Financial highlights during third quarter 2025

• Revenue amounted to EUR 13,033 (9,240) thousand, an increase of 41% compared with the previous year.

• Adjusted EBITDA (before items affecting comparability) was EUR 1,422 (815) thousand, increasing by 75% year-on-year and decreasing by 9% quarter-on-quarter. EBITDA amounted to EUR 1,202 (790) thousand.

• Loss after tax was EUR -681 (-1,040) thousand. Adjusted loss after tax (before items affecting comparability and currency effects) was EUR -221 (-780) thousand.

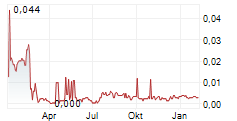

• Earnings per share amounted to EUR -0.0006 (-0.006).

• New Depositing Customers (NDC) amounted to 45,508 (41,204), increasing by 10% year-on-year and decreasing by 7% quarter-on-quarter.

• Cash flow from operating activities amounted to EUR 1,074 (206) thousand.

First nine months of 2025

• Revenue amounted to EUR 33,768 (28,225) thousand, corresponding to an increase of 20% and an organic growth of 2%.

• Adjusted EBITDA (before items affecting comparability) was EUR 3,439 (3,527) thousand, decreasing by 2% year-on-year. EBITDA amounted to EUR 2,930 (5,905) thousand, decreasing by 50% year-on-year.

• Loss after tax was EUR -3,718 (1,342) thousand. Adjusted loss after tax (before items affecting comparability and currency effects) was EUR -1,215 (-1,673) thousand. Items affecting comparability in the same period last year include the profit on disposal of poker assets amounting to EUR 2,730 thousand.

• Earnings per share amounted to EUR -0.003 (0.008). Adjusted earnings per share (before items affecting comparability and currency effects) was EUR -0.001 (-0.010).

• New Depositing Customers (NDC) amounted to 167,216 (132,541), increasing by 26%.

• Cash flow from operating activities amounted to EUR 992 (3,304) thousand.

Important events in the quarter

Acroud announced on 14 July 2025 the appointment of Mikael Strunge as President and CEO.

More detailed information: https://www.acroud.com/en/cision/1FD454C91361E783/

CEO comments for Q3 2025

The third quarter has historically presented challenges for Acroud. Although our market footprint spans multiple regions, including large areas in the southern hemisphere, the majority of major sports leagues pause for their summer break during this period. In years without major international football tournaments or Olympic events, this seasonal pattern typically leads to a temporary slowdown in iGaming activity.

Despite these recurring headwinds, our team once again delivered a record-breaking quarter across several key metrics, while maintaining a dedicated focus on our organic product portfolio and upholding our strong commitment to operational excellence and financial discipline.

Revenue for the quarter reached EUR 13,033 thousand, representing 41% year-on-year growth compared with Q3 2024. This performance was once again driven by the outstanding results of our SaaS Segment, where our Network model delivered an exceptional 91% year-on-year revenue growth. This marks the second consecutive quarter with the highest revenue in Acroud's history, solidifying our positive momentum as we enter the typically strong fourth quarter. Adjusted EBITDA amounted to EUR 1,422 thousand, reflecting 75% year-on-year growth.

Within our iGaming Affiliation Segment, revenue totaled EUR 3,775 thousand with an adjusted EBITDA of EUR 858 thousand. The performance of this segment was temporarily affected by a softer-than-usual net gaming result in September, attributable to the outcomes in a range of European football leagues. We view this as a short-term anomaly and remain focused on executing the rich project pipeline within this segment to drive future growth.

The SaaS Segment delivered EUR 9,258 thousand in revenue and an adjusted EBITDA of EUR 840 thousand - both all-time highs for the segment. Notably, we also achieved a return to positive growth in NDC generation, with a 27% quarter-on-quarter increase. Delivering this level of growth during what is typically the most challenging quarter of the year underscores the strong trajectory of this business unit.

During the quarter, we also implemented several organizational changes to further strengthen our leadership team. We have appointed Daniel Lunnes as Chief Operating Officer, Gary Gillies as Chief Business Development Officer, and Adam McSweeney as Chief Accounting Officer. These positions were all filled internally by team members that know Acroud from both an operational and cultural standpoint.

As we enter the final quarter of the year, we do so with confidence in our project portfolio, a gradually strengthening balance sheet, and a more efficient organization.

Mikael Strunge, President & CEO

25 November 2025

Responsible parties

This information constitutes inside information that Acroud AB (publ) is required to disclose under the EU Market Abuse Regulation 596/2014. The information in this press release has been published through the agency of the contact persons below, at the time specified by Acroud AB's (publ) news distributor Cision for publication of this press release. The persons below may also be contacted for further information.

For further information, please contact:

Mikael Strunge, President and CEO

+45 2092 0995

Andrzej Mieszkowicz, CFO

+356 9911 2090

ACROUD AB (publ)

Telephone: +356 9999 6019

E-mail:info@acroud.com

Website: www.acroud.com

Certified Adviser: FNCA Sweden AB, info@fnca.se

From May 2024 (Q1 Report) Acroud has changed reporting and company language to English. This means that Interim Reports and the correlated press releases will be issued in English only.

About ACROUD AB

ACROUD is a global iGaming affiliate that operates and develops comparison and news sites within Sports Betting and Casino. Acroud also offers SaaS solutions for the iGaming affiliate industry. In past years, a number of companies have joined the ride and thus several experienced individuals in the industry leads Acroud's journey to fulfil our strategic goals. Our mission is to connect people, Content Creators (Youtubers, Streamers, Affiliates) and businesses. We remain a leading global player in the industry with our experts located in Malta, United Kingdom, Denmark, Sweden and Brazil. Acroud has been listed on the Nasdaq First North Premier Growth Market since June 2018.