Reduction of the Company's debt from €40 million to €12 million, spread over 10 years

Capital increase of at least €5 million post-plan adoption, with the issuance of stock warrants (BSAs) to finance the Company to profitability

Issuance of BSAs to all existing shareholders to involve them in future value creation

Vote of affected parties (excluding shareholders) from September 25 to October 2, 2025, and of the shareholder class until October 3, 2025

Regulatory News:

Mauna Kea Technologies (Euronext Growth: ALMKT), (the"Company")inventor of Cellvizio®, the multidisciplinary probe and needle-based confocal laser endomicroscopy (p/nCLE) platform, today presents the final terms of its safeguard plan. Following the initial version presented on September 12, this final version incorporates adjustments agreed upon with stakeholders to secure their support. This ambitious plan aims to overhaul the Company's financial structure and provide it with the means to achieve its strategic objectives, targeting profitability by 2027 and positive cash flow generation from 2029.

Details of the Debt Restructuring

The adjustments compared to the September 12, 2025 draft mainly concern the treatment of the secured debt from the European Investment Bank (EIB), namely:

A 55% write-off of the principal and accrued interest, with the remaining balance (45%) to be repaid progressively over the plan's duration (10 years), coupled with a return-to-better-fortune clause representing 20% of the waived debt;

- A complete write-off of royalties on sales; and

- Conversion of a portion of the remaining debt into capital, resulting in the EIB holding 10% of the Company's capital upon completion of the restructuring and the Capital Increase described below. It is specified that the shares thus issued will be subject to a lock-up period of 2 years from the date the plan is approved.

Overall, the plan aims to reduce debt from €40.2 million to €12.1 million, a 70% reduction in existing debt, with the balance to be repaid over 10 years, according to the following terms for the classes of affected creditors:

CLASS | DESCRIPTION | AMOUNT (EUR)1 | WRITE-OFF | AMOUNT POST-PLAN | REPAYMENT SCHEDULE |

1 | Secured bank debt | 30,992,583 | 67% | 10,346,662 | 10 years |

2 | Tax and social security claims | 1,325,655 | 0% | 1,325,655 | 10 years |

3 | Lessor claims | 136,867 | 80% | 27,273 | 10 years |

4 | Essential supplier claims | 140,116 | 0% | 140,116 | 3 years |

5 | Strategic supplier claims | 298,234 | 0% | 298,234 | 10 years |

6 | Unsecured claims (State guarantee) | 2,242,203 | 100% | ||

7 | Other unsecured claims | 5,138,547 | 100% | ||

TOTAL | 40,274,205 | 70% | 12,138,041 |

Details of the Capital Increase

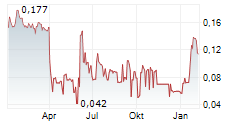

To finance its roadmap, the Company plans to raise a minimum of €5 million through a capital increase (the "Capital Increase"). The Capital Increase would be carried out at a price corresponding to the lower of the 10-day volume-weighted average price (10-day VWAP) and €0.12 per share, thus avoiding a discount if the share price is below €0.12.

To align the interests of all the Company's stakeholders with its long-term success:

New investors would receive stock warrants ("BSAs") attached to the shares subscribed in the Capital Increase, with an exercise price including a premium to the Capital Increase price;

- Current shareholders would be granted 1 free BSA for every 10 shares held, with these BSAs having identical terms to those issued to new investors in the Capital Increase.

The final terms of the Capital Increase are subject to discussions with potential investors and could still evolve.

Thanks to the proceeds from the Capital Increase and the expected proceeds from the exercise of the BSAs, the Company intends to achieve profitability by 2027 and generate positive cash flow from 2029.

Sacha Loiseau, Chairman and CEO of Mauna Kea Technologies, stated: "The presentation of this definitive safeguard plan is a decisive step for Mauna Kea Technologies. Once approved, its implementation will provide the company with a solid and sustainable financial structure. It was also essential for us to fully align our current shareholders in our future success; the allocation of BSAs to them demonstrates our commitment to sharing the fruits of our development with those who have placed their long-term trust in us. With this plan, we can now focus on our mission: accelerating the adoption of Cellvizio and achieving profitability by 2027."

Voting Process

The classes of affected parties (excluding the shareholder class) will be able to vote on the proposed safeguard plan electronically between September 25 and October 2, 2025.

Regarding the shareholder class, they will be able to vote remotely, by proxy, or in person at the shareholder class meeting to be held on October 3, 2025, in each case according to the specific procedures set out in the internal regulations for the classes of affected parties and the meeting notices.

For each class, including the shareholder class, the vote will be decided by a two-thirds majority of the votes cast, with no quorum requirement, according to the specific procedures provided in the internal regulations for the classes of affected parties.

Following the vote of the classes of affected parties, the results of these votes will be published on the Mauna Kea Technologies website.

Availability of the Draft Safeguard Plan and the Internal Regulations for the Vote of the Classes of Parties

The latest version of the draft safeguard plan, prepared by Mauna Kea Technologies with the assistance of the judicial administrator, on which all classes of affected parties will vote, as well as the internal regulations for the classes of affected parties, are available today on the Company's website in the "Restructuring" section.

The draft safeguard plan details the technical terms of the capital transactions and includes a summary of the expert appraisals carried out as part of the safeguard procedure. The internal regulations for the classes of affected parties detail the practical arrangements and rules applicable to the voting of the different classes. Shareholders, holders of securities giving access to capital, and creditors of the Company are encouraged to review them.

About Mauna Kea Technologies

Mauna Kea Technologies is a global medical device company that manufactures and sells Cellvizio®, the real-time in vivo cellular imaging platform. This technology uniquely delivers in vivo cellular visualization which enables physicians to monitor the progression of disease over time, assess point-in-time reactions as they happen in real time, classify indeterminate areas of concern, and guide surgical interventions. The Cellvizio® platform is used globally across a wide range of medical specialties and is making a transformative change in the way physicians diagnose and treat patients. For more information, visit www.maunakeatech.com.

Disclaimer

This press release and the safeguard plan contains forward-looking statements about Mauna Kea Technologies, its business and the progress of the safeguard proceedings initiated for the benefit of the Company. All statements other than statements of historical fact included in this press release and the safeguard plan, including, but not limited to, statements regarding Mauna Kea Technologies' financial condition, business, strategies, plans and objectives for future operations are forward-looking statements. Mauna Kea Technologies believes that these forward-looking statements are based on reasonable assumptions. However, no assurance can be given that the expectations expressed in these forward-looking statements will be achieved. These forward-looking statements are subject to numerous risks and uncertainties, including those described in Chapter 2 of Mauna Kea Technologies' 2024 Annual Report filed with the Autorité des marchés financiers (AMF) on April 30, 2025, which is available on the Company's website (www.maunakeatech.fr), as well as the risks associated with changes in economic conditions, financial markets and the markets in which Mauna Kea Technologies operates. The forward-looking statements contained in this press release and the safeguard plan are also subject to risks that are unknown to Mauna Kea Technologies or that Mauna Kea Technologies does not currently consider material. The occurrence of some or all of these risks could cause the actual results, financial condition, performance or achievements of Mauna Kea Technologies to differ materially from those expressed in the forward-looking statements. This press release and the information contained herein do not constitute an offer to sell or subscribe for, or the solicitation of an order to buy or subscribe for, shares of Mauna Kea Technologies in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The distribution of this press release may be restricted in certain jurisdictions by local law. Persons into whose possession this document comes are required to comply with all local regulations applicable to this document.

1 Amounts due

View source version on businesswire.com: https://www.businesswire.com/news/home/20250922573637/en/

Contacts:

Mauna Kea Technologies

investors@maunakeatech.com

NewCap Investor Relations

Aurélie Manavarere Thomas Grojean

+33 (0)1 44 71 94 94

maunakea@newcap.eu