to MSEK -5.1 (-6.6).

- Earnings per share were SEK -0.23 (-0.54) before and after dilution.

- Cash flow from operating activities was MSEK 1.1 (-0.0).

- Average Revenue Per Daily Active User (ARPDAU) amounted to USD 0.077 (0.091), a decrease of 15 percent compared to the previous year.

- Unique Monthly Active Users (MAU) during the quarter amounted to 0.6 million (0.8).

A FEW WORDS FROM OUR CEO

We conclude the second quarter with continued cost control and are finally approaching the launch of Fishing Tour. At the same time, we face a pivotal decision. On August 19, 2025, an extraordinary general meeting will be held to decide on the board's proposal to apply for delisting of the Company's shares from Nasdaq First North Growth Market. As CEO and board member, I fully support this proposal. As shareholders, we have demonstrated considerable commitment, and by further reducing our operational overhead we strengthen our position as we advance toward realizing Fishing Tour's value. Below, I outline our current position - and why delisting is a central part of our path forward.

After an extensive period of development and reorganization, we are now ready to launch a crucial update for Fishing Tour. As communicated in the Q1 report, the launch was planned for the second quarter, but to ensure we can execute our strategic shift from development to live operations, we have postponed the launch to the third quarter.

This is about more than technical completion - it's about delivering on a vision that will meet an evolving market. When we began developing Fishing Tour, the market was undergoing fundamental shifts. Our development has been agile, continuously adapting to understand and accommodate these changes. First, how people consume digital entertainment - where mobile usage parallel to other activities has become the norm. Second, how expectations have changed - where a constant, rapid flow of new content is no longer an exception, but essential for maintaining user engagement.

Fishing Tour is designed to meet these expectations, with a content model built for continuous updates in close collaboration with fishing enthusiasts, relevant influencers, and brands. Our strategy is to initially deliver monthly content, then weekly - ultimately creating a daily flow where players themselves contribute to the experience. This creates a natural foundation for a subscription-based revenue model, where premium access and exclusive content ensure recurring revenues - reinforced by in-app purchases and advertising revenue.

We are convinced this can position Fishing Tour at the forefront of a new era for mobile entertainment - an era where games are designed for how people actually consume digital content today.

The launch of Fishing Tour also marks the beginning of SOZAP's transformation from game developer to entertainment company. Our vision is for the game to become a living service - more like an interactive streaming platform than a traditional mobile game. During the fall, we will evaluate the entire business, including the portfolio of launched games and the collaboration with Supersonic, to - if the launch proves successful - streamline the company with full focus on Fishing Tour.

The first major step is the board's proposal for delisting. With the right structure and focus, we can realize Fishing Tour's full potential and scale globally. In today's market climate, these conditions are best achieved outside the public markets, where valuation and financing can reflect real potential rather than short-term market sentiment. As we stated in the press release published July 2, there are several strong arguments for why delisting is best for the company and its shareholders:

- High costs: The ongoing costs and requirements that come with a listing are no longer proportionate to the benefit for the company.

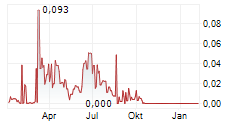

- Low liquidity: Trading in the shares is very limited, reducing the practical value of the listing.

- Financing climate: It has become more difficult to raise capital as a listed gaming company of our size.

- Path to profitability: Without listing costs, we see a more direct path to positive cash flow and better conditions for future financing.

- Strategic freedom: An unlisted environment gives us greater freedom to act long-term and flexibly, without the pressure from short-term market demands.

- Stable ownership: The company has strong and stable owner support that secures continued development in an unlisted environment.

For those of you who remain shareholders, our promise remains the same: to develop Fishing Tour with full force and build long-term shareholder value.

Rade Prokopovic

Chief Executive Officer

FINANCIAL CALENDAR

All financial reports are published on https://www.sozap.com/ir/financial-reports

- Interim Report first quarter 2025: 14 Nov 2025

- Year-End Report 2025: 13 Feb 2026

BOARD OF DIRECTORS

The Board of Directors and the CEO affirm that the interim report provides a fair overview of the Parent Company's and the Group's operations, financial positions and results, and describes the significant risks and uncertainties which the Parent Company and the Group are facing.

Nyköping, 15 August, 2025

Daniel Somos

Chair of the Board

Stefan Janse

Board member

Hanif Bali

Board member

Rade Prokopovic

CEO & Board member

This report and press release are translated versions of the Swedish originals. Every care has been taken in the translation of this document. In the event of discrepancies, the Swedish original will supersede the English translation.

For additional information, please contact:

Rade Prokopovic, VD

Email: rade@sozap.com

Telefon: +46 708 800 558

Certified Adviser

As a publicly traded company at Nasdaq First North Growth Market Stockholm, the company must have a certified adviser. SOZAP has chosen Augment Partners AB as Certified Adviser (www.augment.se).

About SOZAP

SOZAP is a Swedish digital entertainment company that develops qualitative and innovative games with the ambition of building a product portfolio which appeals to a broad target group. SOZAP was founded in 2014 and shortly after established its first development team, focusing on games in the shooter genre. SOZAP has offices in Nyköping (Sweden) and Niš (Serbia).

Important Information

This press release may contain forward looking statements reflecting the Company's current view on future events, as well as financial and operational development. Expressions like "intends", "aims", "expects", "may", "estimates", "plans" and other expressions that indicate or predict future development or trends, and which are not based on historical facts, are forward-looking statements. Such forward-looking statements are based on assumptions or estimates and the Company makes no assurance that such statements will be fulfilled or prove to be correct. The Company also does not assume responsibility for the future accuracy of the information.

This information is information that SOZAP AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-08-15 07:00 CEST.