The Board of Acroud AB ("Acroud") proposes that an extraordinary general meeting to be held on 23 December 2025 resolves on a directed set-off issue of 82,222,500 shares at a price corresponding to approximately SEK 0.20 per share and to approve certain ancillary changes to a vendor loan note.

For the purpose of strengthening Acroud's financial position, the board of directors proposes that Acroud carries out a directed set-off issue of 82,222,500 shares against a total subscription price of EUR 1,500,000, corresponding to a subscription price per share of approximately EUR 0.018 or SEK 0.20 (calculated on an EUR/SEK exchange ratio of 10.963). Following Acroud's acquisition of shares in Acroud Media Ltd, which was completed in January 2025, RIAE Media Ltd, as creditor, holds a vendor loan note against Acroud, as debtor, with a current outstanding principal amount of EUR 1,750,000 (the "Vendor Loan Note"). The set-off issue is directed to RIAE Media Ltd with payment by way of set-off against part of the principal amount under the Vendor Loan Note. The remaining principal amount under the Vendor Loan Note, after the proposed set-off issue, will be EUR 250,000, and the board of directors is also proposing that the extraordinary general meeting resolves to approve certain adjustments to the terms of the Vendor Loan Note in respect of the debt remaining thereunder. The Company and RIAE Media Ltd have entered into an agreement, conditional upon the general meeting's approvals, regarding the terms proposed to be adjusted in the Vendor Loan Note and with an undertaking for RIAE Media Ltd to subscribe for the shares in the set-off issue.

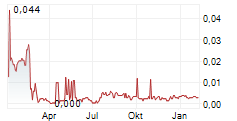

The subscription price in the directed share issue is the result of negotiations with the creditor RIAE Media Ltd. The closing price for the Company's share on Nasdaq First North Growth Market on 3 December 2025 amounts to SEK 0.131, and in relation to that share price, the agreed subscription price of the equivalent of SEK 0.20 per share corresponds to a premium of 53 per cent. A directed share issue constitutes a deviation from the shareholders' preferential rights and the board of directors has carefully evaluated the possibility to instead carry out a rights issue to raise the corresponding capital. Under the circumstances, the directed share issue has been deemed to be the most favourable option for the Company and in the best interest of the shareholders since (1) a rights issue would take significantly longer time to complete and entail an increased exposure to market risks and share price volatility, also considering that RIAE Media Ltd has accepted a subscription price corresponding to a premium compared to the prevailing share price on Nasdaq First North Growth Market, and (2) the effort and costs associated with the implementation of a rights issue would have been disproportionately burdensome given the limited size of the current capital injection compared to the Company's total market capitalisation.

Following completion of the set-off issue, RIAE Media Ltd will hold 547,419,535 of the shares and votes in the Company, which corresponds to an ownership share of approximately 42.80 per cent of the shares and votes in the Company. Gary Gillies and RIAE Media Ltd have been granted an exemption from the mandatory bid obligation by the Swedish Securities Council (AMN 2025:64) for the mandatory bid obligation that would otherwise arise through RIAE Media Ltd's subscription of shares in the set-off issue.

Following the completion of the set-off issue, the number of shares and votes in Acroud will increase by 82,222,500 shares, from 1,196,998,584 shares to 1,279,221,084 shares. The share capital will increase by EUR 317,636.938761, from EUR 4,624,171.801175 to EUR 4,941,808.739936. The set-off issue will result in a dilution effect of approximately 6.4 percent (calculated as the new number of shares and votes divided by the total number of shares and votes in the Company after the set-off issue).

The extraordinary general meeting will be held on Tuesday, 23 December 2025 at 09.00 a.m. CET at the premises of Gernandt & Danielsson Advokatbyrå KB at Hamngatan 2, Stockholm. The notice will be separately distributed.

Responsible parties

This information constitutes inside information that Acroud AB (publ) is required to disclose under the EU Market Abuse Regulation 596/2014. The information in this press release has been published through the agency of the contact persons below, at the time specified by Acroud AB's (publ) news distributor Cision for publication of this press release. The persons below may also be contacted for further information.

For further information, please contact:

Mikael Strunge, President and CEO

+ 45 20920995

Andrzej Mieszkowicz, CFO

+356 9911 2090

ACROUD AB (publ)

Telephone: +356 2132 3750/1

E-mail: info@acroud.com

Website: www.acroud.com

Certified Adviser: FNCA Sweden AB, info@fnca.se

From May 2024 (Q1 Report) Acroud has changed reporting and company language to English. This means that Interim Reports and the correlated press releases will be issued in English only.

About ACROUD AB

ACROUD is a fast-growing global challenger that operates and develops comparison and news sites within Poker, Sports Betting and Casino. Acroud also offers SaaS solutions for the iGaming affiliate industry. In past years, a number of companies have joined the ride and thus several experienced individuals in the industry leads Acroud's journey to become "The Mediahouse of The Future". Our mission is to connect people, Content Creators (Youtubers, Streamers, Affiliates) and businesses. We are growing fast and remain a leading global player in the industry with just over 70 people in Malta, United Kingdom, Denmark and Sweden. Acroud has been listed on the Nasdaq First North Growth Market since June 2018.