Farmout of PEL 98 and License extensions for PEL's 97, 99 and 100

TORONTO, ONTARIO / ACCESS Newswire / September 16, 2025 / Eco (Atlantic) Oil & Gas Ltd. (AIM:ECO)(TSXV:EOG), a leading independent oil and gas exploration company focused on the Atlantic Margin, is pleased to announce key developments in its Namibian portfolio aimed at optimising operations and exploration focus.

Eco has signed deeds of amendments and secured license extensions across all four of its Petroleum Exploration Licences ("PEL"s) in Namibia. In addition, Eco has farmed out its total 85% Working Interest, pending government approval, in PEL 98 (Block 2213 "Sharon Block") to an arms-length wholly Namibian-owned company, Lamda Energy (Pty) Ltd ("Lamda Energy").

These strategic developments allow Eco to focus on unlocking the hydrocarbon potential of its highly prospective and deeper water acreage in Namibia while continuing to support local ownership and operational leadership. The Company is currently receiving interest to farm down the extended licenses and their revised work programmes.

Namibia Optimisation Highlights:

One (1) year extension granted to the Initial Exploration Period for PELs 97, 98, 99 and 100 now continuing to September 2026 (the "Initial Extension Year")

Optional First Renewal Period of two (2) years following the Initial Extension Year (the "First Renewal Period")

Optional Extension of the First Renewal Period of additional one (1) year, following completion of the initial First Renewal (the "First Renewal Extension")

Optional Second Renewal Period of two (2) additional years, commencing after the completion of the First Renewal Extension

New Negotiated Schedule and Work Programmes for PELs 97, 99 and 100

Farm-out of all of Eco's 85% interest in PEL 98, subject to government approval, to Lamda Energy, a 100% Namibian-owned company

Eco received Environmental Clearance Certificate for planned seismic surveys across the Namibian portfolio on 15 June 2025

Eco is engaged in farm-down and seismic operations discussions with potential new partners.

Farm-Out of PEL 98 to Lamda Energy:

As Eco shifts its geological focus to deeper proven plays in Namibia, the Company has approved the Farm-Out of its entire 85% Participating Interest in the shallower PEL 98 Block 2213 to locally owned Lamda Energy.

Lamda Energy is a privately owned and operated offshore oil and gas company with an experienced Operating Team. Lamda Energy will become a wholly Namibian-owned qualified offshore Operator upon Ministerial approval. This Farm-Out aligns with Eco's longstanding commitment to advancing local participation and partnerships in Namibia's oil and gas sector.

Under the terms of the Farm-Out Agreement, Lamda Energy will make an up-front payment to Eco for administrative costs, and, on completion, will assume all obligations and liabilities associated to PEL 98. In addition, in the event of a future farm-out by Lamda Energy to a third party, Lamda Energy will be required to make certain payments to Eco at a fixed quantum per percentage interest farmed out, up to a maximum of US$2 million.

Eco will retain a board seat at Lamda Energy to support a comprehensive transition and knowledge transfer ensuring a smooth and responsible handover. This marks a significant milestone in building local capacity and advancing inclusive energy development.

Portfolio-Wide Newly Negotiated Schedules and Work Programmes:

The Ministry of Industries, Mines and Energy of the Republic of Namibia has formally approved a 12-month extension to the First Renewal Exploration Period for all four licenses, granted under Section 30 (2A) of the Petroleum (Exploration and Production) Act. The revised expiry date for the First Renewal Exploration Period is now September 2026. In summary: one (1) year extension granted to the Initial Exploration Period for PELs 97, 98, 99 and 100; Optional First Renewal Period of two (2) years, after extension year; Optional Extension of the First Renewal Period of additional one (1) year, after First Renewal; Optional Second Renewal Period of an additional two (2) years, after First Renewal Extension. These extended schedules provide Eco and its partners additional time to pursue enhanced exploration activities and attract new farm-in partners to the licenses.

The updated and approved Work Programmes include on PEL 97 3D seismic reprocessing, and a ~1000 km2 3D seismic survey and processing on each of PEL 99 and 100. An Environmental Clearance Certificate, issued on 15 June 2025 by the Ministry of Environment, Forestry and Tourism, authorises Eco to undertake the planned seismic activities across its licenses in the deepwater Walvis Basin offshore Namibia.

Gil Holzman, President and CEO of Eco Atlantic, commented:

"These developments represent an important step in our tactical vision and an optimisation of our Namibian portfolio and work programmes. I want to sincerely thank our dedicated team and our key stakeholders within the Ministry of Industries, Mines and Energy, who have worked tirelessly over the past 12 months to ensure a mutually beneficial plan and a smooth transition for the Farm-Out of PEL 98 (Sharon Block). Their support has been instrumental in the alignment of our efforts on our deeper water PEL's 97, 99 and 100 which have been the recent focus of industry partners.

"This strategy builds on Eco's long-standing history of pioneering and supporting local involvement and contributions, beginning with the first proposal of NAMCOR as a 10% carried interest partner in 2011. And additionally with our new license issuance in 2021 adding a further 5% Local Partner (carried) on each of our blocks, we remain firmly committed to promoting local content and ensuring equitable partnerships for Namibian stakeholders and colleagues. With these license extensions and updated work programmes, we are now well-positioned to unlock further value in Namibia. I would also like to thank the Ministry of Mines, Energy and Industries Petroleum Commissioner for her collaborative work and guidance, as well as to our Namibia country manager Tironenn Kauluma for his ongoing leadership and stakeholder engagement efforts."

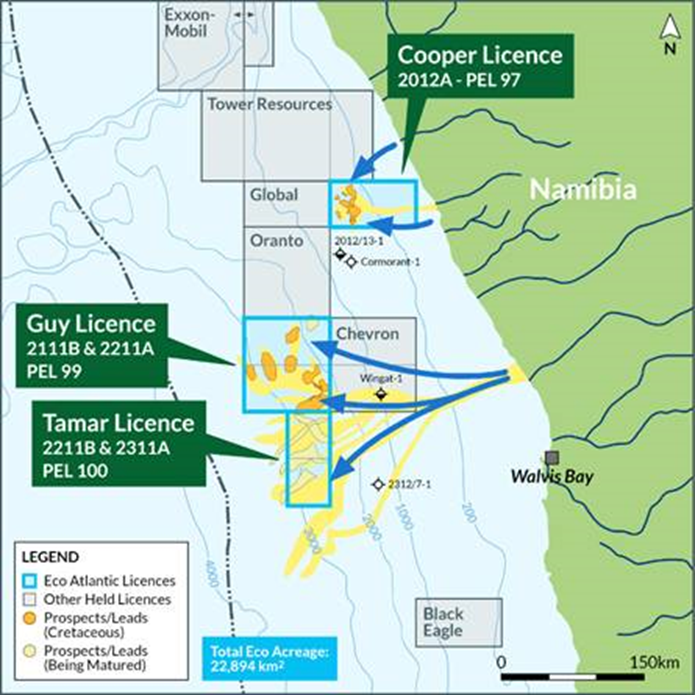

Figure 1: Eco Atlantic's Namibia acreage following approval of PEL 98 farmout

ENDS

For more information, please visit www.ecooilandgas.com or contact the following.

Eco Atlantic Oil and Gas | c/o Celicourt |

Gil Holzman, Chief Executive Officer |

|

Strand Hanson (Financial & Nominated Adviser) | +44 (0) 20 7409 3494 |

James Harris |

|

Berenberg (Broker) | +44 (0) 20 3207 7800 |

Matthew Armitt |

|

Celicourt (PR) | +44 (0) 20 7770 6424 |

Mark Antelme |

|

About Eco Atlantic:

Eco Atlantic is a TSX-V and AIM-quoted Atlantic Margin-focused oil and gas exploration company with offshore license interests in Guyana, Namibia, and South Africa. Eco aims to deliver material value for its stakeholders through its role in the energy transition to explore for low carbon intensity oil and gas in stable emerging markets close to infrastructure.

Offshore Guyana, in the proven Guyana-Suriname Basin, the Company operates a 100% Working Interest in the 1,354 km2 Orinduik Block. In Namibia, the Company holds Operatorship and an 85% Working Interest in four offshore Petroleum Licences: PELs: 97, 99, and 100, representing a combined area of 22,894 km2 in the Walvis Basin. Offshore South Africa, Eco holds a 5.25% Working Interest in Block 3B/4B and a 75% Operated Interest in Block 1, in the Orange Basin, totalling approximately 37,510km2.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Certain information set forth in this document contains forward-looking information and statements including, without limitation, management's business strategy, and management's assessment of future plans and operations, approval of the farm-out of PEL 98, operations in Namibia, the results of discussions with farm-down and seismic operations. Such forward-looking statements or information are provided for the purpose of providing information about management's current expectations and plans relating to the future, including successful negotiation of farm-in agreement, results of exploration as proposed or at all. Forward-looking statements or information typically contain statements with words such as "anticipate", "believe", "expect", "plan", "intend", "estimate", "propose", "project", "potential" or similar words suggesting future outcomes or statements regarding future performance and outlook. Readers are cautioned that assumptions used in the preparation of such information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted as a result of numerous known and unknown risks, uncertainties and other factors, many of which are beyond the control of the Company. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them as actual results may differ materially from the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include risks and uncertainties identified under the headings "Risk Factors" in the Company's management's discussion and analysis for the financial year ended March 31, 2025 and other disclosure documents available on the Company's profile on SEDAR+ at www.sedarplus.ca. The forward-looking statements contained in this press release are made as of the date hereof, and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, except as required by law.

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulation (EU) No. 596/2014 as it forms part of United Kingdom domestic law by virtue of the European Union (Withdrawal) Act 2018, as amended by virtue of the Market Abuse (Amendment) (EU Exit) Regulations 2019.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Eco (Atlantic) Oil and Gas Ltd.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/oil-gas-and-energy/eco-atlantic-oil-and-gas-ltd.-announces-namibia-portfolio-update-1074014