Financial highlights during second quarter 2025

• Revenue amounted to EUR 10 931 (9 498) thousand, an increase of 15% compared with the previous year.

• Adjusted EBITDA (before items affecting comparability) was EUR 1 568 (1 466) thousand increasing by 7% year-on-year and 251% quarter-on-quarter. EBITDA amounted to EUR 1 519 (1 217) thousand.

• Profit after tax was EUR 218 (-426) thousand. Adjusted profit after tax (before items affecting comparability and currency effects) was EUR -46 (-515) thousand.

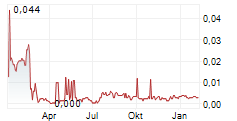

• Earnings per share amounted to EUR 0.00018 (-0.002).

• New Depositing Customers (NDC) amounted to 48 802 (45 806) increasing by 7% year-on-year and a decrease of 33% quarter-on-quarter.

• Cash flow from operating activities amounted to EUR 1 053 (1 009) thousand.

Important events during the quarter

• Acroud announced on 27th May 2025 the approval of the parallel written procedure under its outstanding bond loan.

More detailed information on press release: More detailed information:

https: //www.acroud.com/en/cision/B1C726B805869FE6/

• Acroud held the annual general meeting on 30th June 2025 of which income statements and balance sheets for 2024 were adopted and it was resolved to, among other things, re-elect Richard Gale, Daniel Barfoot, Morten Marcussen and Jørgen Beuchert as board members and elect Morten Marcussen as new chairman of the board.

More detailed information on press release:

https: //www.acroud.com/en/cision/7B209DD6B9C5C771/

Important events after the quarter

• Acroud announced on 14th July 2025 the appointment of Mikael Strunge as President and CEO.

More detailed information on press release:

https: //www.acroud.com/en/cision/1FD454C91361E783/

CEO comments: Reaping the fruits of our strategic efforts

When I joined Acroud in January 2021, the group was a classic enterprise-sized SEO affiliate in the iGaming space, promoting major brands through a growing catalogue of content designed to win search engine favor.

The industry has since changed dramatically. While Acroud did not move fast enough to fully offset the decline within our large SEO brands, we have successfully reshaped ourselves into an organization built for today's competitive landscape. We have shed the weight of being asset- and brand-heavy and embraced agility as our core strength.

Today, Acroud has the knowledge, structure, and talent to pivot into new markets quickly and effectively and this quarter we are seeing the first clear proof that our transformation is delivering results.

My tenure as President & CEO will be defined by a relentless focus on operational efficiency. We have all the building blocks needed to reach our operational and financial targets and will aim to block out the noise and primarily focus on optimizing the current segments of the group to reach their full potential.

Q2 2025 was a showcase of what Acroud can achieve when we execute with discipline and commitment. Revenue reached EUR 10 932 thousand, a solid 15% increase year-on-year and the highest quarterly revenue in Acroud's history. Adjusted EBITDA was EUR 1 568 thousand, up 7% year-on-year and 251% quarter-on-quarter, reflecting the strength of our operational and strategic shift.

In our iGaming Affiliation segment, we rebounded strongly from a challenging Q1. Brazil, one of our biggest markets, despite facing legislative and bureaucratic hurdles, is presenting competitive openings that we are decisively pursuing. Gaming activity from players has also picked up, indicating that the slow Q1 was largely a period of market adjustment to the new licensed framework.

This segment is central to our growth strategy. Recent quarters have seen a surge of new projects targeting diverse markets and marketing channels. The high success rate of these initiatives has not only driven this quarter's growth but has also reinforced our confidence in our strategic direction.

Within our SaaS segment, we are breaking records. The SaaS business has cemented a strong position for the first half of 2025, and we are poised to build on this momentum going forward. The SaaS segment as a whole delivered a revenue of EUR 6 441 thousand resulting in an increase of 15% year-on-year and an increase of 12% over Q1 2025. Revenues derived from subscription-model amounted to EUR 375 thousand which reflects a quarter-on-quarter increase of 17% and year-on-year increase of 30% while Network model revenues amounted to EUR 6 066 thousand which represents a quarter-on-quarter increase of 7% and a year-on-year increase of 54%.

Following the debt restructuring in Q1, our balance sheet is stronger, giving us the platform to accelerate growth. Acroud is now positioned to deliver on its long-term goals. With a clear strategy, a strong financial position, and a talented team, we will continue to capture the opportunities ahead while keeping a sharp focus on operational excellence.

Mikael Strunge, President & CEO

26 August 2025

Responsible parties

This information constitutes inside information that Acroud AB (publ) is required to disclose under the EU Market Abuse Regulation 596/2014. The information in this press release has been published through the agency of the contact persons below, at the time specified by Acroud AB's (publ) news distributor Cision for publication of this press release. The persons below may also be contacted for further information.

For further information, please contact:

Mikael Strunge, President and CEO

+45 2092 0995

Andrzej Mieszkowicz, CFO

+356 9911 2090

ACROUD AB (publ)

Telephone: +356 9999 6019

E-mail: info@acroud.com

Website: www.acroud.com

Certified Adviser: FNCA Sweden AB, info@fnca.se

From May 2024 (Q1 Report) Acroud has changed reporting and company language to English. This means that Interim Reports and the correlated press releases will be issued in English only.

About ACROUD AB

ACROUD is a global iGaming affiliate that operates and develops comparison and news sites within Sports Betting and Casino. Acroud also offers SaaS solutions for the iGaming affiliate industry. In past years, a number of companies have joined the ride and thus several experienced individuals in the industry leads Acroud's journey to fulfil our strategic goals. Our mission is to connect people, Content Creators (Youtubers, Streamers, Affiliates) and businesses. We remain a leading global player in the industry with our experts located in Malta, United Kingdom, Denmark, Sweden and Brazil. Acroud has been listed on the Nasdaq First North Premier Growth Market since June 2018.