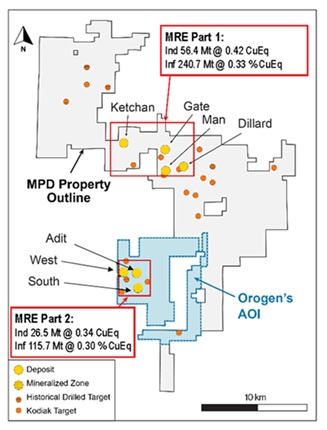

VANCOUVER, BC / ACCESS Newswire / December 11, 2025 / (TSXV:OGN)(OTCQB:OGNNF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to note Kodiak Copper Corp.'s (TSX.V:KDK) ("Kodiak") announcement of an initial Mineral Resource Estimate ("MRE") on Kodiak's South, West and Adit deposits forming the southern area of the greater MPD copper-gold porphyry project ("MPD") in British Columbia. Orogen holds a 2% net smelter return ("NSR") royalty on the southern area of the MPD project subject to a 0.5% buydown for C$2 million.

Highlights

Total Indicated Mineral Resources at MPD of 82.9 million tonnes ("Mt") grading 0.39% copper equivalent ("CuEq") for 519 million pounds ("Mlb") of copper and 0.39 million ounces ("Moz") of gold, of which 134 Mlb copper and 0.14 Moz gold is attributable to Orogen's royalty area of interest1

Total Inferred Mineral Resources at MPD of 356.3 Mt grading 0.32% CuEq for 1,889 Mlb of copper and 1.28 Moz of gold, of which 599 Mlb copper and 0.32 Moz gold is attributable to Orogen's royalty area of interest1

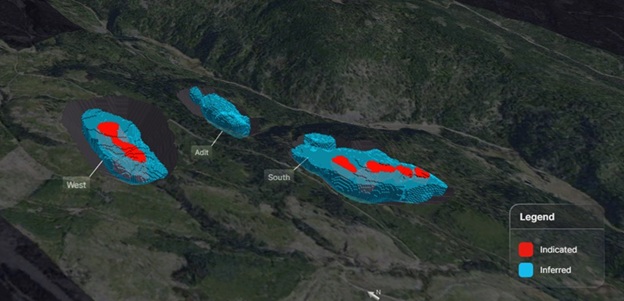

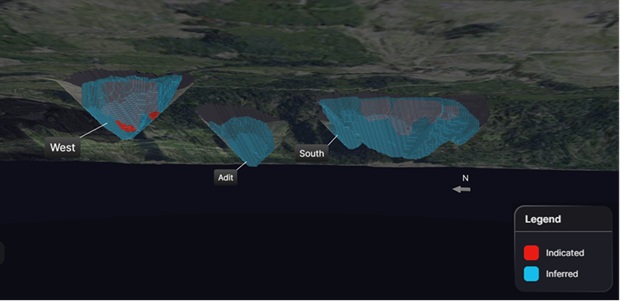

West and Adit deposits host high grade mineralization from surface while South is a larger bulk tonnage deposit over one kilometre in length and underexplored

Copper and gold mineralization at the West, Adit and South deposits remain open in several directions and at depth, highlighting the potential for resource growth

For additional information on Kodiak Copper's Mineral Resource Estimate on the MPD project, please visit: https://kodiakcoppercorp.com/kodiak-reaches-key-milestone-with-initial-mineral-resource-estimate-at-the-mpd-copper-gold-project/

Orogen CEO, Paddy Nicol, commented, "Orogen purchased the southern lands of the MPD project in 2015, a time in the commodity cycle when exploration was difficult and acquisition prices were favourable. We have been successful in having the ground partnered to various companies and are pleased to see this outcome. The initial MRE at MPD represents a significant milestone for the project and Kodiak. We are encouraged by the growth potential of MPD and look forward to the resource expansion plan and exploration in 2026."

About the MPD South Project

Orogen holds a royalty interest on approximately 50 square-kilometres of land forming part of the larger MPD copper-gold project owned and operated by Kodiak Copper Corp.2 (Figure 1) The MPD project contains extensive copper-gold bearing porphyry systems within the highly prospective southern Quesnellia terrane rocks, the same rocks that host the Highland Valley, Copper Mountain and New Afton Mines in south-central British Columbia.

Resources for the West, South and Adit deposits, which fall within Orogen's royalty area of interest, have been reported by Kodiak with shallow mineralization and favourable geometry. (Figure 2) West and Adit host high grade mineralization from surface, while South is a large bulk tonnage deposit over one kilometre in length that is still underexplored.1 All three deposits remain open, and at depth beyond the MRE pit shells, with drilling by Kodiak in 2026 focused on resource growth (Figure 3). Multiple other target zones exist on the property further indicating the region's upside.1 The table below contains the entirety of Kodiak's MRE, including resources on Orogen royalty lands (denoted by (*)).

Zone | Resource | Tonnes | Average Grade | Metal Content | Date | ||||||

Category | Reported | ||||||||||

|

| (Mt) | Cu | Au | Ag | CuEq | Cu | Au | Ag | CuEq |

|

(%) | (g/t) | (g/t) | (%) | (Mlbs) | (Moz) | (Moz) | (Mlbs) | ||||

Gate | Indicated | 56.4 | 0.31 | 0.14 | 1.18 | 0.42 | 385 | 0.25 | 2.14 | 522 | 6/25/2025 |

West* | Indicated | 14.2 | 0.21 | 0.24 | 0.8 | 0.37 | 66 | 0.11 | 0.37 | 116 | 12/9/2025 |

South* | Indicated | 12.3 | 0.25 | 0.07 | 1.17 | 0.3 | 68 | 0.03 | 0.46 | 82 | 12/9/2025 |

Gate | Inferred | 114.5 | 0.27 | 0.13 | 1.07 | 0.36 | 681 | 0.48 | 3.94 | 909 | 6/25/2025 |

Ketchan | Inferred | 66 | 0.24 | 0.12 | 1.09 | 0.33 | 349 | 0.25 | 2.31 | 480 | 6/25/2025 |

Dillard | Inferred | 51.9 | 0.2 | 0.09 | 0.39 | 0.26 | 229 | 0.15 | 0.65 | 298 | 6/25/2025 |

Man | Inferred | 8.3 | 0.17 | 0.3 | 0.56 | 0.37 | 31 | 0.08 | 0.15 | 68 | 6/25/2025 |

West* | Inferred | 24.7 | 0.22 | 0.2 | 0.77 | 0.36 | 120 | 0.16 | 0.61 | 196 | 12/9/2025 |

Adit* | Inferred | 20.1 | 0.34 | 0.03 | 2.79 | 0.38 | 151 | 0.02 | 1.8 | 168 | 12/9/2025 |

South* | Inferred | 70.9 | 0.21 | 0.06 | 1.25 | 0.26 | 328 | 0.14 | 2.85 | 406 | 12/9/2025 |

Total Indicated | 82.9 | 0.28 | 0.15 | 1.11 | 0.39 | 519 | 0.39 | 2.97 | 719 | 12/9/2025 | |

Total Inferred | 356.3 | 0.24 | 0.11 | 1.07 | 0.32 | 1,889 | 1.28 | 12.31 | 2,524 | 12/9/2025 | |

Table 1: MPD copper-gold project initial Mineral Resource Estimate. See note at end of this release. (*) Denotes Orogen's royalty area of interest.

Qualified Person Statement

Certain technical disclosure in this release, including the details of the MRE, is a summary of previously released information, and the Company is relying on the interpretation provided by the relevant company. Additional information can be found on the links in the footnotes or on SEDAR+ (www.sedarplus.ca).

Full details of estimation methodology, sensitivity and notes on the resource can be found in Kodiak's disclosure: https://kodiakcoppercorp.com/kodiak-reaches-key-milestone-with-initial-mineral-resource-estimate-at-the-mpd-copper-gold-project/

All new technical data, as disclosed in this press release, has been reviewed and approved by Laurence Pryer, Ph.D., P.Geo., Vice President of Exploration for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

About Orogen Royalties Inc.

Orogen Royalties is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver Mine in Sonora, Mexico (2.0% NSR royalty) operated by First Majestic Silver Corp. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President of Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

1. https://kodiakcoppercorp.com/kodiak-reaches-key-milestone-with-initial-mineral-resource-estimate-at-the-mpd-copper-gold-project/

2. https://orogenroyalties.com/news-releases/orogen-sells-the-axe-project-to-kodiak-copper-for-shares-and-a-royalty/

3. Notes on Kodiak Copper's MRE from Table 1:

The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), Definition Standards for Mineral Resources and Reserves, as prepared by the CIM Standing Committee and adopted by CIM Council.

A cut-off grade of 0.2% CuEq was applied to the MRE models within the pit shells.

Pit shell optimization used average recoveries derived from metallurgical test work of Cu 82%, Au 60% and Ag 54%, exchange rate of 1.35 CAD:USD, mining cost of C$2.3/t, process cost of C$8.5/t, and pit slope of 45 degrees.

Copper equivalence (CuEq) and constraining pit shells assume metal prices (US$) of: $4.2/lb copper, $2,600/oz gold, $30/oz silver.

The copper equivalency equation used is: CuEq(%) = Cu(%) + Au(g/t) x 0.6606 + Ag(g/t) x 0.0069

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves in the future. The MRE may be materially affected by considerations including, but not limited to, permitting, legal, sociopolitical, environmental issues, market conditions or other factors.

All figures are rounded to reflect the relative accuracy of the estimate. Totals may not sum due to rounding as required by reporting guidelines.

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward looking statements. Forward looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Except where otherwise stated, the disclosure in this news release relating to properties and operations in which Orogen holds a royalty are based on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as at the date hereof, and none of this information has been independently verified by Orogen. Specifically, as a royalty holder and prospect generator, the Company has limited, if any, access to properties on which it holds royalty or other interests in its asset portfolio. The Company may from time to time receive operating information from the owners and operators of the mining properties, which it is not permitted to disclose to the public. Orogen is dependent on, (i) the operators of the mining properties and their qualified persons to provide information to Orogen, or (ii) on publicly available information to prepare disclosure pertaining to properties and operations on the properties on which the Company holds royalty or other interests, and generally has limited or no ability to independently verify such information. Although the Company does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some reported public information in respect of a mining property may relate to a larger property area than the area covered by Orogen's royalty or other interest. Orogen's royalty or other interests may cover less than 100% of a specific mining property and may only apply to a portion of the publicly reported mineral reserves, mineral resources and or production from a mining property.

SOURCE: Orogen Royalties Inc

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/orogen-royalties-notes-initial-resource-estimate-on-kodiak-coppers-mpd-copper-gol-1116594