Edmonton, Alberta--(Newsfile Corp. - August 27, 2025) - Emperor Metals Inc. (CSE: AUOZ) (OTCQB: EMAUF) (FSE: 9NH) ("Emperor Metals") is pleased to announce the filing of a technical report (the "Technical Report") in support of its initial Mineral Resource Estimate ("2025 Duquesne West MRE" or "MRE") for its Duquesne West Gold Project in the Province of Quebec, Canada, as previously announced on July 9, 2025. The Technical Report, entitled "NI 43-101 Technical Report and Maiden Mineral Resource Estimate, Duquesne West Property, Quebec, Canada" by Warren E. Black, M.Sc., P.Geo., Fallon T. Clarke, B.Sc., P.Geo., and Kristopher J. Raffle, B.Sc., P.Geo. of APEX Geoscience is dated as of August 21, 2025 with effective date of July 2, 2025 and is available under the Company's profile at SEDAR+ (www.sedarplus.ca).

2025 Mineral Resource Estimate

The 2025 Duquesne West MRE comprises an Inferred Mineral Resource of 26.9 Mt, containing 1.460 Moz of Au at an average grade of 1.69 g/t Au. Table 1 presents the 2025 Duquesne West MRE statement. Tables 2 and 3 show the cutoff grade sensitivities for the open-pit and out-of-pit resources, respectively.

CEO John Florek commented: "We are pleased to file this technical report, which highlights the compelling nature of the opportunity and the significant growth potential that remains within the initial footprint of this deposit. The report includes a sensitivity table that illustrates robust values in both grade and size, even at higher cut-off grades; consistent with the expectations we have communicated to our investors."

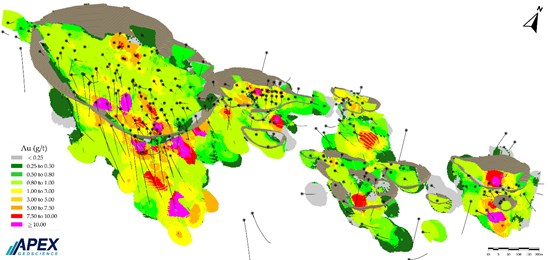

Figure 1: Oblique View of the 2025 Duquesne West MRE Conceptual Pit Shell (beige) and Gold Block Model (gradational colour bar), and drillholes (black traces).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8461/264037_5bd9ff41240269fe_002full.jpg

Note:

- Block model shown using maximum intensity projection to visualize the estimated grades.

Table 1 Summary of the Inferred Mineral Resources on the Duquesne West Project.

| Au Cutoff (g/t) | Tonnes (Mt) | Au (Moz) | Au (g/t) |

| Pit-Constrained Mineral Resource Estimate | |||

| 0.25 | 18.2 | 0.646 | 1.11 |

| Out-of-Pit Mineral Resource Estimate | |||

| 1.15 | 8.7 | 0.815 | 2.92 |

| Total Mineral Resource Estimate | |||

| 0.25/1.15 | 26.9 | 1.460 | 1.69 |

Notes:

- Warren Black, M.Sc., P.Geo., Senior Consultant, Mineral Resources of APEX Geoscience Ltd., who is deemed a qualified person as defined by NI 43-101 is responsible for the completion of the mineral resource estimation, with an effective date of July 2, 2025.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could potentially be upgraded to an Indicated Mineral Resource with continued exploration.

- The Mineral Resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

- Economic assumptions used include US$2,300/oz Au, 0.75 US$:CA$ FX, process recoveries of 90% for Au, a CA$12.5/t processing cost, and a G&A cost of CA$3.0/t.

- The constraining pit optimization parameters were CA$3.5/t mineralized and CA$3.0/t waste material mining cost and 50° pit slopes. Pit-constrained Mineral Resources are reported at a cutoff of 0.25 g/t Au.

- The Underground Mineral Resources include blocks below the constraining pit shell that form continuous and potentially minable shapes. A mining cost of CA$80/t and the economic assumptions above result in the out-of-pit cutoff of 1.15 g/t Au. Mining shapes encapsulate material within domains with a minimum horizontal width of 1.5 m, perpendicular to strike, and target vertical and horizontal dimensions of approximately 10 m (H) by 20 m (L).

Table 2 Sensitivities of the Inferred Pit-Constrained 2025 Duquesne West MRE.

| Au Cutoff (g/t) | Tonnes (Mt) | Au (Moz) | Au (g/t) |

| 0.2 | 20.19 | 0.661 | 1.02 |

| 0.25 | 18.17 | 0.646 | 1.11 |

| 0.3 | 16.24 | 0.629 | 1.21 |

| 0.4 | 13.01 | 0.593 | 1.42 |

| 0.5 | 10.62 | 0.559 | 1.64 |

| 1 | 5.01 | 0.432 | 2.68 |

| 1.5 | 2.75 | 0.345 | 3.90 |

| 2 | 1.89 | 0.297 | 4.90 |

| 2.5 | 1.49 | 0.268 | 5.62 |

| 3 | 1.11 | 0.235 | 6.60 |

| 3.5 | 0.93 | 0.217 | 7.24 |

| 4 | 0.78 | 0.199 | 7.90 |

Notes:

- All tonnage, grade, and contained metal values in this table are reported within the optimized pit shell used to constrain the stated mineral resource estimate.

- The cutoff grade used to report the stated pit-constrained mineral resource estimate is shown in bold.

Table 3 Sensitivities of the Inferred Out-of-Pit 2025 Duquesne West MRE.

| Au Cutoff (g/t) | Tonnes (Mt) | Au (Moz) | Au (g/t) |

| 1 | 8.72 | 0.816 | 2.91 |

| 1.15 | 8.69 | 0.815 | 2.92 |

| 1.3 | 7.59 | 0.771 | 3.16 |

| 1.5 | 6.46 | 0.721 | 3.47 |

| 2 | 4.53 | 0.614 | 4.21 |

| 2.5 | 3.43 | 0.535 | 4.85 |

| 3.5 | 2.44 | 0.447 | 5.70 |

| 4 | 1.91 | 0.391 | 6.39 |

Notes:

- All tonnage, grade, and contained metal values in this table are reported within the underground mining shapes used to constrain the out-of-pit portion of the stated mineral resource estimate.

- The cutoff grade used to report the stated out-of-pit mineral resource estimate is shown in bold.

QP Disclosure

The technical content for the Duquesne West Project in this news release has been reviewed and approved by John Florek, M.Sc., P.Geo., a Qualified Person pursuant to CIM guidelines. Mr. John Florek is in good standing with the Professional Geoscientists of Ontario (Member ID:1228) and an employee and officer of Emperor Metals.

About Emperor Metals Inc.

Emperor Metals Inc. is a high-grade gold exploration and development company focused on Quebec's Southern Abitibi Greenstone Belt, leveraging AI-driven exploration techniques. Emperor Metals is dedicated to unlocking the substantial resource potential of the Duquesne West Gold Project and the Lac Pelletier Project, both situated in this prolific mining district.

Emperor Metals is led by a dynamic group of resource sector professionals who have a strong record of success in evaluating and advancing mining projects from exploration through to production, attracting capital and overcoming adversity to deliver exceptional shareholder value. For more information, please refer to SEDAR+ (www.sedarplus.ca), under Emperor Metals' profile.

Under an Option Agreement, Emperor Metals agreed to acquire a 100% interest in a mineral claim package comprising 38 claims covering approximately 1,389 ha, located in the Duparquet Township of Quebec (the "Duquesne West Property") from Duparquet Assets Ltd., a 50% owned subsidiary of Globex Mining Enterprises Inc. (TSX: GMX).

ON BEHALF OF THE BOARD OF DIRECTORS

s/ "John Florek"

John Florek, M.Sc., P.Geol

President, CEO and Director

Emperor Metals Inc.

Contact

John Florek

President/CEO

T: (807) 228-3531

E: johnf@emperormetals.com

Alex Horsley

Director

T: (778) 323-3058

E: alexh@emperormetals.com

Website: www.emperormetals.com

The Canadian Securities Exchange has not approved nor disapproved the content of this press release.

Cautionary Note Regarding Forward-Looking Statements

Certain statements made and information contained herein may constitute "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian and United States securities legislation. These statements and information are based on facts currently available to Emperor Metals and there is no assurance that the actual results will meet management's expectations. Forward-looking statements and information may be identified by such terms as "anticipates," "believes," "targets," "estimates," "plans," "expects," "may," "will," "could" or "would."

Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and other matters. While Emperor Metals considers its assumptions to be reasonable as of the date hereof, forward-looking statements and information are not guarantees of future performance and readers should not place undue importance on such statements as actual events and results may differ materially from those described herein. Emperor Metals does not undertake to update any forward-looking statements or information except as may be required by applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/264037

SOURCE: Emperor Metals Inc.