VANCOUVER, BC / ACCESS Newswire / September 10, 2025 / Kingfisher Metals Corp. (TSXV:KFR)(FSE:970)(OTCQB:KGFMF) ("Kingfisher" or the "Company") is pleased to announce initial results from the 2025 drilling program at the HWY 37 Project. The 849 km 2 HWY 37 Project is located within the Golden Triangle, British Columbia.

HW-25-004 has returned one of the highest and longest grade copper-gold intercepts ever completed at the Williams porphyry copper-gold deposit. The drillhole intercepted 557.8 meters 1 of 0.29% copper, 0.30 g/t gold, and 1.6 g/t silver (0.64% CuEq) 2 (Table 1). Importantly this hole highlights a body of strong bornite mineralization demonstrating the potential for additional high-grade porphyry copper gold deposits at the HWY 37 Project. Highlights include:

HW-25-004: 557.8 meters at 0.64% CuEq from 328.10 meters

Including 234.35 meters at 1.00% CuEq from 328.10 meters

Dustin Perry, CEO of Kingfisher, states "In these initial drill results we see clear confirmation of our exploration concepts - consistent vertical grade and expansion of the bornite-rich stockwork. The new data de-risks the broader project targets, justifies future drill meters, and strengthens our conviction that we're advancing a value-creating asset for shareholders."

HW-25-004 Summary

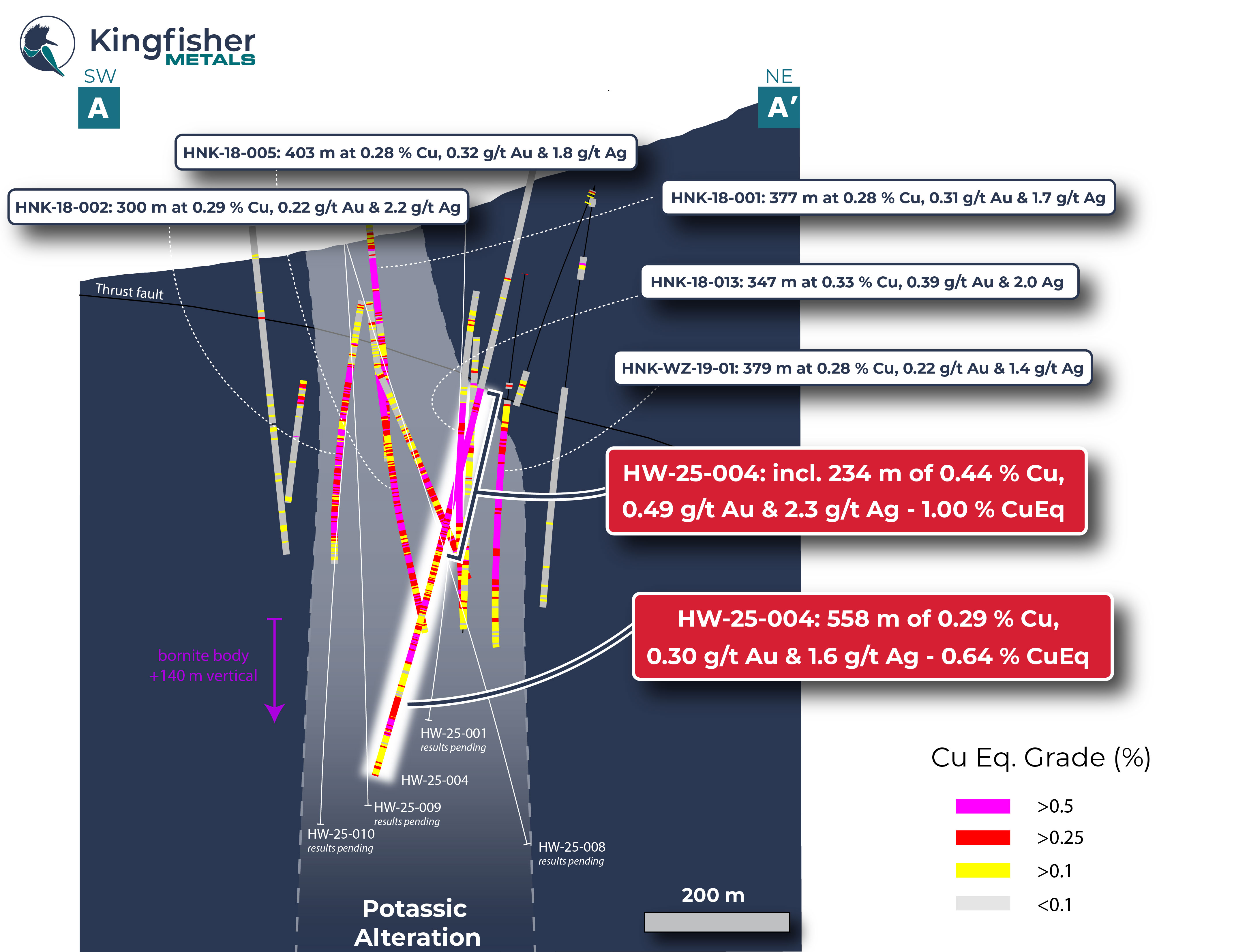

HW-25-004 was collared at 169 o degrees and -75 o dip (Figure 1 & 2), upslope and north of potassic alteration at Williams. After passing through the Williams thrust fault at 327 meters (m), the drill cut into copper-bearing potassic alteration ( Figure 3). Well-developed potassic alteration with chalcopyrite-bornite-diginite is present from 328 to 805 m downhole with chalcopyrite-dominant mineralization from 805 to end of hole at 885.9 m. Bornite occurs at surface at the discovery outcrop 1040 m elevation (m el.) and has been intersected in historical drilling down to 480 m el. These new results extend bornite mineralization to 340 m el., or 140 m deeper than previously known (Figure 2). The higher-grade subinterval of 328.10 to 562.45 m is associated with several syn-mineral porphyry phases and elevated copper is best developed in high fracture zones, breccia and higher vein density at the margin to the porphyry contacts. This subinterval is interpreted to be the hot core of the sulfide system, as bornite > chalcopyrite. Bornite-rich cores to porphyry systems are commonly associated with associated elevated gold grades. This is the first intercept of the deeper extents of the bornite > chalcopyrite body and the vertical extent of this body is unknown.

Table 1: Hole HW-25-004 Assay Results

Hole | From (m) | To (m) | Interval 1 (m) | Cu % | Au g/t | Ag g/t | CuEq 2 % |

HW-25-004 | 328.10 | 885.90 | 557.80 | 0.29 | 0.30 | 1.6 | 0.64 |

Incl. | 328.10 | 562.45 | 234.35 | 0.44 | 0.49 | 2.3 | 1.00 |

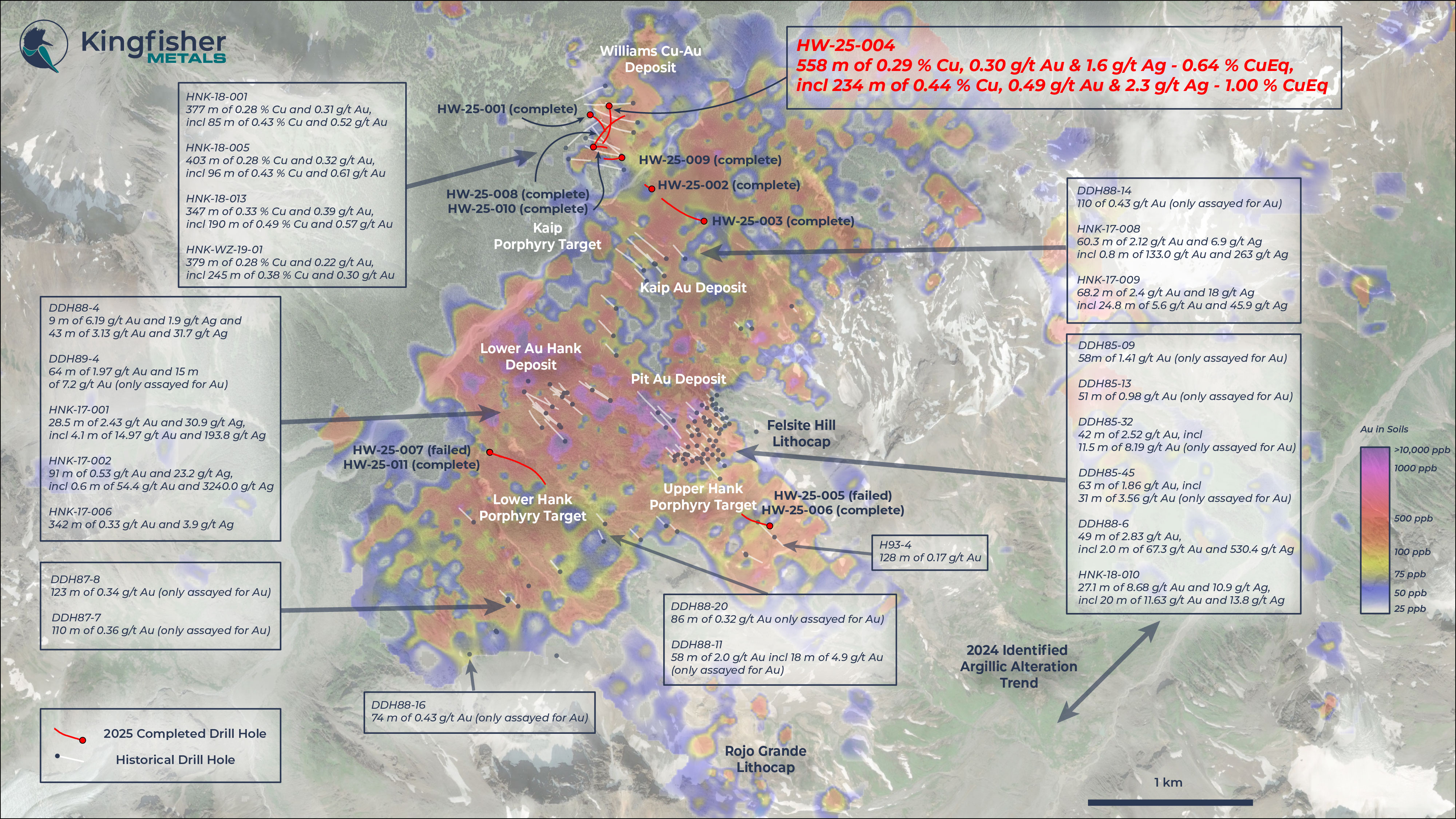

Figure 1: Plan View Historical and 2025 Drillhole Locations

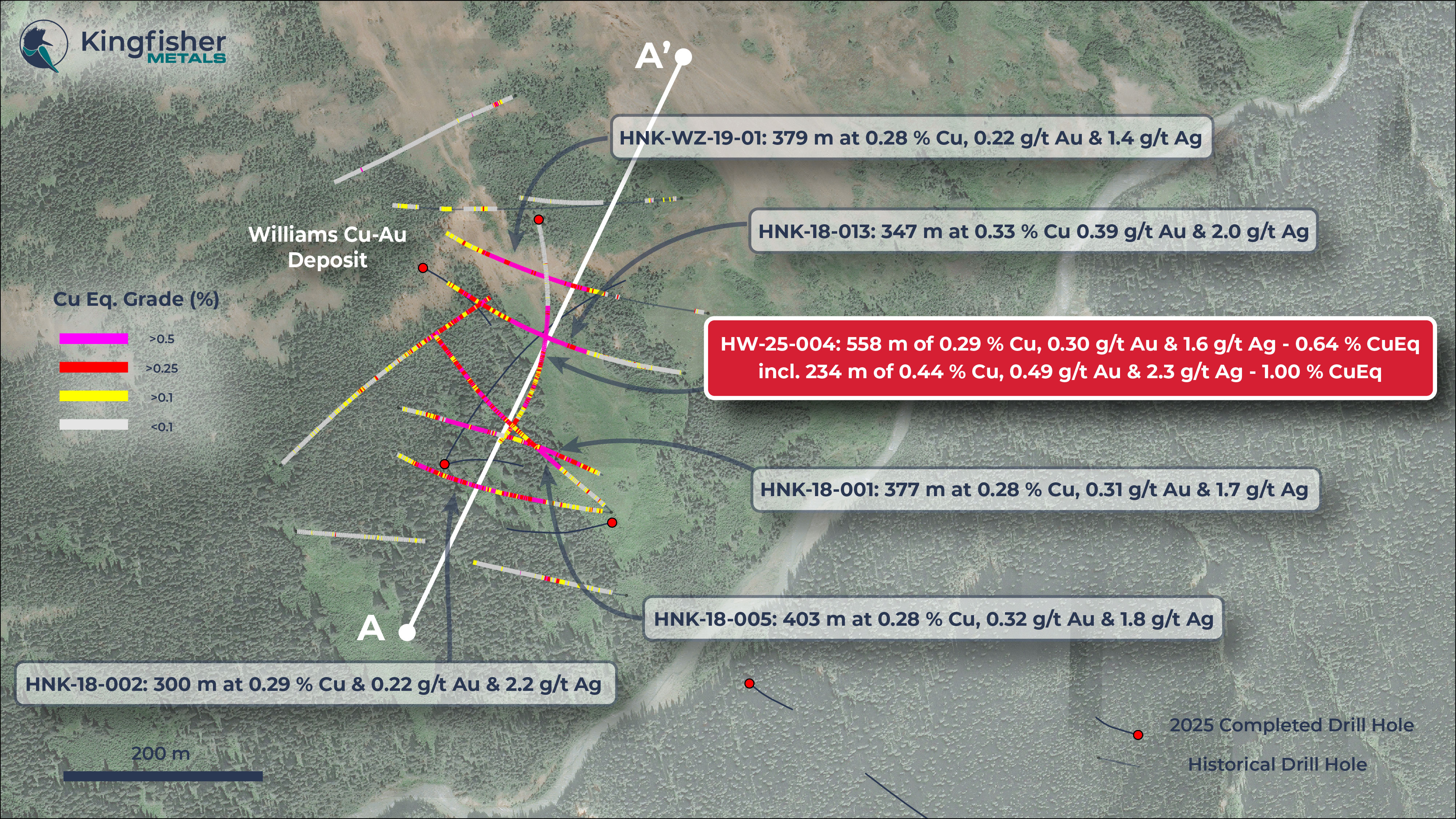

Figure 2. Plan view of Williams deposit area

Figure 3: Hole HW-25-004 Cross Section with 130m window width, Williams Deposit

Table 1. Summary of Diamond Drill Holes

Hole ID | Zone | Easting (mE) | North (mN) | Azi ( o ) | Dip ( o ) | Final Depth (m) | Status |

|---|---|---|---|---|---|---|---|

UTM NAD83 Zone 09 | |||||||

HW-25-001 | Williams | 409395 | 6344077 | 119 | -80 | 803 | Complete , samples shipped to assay lab |

HW-25-002 | East Williams | 409769 | 6343628 | 292 | -85 | 550 | Complete , samples shipped to assay lab |

HW-25-003 | East Williams | 410086 | 6343432 | 286 | -68 | 668 | Complete , samples shipped to assay lab |

HW-25-004 | Williams | 409510 | 6344131 | 169 | -75 | 886 | Reported in this release, Samples were prioritized |

HW-25-005 | Upper Hank | 410475 | 6341586 | 295 | -76 | 282 | Lost hole at 282 m short of proposed depth - no plans to send for assay at this time |

HW-25-006 | Upper Hank | 410475 | 6341586 | 295 | -77 | 839 | Complete , samples shipped to assay lab. Redrill of HW-25-005 |

HW-25-007 | Lower Hank | 408790 | 6342028 | 110 | -65 | 192 | Lost hole at 192 m short of proposed depth - no plans to send for assay at this time |

HW-25-008 | Williams | 409415 | 6343882 | 027 | -73 | 893 | Complete , samples shipped to assay lab |

HW-25-009 | Williams | 409586 | 6343818 | 255 | -82 | 761 | Complete , samples shipped to assay lab |

HW-25-010 | Williams | 409419 | 6343879 | 075 | -84 | 797 | Complete , detail logging and sampling in progress |

HW-25-011 | Lower Hank | 408790 | 6342028 | 111 | -65 | 959 | Complete , Redrill of HW-25-007, detail logging and sampling in progress |

Summary of Work Completed to date:

Drilling was completed on September 7 th , totalling 7,630 m

HW-25-001, -002, -003, -004, -006, -008, and -009 have been sent to the Bureau Veritas ("BV") lab for assay (currently logging and sampling HW-25-010 and 011). Failed holes HW-25-005 and -007 will not be assayed at this time.

84 person days of mapping

>750 soil samples

>650 surface rocks samples

30.7 line-km of IP geophysics

1,750 line-km (covering ~319 km 2 ) of airborne Mobile Magnetotellurics (MMT) geophysical survey

Light Detection and Ranging (LiDAR) survey covering 256 km 2

Quality Assurance / Quality Control (QAQC)

Drilling on site at the HWY 37 Project was supervised by on-site Kingfisher personnel who implemented a full QAQC program using coarse blanks, pulp blanks, standards, and duplicates inserted into the sample stream to monitor analytical accuracy and precision. The samples were sealed on site using tamper proof seals with unique identifiers. The samples were sent to the BV lab in Vancouver, British Columbia. BV's quality control system complies with global certifications for Quality ISO/IEC 17025:2017 - General requirements for the competence of testing and calibration laboratories . Diamond drill core samples were analyzed using a combination of BV's MA200 process for low level concentrations (4 acid digestion/ICP-ES/MS) and MA 370 process for higher level concentrations (4 acid digestion/ICP-ES). Gold assaying was completed using FA430, a 30-gram fire assay with AAS finish. If applicable, base metal overlimits were finalized with titration, and gold overlimits completed with a gravimetric finish. Technical aspects of this news release have been reviewed, verified, and approved by Tyler Caswell, P.Geo., Vice President Exploration of Kingfisher, who is a qualified person as defined by National Instrument 43-101 - Standards of Disclosure for Minerals Projects.

About Kingfisher Metals Corp.

Kingfisher Metals Corp. (https://kingfishermetals.com/) is a Canadian based exploration company focused on copper-gold exploration in the Golden Triangle, British Columbia. Through outright purchases and option earn in agreements (Orogen Royalties and Golden Ridge Resources) the Company has quickly consolidated one of the largest land positions in the region at the contiguous 849 km 2 HWY 37 Project. Kingfisher also owns (100%) two district-scale orogenic gold projects in British Columbia that total 641 km 2 . The Company currently has 88,822,226 shares outstanding.

For further information, please contact:

Dustin Perry, P.Geo.

CEO and Director

Phone: +1 778 606 2507

E-Mail: info@kingfishermetals.com

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property. This news release contains statements that constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur.

Forward-looking statements in this news release include, among others, statements relating to expectations regarding the projects, and other statements that are not historical facts. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company's business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company's securities, regardless of its operating performance.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

1 True widths of the reported mineralized interval have not been determined.

2 Assumptions used in USD for the copper equivalent calculation (CuEq) were metal prices of $4.00/lb copper, $3,000/oz gold, and $30/oz silver. Recovery is assumed to be 80% for copper, 80% for gold and 80% for silver. The following equations was used to. calculate the copper equivalence: CuEq = copper (%) + (gold (g/t) x 1.0938) + (silver (g/t) x 0.0109). Differences may occur due to rounding.

SOURCE: Kingfisher Metals Corp.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/kingfisher-metals-reports-234-meters-of-1.0-copper-equivalent-within-558-meters-o-1071033