VANCOUVER, BC / ACCESS Newswire / September 2, 2025 / (TSXV:OGN)(OTC:OGNNF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce that the Company has signed a purchase and sale agreement (the "Agreement") with Prospect Ridge Resources Corp. (CSE:PRR) ("Prospect Ridge") whereby Prospect Ridge has acquired the Camelot (formerly Lemon Lake) copper-gold porphyry project, located in British Columbia, Canada.

To acquire a 100% interest in the Camelot project, Prospect Ridge will pay Orogen C$200,000 in cash or common shares of Prospect Ridge over a six-month period. Orogen will retain a 1% net smelter return ("NSR") royalty with the right to acquire an additional 0.25% NSR royalty from an underlying vendor.

Paddy Nicol, CEO of Orogen commented, "The Camelot project contains a fully permitted drill target outlined by the coincidence of anomalous copper in soils, a magnetic high, and a strong chargeability anomaly with an inferred area of potassically altered monzonite. Prospect Ridge is a well funded and managed exploration company with plans to drill this exciting target in 2025. Orogen maintains its upside exposure to the property through its retained royalty and we are excited to see drill results in the coming months."

Orogen and Prospect Ridge acknowledge that the Camelot project is situated within the traditional territory of the Williams Lake Indian Band, Xatsull First Nation, and the Neskonlith Indian Band. Both companies are committed to developing positive and mutually beneficial relationships with First Nations based on trust and respect and a foundation of open and honest communications.

About the Camelot Copper-Gold Project

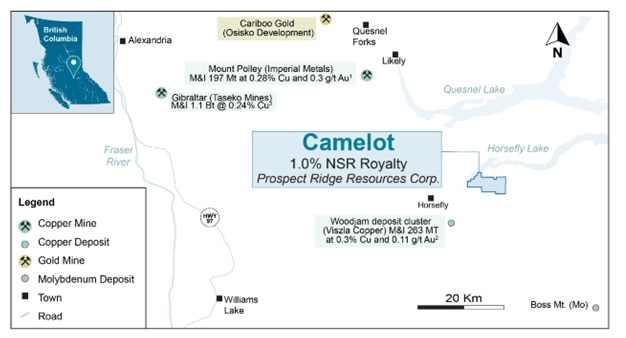

The 2,600 hectares Camelot project is located in the prolific Quesnel Belt in British Columbia, known to host both calc-alkaline copper and alkaline copper-gold porphyry systems including Imperial Metal's Mount Polley and New Gold's New Afton mines, and Vizsla Copper's Woodjam deposit cluster. (Figure 1)

The Camelot property contains the fifteen square kilometre Late Triassic to Early Jurassic composite Lemon Lake pluton with early phases of gabbro and diorite cut by at least two phases of monzonite porphyry, local monzonite breccias and, late monzonite-syenite dykes.

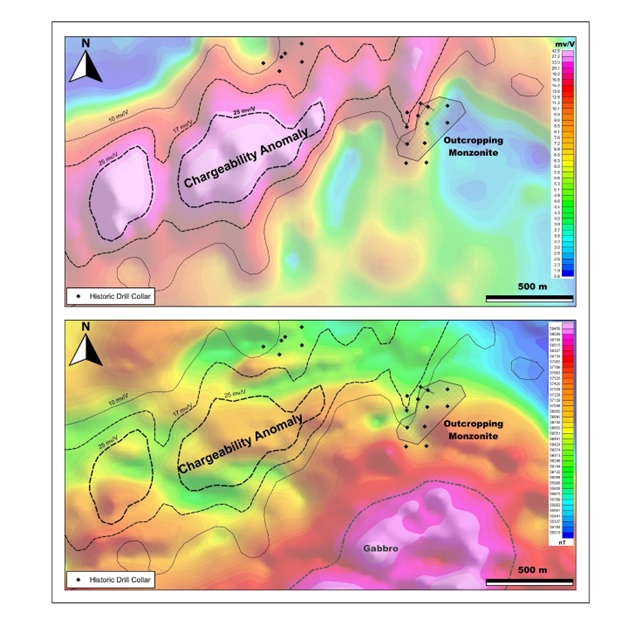

Limited historical exploration work has outlined a multi-kilometre copper in soil anomaly coincident with a 1,700 metre long chargeability (>17mv/V) anomaly developed in an undrilled overburden covered area (Figure 2 Top). The strongest regions of chargeability (>25mV/V) coincide with discrete magnetic highs (Figure 2 bottom).

Drilling in 1974 focused on sparse outcrop exposures of altered monzonite and intersected 21.3 metres of 0.25% copper with no gold assays. Additional drilling in 2022 intersected copper and gold enriched potassically altered Monzonite dykes returning up to 0.67 metres grading 0.61 grams per tonne ("g/t") gold and 1.45% copper. Both generations of holes are drilled into the peripheries of the chargeability anomaly the core of which remains undrilled.

The mineralization observed in historical drilling consists of chalcopyrite and pyrite associated with moderate K-Feldspar and biotite alteration developed in the monzonitic phase of the intrusive. Quartz veining is absent consistent with a quartz undersaturated alkalic porphyry system analogous to Mount Polley.

The core of the coincident geophysical and geochemical target remains undrilled but is permitted through 2025.

Acquisition Terms

Under the terms of the Agreement, Prospect Ridge can acquire a 100% interest in the Camelot property for a total consideration of $200,000, with $25,000 in common shares of Prospector based on a 10-day volume weighted average price ("VWAP") to be paid within five days of regulatory approval (the "Approval Date"), and $175,000 to be paid in cash or common shares of Prospector (subject to a 10-day VWAP) at the sole discretion of Prospector within six months and two days of the Approval Date. Orogen will retain a 1% NSR royalty on the project.

Orogen will also retain the right to acquire an additional 0.25% NSR royalty subject to an underlying agreement for $500,000.

The Agreement is subject to regulatory approval of the TSX Venture Exchange.

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo. VP Exploration for the Company. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

About Orogen Royalties Inc.

Orogen Royalties is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver Mine in Sonora, Mexico (2.0% NSR royalty) operated by First Majestic Silver Corp. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President, Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

info@orogenroyalties.com

Forward Looking Information

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Except where otherwise stated, the disclosure in this news release relating to properties and operations in which Orogen holds a royalty are based on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as at the date hereof, and none of this information has been independently verified by Orogen. Specifically, as a royalty holder and prospect generator, the Company has limited, if any, access to properties on which it holds royalty or other interests in its asset portfolio. The Company may from time to time receive operating information from the owners and operators of the mining properties, which it is not permitted to disclose to the public. Orogen is dependent on, (i) the operators of the mining properties and their qualified persons to provide information to Orogen, or (ii) on publicly available information to prepare disclosure pertaining to properties and operations on the properties on which the Company holds royalty or other interests, and generally has limited or no ability to independently verify such information. Although the Company does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some reported public information in respect of a mining property may relate to a larger property area than the area covered by Orogen's royalty or other interest. Orogen's royalty or other interests may cover less than 100% of a specific mining property and may only apply to a portion of the publicly reported mineral reserves, mineral resources and or production from a mining property.

1. https://imperialmetals.com/assets/docs/2024-AIF.pdf

SOURCE: Orogen Royalties Inc

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/orogen-royalties-creates-a-royalty-on-the-camelot-copper-gold-project-1067195