VANCOUVER, BC / ACCESS Newswire / September 10, 2025 / Irving Resources Inc. (CSE:IRV)(OTCQX:IRVRF) ("Irving" or the "Company") is pleased to announce that diamond drill hole 25SY-001 completed at the East Yamagano Joint Venture (the "JV") has encountered multiple mineralized vein zones. Significant assays are tabulated below:

Hole | From (m) | To (m) | Length (m) | Au (gpt) | Ag (gpt) | AuEq (gpt) |

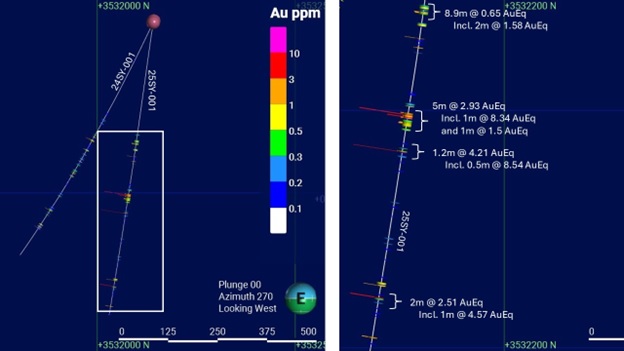

25SY-001 | 306.10 | 315.00 | 8.90 | 0.64 | 1.03 | 0.65 |

including | 313.00 | 315.00 | 2.00 | 1.56 | 1.58 | 1.58 |

| 328.00 | 331.00 | 3.00 | 0.55 | 0.97 | 0.56 |

| 346.50 | 347.00 | 0.50 | 2.41 | 4.84 | 2.47 |

| 358.00 | 359.00 | 1.00 | 1.06 | 49.70 | 1.68 |

| 442.00 | 458.50 | 16.50 | 1.38 | 1.92 | 1.40 |

including | 444.00 | 449.00 | 5.00 | 2.90 | 2.26 | 2.93 |

including | 444.00 | 445.00 | 1.00 | 8.30 | 2.89 | 8.34 |

and | 454.00 | 456.20 | 2.20 | 1.48 | 1.84 | 1.50 |

| 490.80 | 492.00 | 1.20 | 4.14 | 5.79 | 4.21 |

including | 491.50 | 492.00 | 0.50 | 8.38 | 13.10 | 8.54 |

| 659.00 | 663.57 | 4.57 | 0.89 | 0.97 | 0.90 |

including | 662.00 | 663.57 | 1.57 | 1.62 | 0.97 | 1.63 |

| 678.00 | 680.00 | 2.00 | 2.48 | 2.00 | 2.51 |

including | 678.00 | 679.00 | 1.00 | 4.53 | 2.86 | 4.57 |

| 729.00 | 730.00 | 1.00 | 1.83 | 0.80 | 1.84 |

AuEq = Au + (Ag/80); recovery of both Au and Ag is expected to be +95% as smelter flux

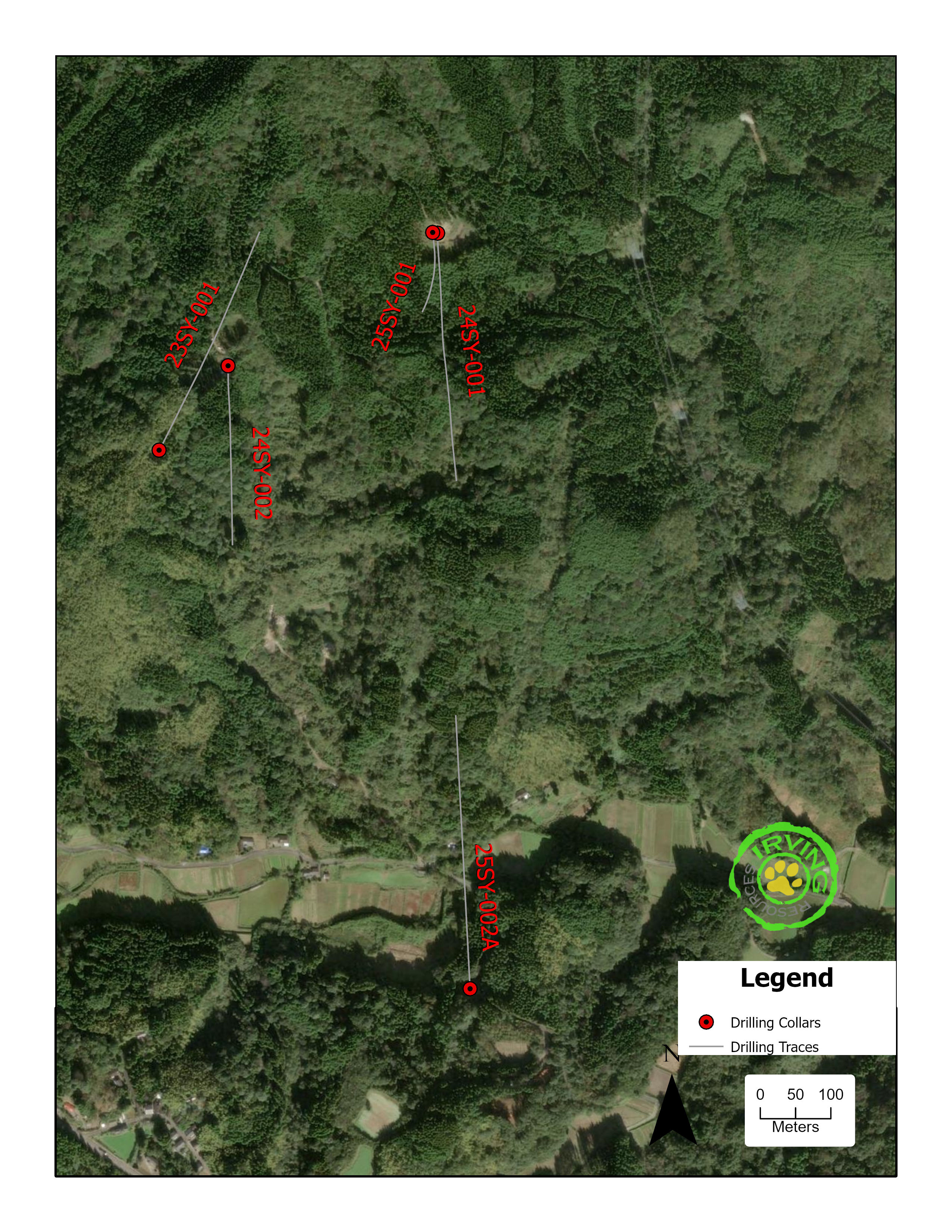

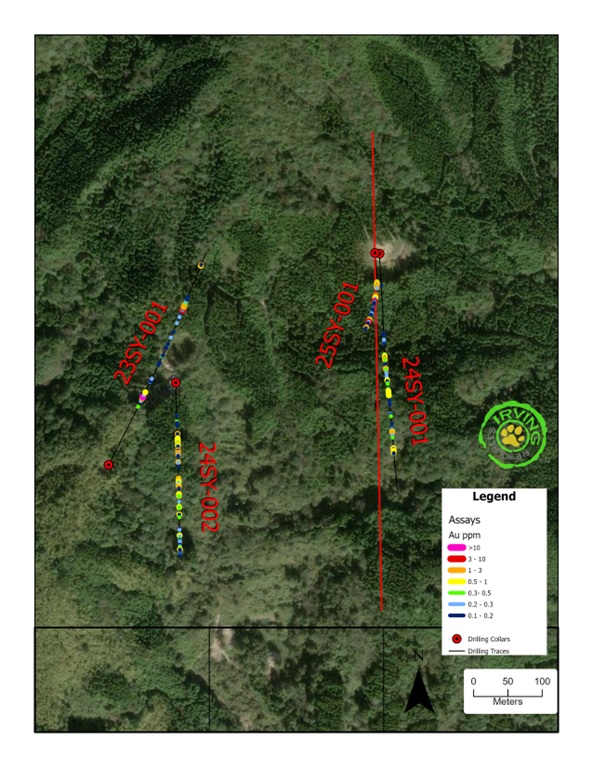

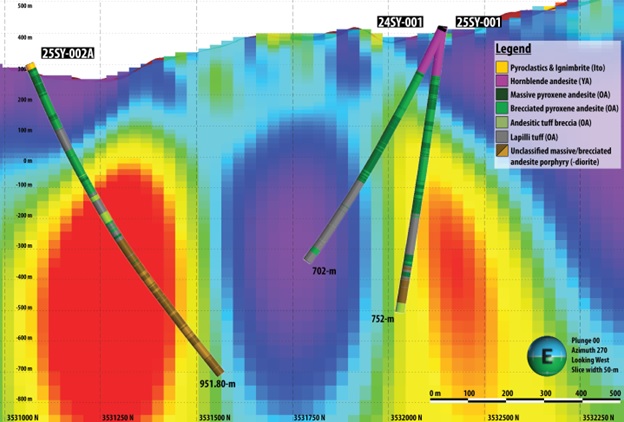

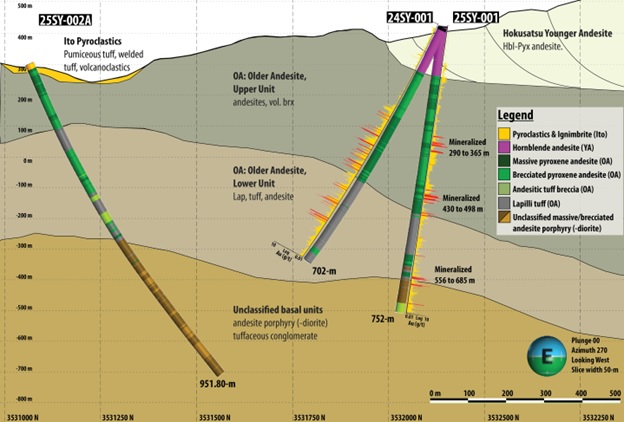

Hole 25SY-001 is oriented in a southerly direction at a steep inclination of 82 degrees reaching a depth of 752 metres (Figures 1-3). This hole is drilled from the same drill pad as hole 24SY-001, a southerly oriented 702.1-metre long hole drilled at a shallower inclination of 65 degrees. Hole 24SY-001 encountered anomalous gold mineralization discussed in the Company's news release dated May 5, 2025. Given the strong geologic indicators observed in hole 24SY-002 as well as the presence of a deeper resistive feature evident in AMT data, the JV geologic team thought that drilling a steeper hole in this same location was warranted, hence the reasoning behind drilling hole 25SY-001.

As hoped, hole 25SY-001 encountered higher grade gold values than its shallower counterpart, hole 24SY-001. Discreet zones of gold-rich stockwork veining include:

5.0 metres grading 2.90 gpt Au including 1.0 metre grading 8.3 gpt Au starting at a downhole depth of 444.0 metres,

1.2 metres grading 4.14 gpt Au including 0.5 metre grading 8.38 gpt Au starting at a downhole depth of 490.8 metres, and

2.0 metres grading 2.48 gpt Au including 1.0 metre grading 4.53 gpt Au starting at a downhole depth of 678.0 metres.

True widths of these structures cannot be determined at this time.

In addition to higher gold values, the degree of silicification in hole 25SY-001 is notably higher than that observed in hole 24SY-001. Current thinking by Irving's geologic team is that potential remains for improved gold grades as well as structural widths of vein zones deeper within the AMT resistive zone in this area. Consideration is being given to potentially conducting further drilling in this area.

The JV recently completed drilling a 951.8 metre deep diamond drill hole, 25SY-002A, collared approximately 1.07 km south of 25SY-001. Hole 25SY-002A is oriented northward of 357 degree at an inclination of 66 degrees. Although the targeted resistive zone here is distinct from that tested further north, the concept that this feature is related to hydrothermal silicification related to gold mineralization is the same (Figure 4). Significant silicification, silica breccias and stockwork vein zones were notably abundant over the deepest 300 metres of this hole. Given the horizontal distance between the end of hole 25SY-002A and holes further north is over 700 metres, this opens up the possibility that there exists a corridor of prospectivity for vein mineralization trending through this area (Figure 5). Hole 25SY-002A is in the final stages of logging, splitting and sampling. Assays are expected back later this year. The Phase II drilling has commenced, utilizing Japan based drilling contractor Mitsui Mineral Development Co., Ltd (MINDECO)

"Hole 25SY-001 gives us confidence that we have a vein system emerging at depth in this area," commented Dr. Quinton Hennigh, director and technical advisor to Irving. "As hoped, gold grades are substantially higher in hole 25SY-001 than those observed in hole 24SY-001. We now see a vector pointing to potentially higher gold grades and wider vein zones associated with the deeper core of the AMT resistor. We eagerly await results from our newest hole, 25SY-002A, in which we observed silicification, silica breccias and stockwork vein zones at depth. The veining in this hole coupled with results from holes further north indicates we may have found extensions of the Yamagano vein system trending through East Yamagano."

East Yamagano is a joint venture between Newmont Overseas Exploration Limited ("Newmont"), a wholly-owned subsidiary of Newmont Corporation, Sumitomo Corporation ("Sumitomo") and Irving. The initial interests of the parties in the joint venture are Newmont, 60%, Sumitomo, 12.5%, and Irving, 27.5%.

All samples discussed in this news release are ½ split sawn diamond core samples. Irving submitted samples to ALS Global, Brisbane, Australia, for analysis. Au and Ag were analyzed by fire assay with AA finish. Overlimit samples were assayed by fire assay with gravimetric finish. Multielements were analyzed by mass spectrometry following four-acid digestion. Irving routinely inserts standard and blank samples in assay batches submitted to the laboratory. Company staff are responsible for geologic logging and sampling of core. Au equivalent is calculated by adding Au (gpt) to Ag (gpt)/80. Results referred to in this news release are not necessarily representative of mineralization throughout the project.

Quinton Hennigh (Ph.D., P.Geo.) is the qualified person pursuant to National Instrument 43-101 Standards of Disclosure for Mineral Projects responsible for, and having reviewed and approved, the technical information contained in this news release. Dr. Hennigh is a technical advisor and a director of Irving and has verified the data disclosed including sampling, through review of photographs of core prior to and after sawing and sampling, and analytical, through review of standard and blank analyses.

About Irving:

Irving is a junior exploration company with a focus on gold in Japan. Irving resulted from completion of a plan of arrangement involving Irving, Gold Canyon Resources Inc. and First Mining Finance Corp. Additional information can be found on the Company's website: www.IRVresources.com.

Akiko Levinson,

President, CEO & Director

For further information, please contact:

Tel: (604) 682-3234 Toll free: 1 (888) 242-3234 Fax: (604) 971-0209

info@IRVresources.com

Forward-looking information

Some statements in this news release may contain forward-looking information within the meaning of Canadian securities legislation including, without limitation, statements as to planned exploration activities and the potential of the JV property. Forward-looking statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, customary risks of the mineral resource exploration industry, the funding of planned drilling and other exploration activities, as well as the performance of services by third parties.

THE CSE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ACCURACY OR ADEQUACY OF THIS RELEASE

SOURCE: Irving Resources Inc

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/irving-encounters-multiple-gold-veins-in-latest-diamond-drill-hole-at-east-yamaga-1071076