Victoria, British Columbia--(Newsfile Corp. - September 23, 2025) - ALUULA Composites Inc. (TSXV: AUUA) ("ALUULA" or the "Company") today reported its financial results for the three and nine month periods ended July 31, 2025 ("Q3 2025" and "YTD Q3 2025" respectively). All currency amounts noted are in Canadian dollars.

Momentum continues to build at ALUULA as the Company embraces its corporate philosophy of continuous improvement, which supports the ongoing achievement of fiscal 2025 strategic objectives. During Q3 2025, the Company:

- reported strong sales growth across both primary sales channels,

- significantly increased open sales orders,

- maintained gross margins within its targeted range,

- vetted an alternative manufacturing method that enables the production of ALUULA materials at a wider width and enhances existing manufacturing capacity, and

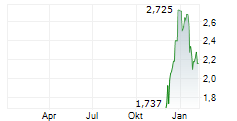

- saw its market capitalization and share price increase triggering accelerated vesting of recently repriced warrants subsequent to July 31, 2025, resulting in the raise of $987,372 gross proceeds.

"Our Q3 2025 results reflect the strong market demand and sales orders for ALUULA's ultra-light, high-performance, and recycle-ready composite materials," said Sage Berryman, CEO and President at ALUULA. "With the increased demand, we are implementing operational efficiencies to streamline procurement of raw materials and manufacturing processes as we continue to work closely with our partners and customers to fulfill their needs. We have successfully established our new method of manufacturing to enable 1.5-meter products to help manage some of the demand above our current facility's capacity."

Key Q3 2025 Highlights

- Sales for Q3 2025 were $2,121,588 compared to $1,291,938 for the three-month period ended July 31, 2024 ("Q3 2024"), which represents a $829,650 or 64% increase.

- Sales growth during Q3 2025 was achieved in both primary sales channels, with performance outdoor increasing by 61% and commercial industrial increasing 106% compared to Q3 2024.

- Within the performance outdoor channel, ALUULA's Q3 2025 sales increased across all core vertical markets compared to Q3 2024 with:

- 62% sales growth in the windsport vertical market as the Company benefited from consumer driven demand for premium priced kites and wings featuring ALUULA's materials, which deliver superior performance.

- 68% sales growth in the pack and bag vertical market as the Company doubled the number of commercial stage brand partners.

- 22% sales growth in the sailing vertical market as leading customers continued to order ALUULA materials for use in spinnaker sails as sea trials progress.

- The Company's Q3 2025 sales to the commercial industrial channel increased by 106% compared to Q3 2024 as a result of the continued progression of a collaborative research project between ALUULA and a customer in the wind power market aimed at harnessing wind to tow cargo ships with the goal of reducing carbon emissions and fuel costs.

- Open sales orders pending fulfillment were approximately $3 million at July 31, 2025, representing a 245% increase compared to open sales orders at October 31, 2024 demonstrating success with the conversion of sales pipeline opportunities.

- Gross margins for Q3 2025 were 41% which is within the Company's expected range of 40%-45% and improved from Q3 2024 gross margins of 38%.

- Operating expenses excluding non-cash share-based compensation expense were $963,902 in Q3 2025 compared to $1,517,321 in Q3 2024 representing a decrease of $553,419. Operating expenses in Q3 2024 were higher primarily due to the write off of accounts receivable and raw material deemed unusable in the production process.

- Share-based compensation in Q3 2025 was $586,431 compared to $57,922 in Q3 2024 representing an increase of $528,509. During the quarter, ALUULA made certain modifications to stock option grants as management determined providing meaningful equity incentives is essential to attracting and retaining top talent which in turn will support long term growth objectives. The modifications made were accounted for in accordance with IFRS 2, Share based payment, and were the primary cause of the increase. If this non-cash expense were excluded, the Company's Income before interest, tax and amortization would have been approaching breakeven.

- Net and comprehensive loss from Ocean Rodeo's discontinued operations was $34,620 Q3 2025 compared to a net and comprehensive income of $91,930 in Q3 2024. The Q3 2025 loss is primarily due to the write off of remaining inventory on hand as well as minor administrative costs incurred during wind down. The net and comprehensive income in Q3 2024 was due to the collection of an account receivable previously written down.

Key YTD Q3 2025 Highlights

- Sales for YTD Q3 2025 were $4,956,794 compared to $4,692,368 during YTD Q3 2024, which represents a 6% increase.

- The increase was driven by a 1% increase in the performance outdoor channel and a 151% increase in the commercial industrial channel.

- Within the performance outdoor channel, sales to the pack and bag vertical market increased by 47% in YTD Q3 2025 compared to YTD Q3 2024. The increase was driven by successful customer conversion and retention as seven additional brand partners transitioned to the commercial stage and 85% of YTD Q3 2024 customers placed follow-on orders after successful product launches.

- YTD Q3 2025 commercial industrial sales increased by 151% compared to YTD Q3 2024 due to the Company's collaboration with customers in the wind power vertical market.

- Gross margins for YTD Q3 2025 were 42%, which was consistent with the YTD Q3 2024 period and within the Company's expected range of 40%-45%.

- Operating expenses excluding non-cash share-based compensation expense were $2,584,836 in YTD Q3 2025 compared to $3,727,949 in Q3 2024 representing a decrease of $1,143,113. Operating expenses in YTD Q3 2024 were higher due to costs incurred to effect organizational restructuring as well as the write off of bad debt and raw input materials.

- Share-based compensation in YTD Q3 2025 was $666,870 compared to $86,819 in YTD Q3 2024 representing an increase of $580,051. The increase is due to modifications made to stock options granted as detailed earlier in this press release.

- Net and comprehensive loss from Ocean Rodeo's discontinued operations was $100,951 in YTD Q3 2025 compared to a net and comprehensive loss of $649,307 in YTD Q3 2024 representing a decrease of $548,356. This decrease is a result of declining operating costs and spending controls in put in place as operations are wound down.

Outlook

ALUULA empowers sustainable innovation through high-performance materials that are essential to our brand partners' market-leading products-many of which wouldn't be possible otherwise. As a visible ingredient brand, ALUULA ensures its distinctive aesthetic aligns with its reputation for performance and sustainability, setting it apart from commodity materials.

A focused group of brand partners, combined with targeted commercial outreach into high-growth markets such as wind power and defense shelters, is expected to drive increased demand, market share, and revenue. This strategic commercial focus is already yielding results, as seen in rising sales orders, and is projected to continue contributing to higher revenues into FY2026. At the same time, ALUULA remains committed to margin discipline, aiming for profitable growth.

The technical team, working closely with key partners, is advancing industry-defining construction techniques-such as no-sew applications-enabled by ALUULA's unique material properties. These innovations will power the next generation of products. Strategic R&D efforts are also expanding ALUULA's IP portfolio, supporting the evolution of manufacturing with 1.5-meter materials, waterproof breathables, and progress toward full circularity.

Meanwhile, the manufacturing team is scaling production capacity while maintaining quality and consistency to meet growing demand. These efforts ensure ALUULA can deliver premium materials at scale.

All of these strategic and operational initiatives are grounded in ALUULA's core value of continuous improvement-driving performance, sustainability, and innovation both internally and externally. Together, they support ALUULA's mission to lead a global composite textile revolution, combining high-performance, circularity, and profitable growth.

ALUULA announces leadership change

The Company also announces that Briony Bayer has issued her notice of resignation from the Chief Financial Officer ("CFO") role. Briony will continue as CFO until October 31, 2025, and has agreed to remain available to the Company on a consulting basis after that time and will remain on the Company's Board of Directors. Briony joined ALUULA as part-time interim CFO in October 2023 and has played an essential role in the maturation of the business, building out the team, shaping the Company's strategic direction, and, of course, building the financial reporting and governance functions within ALUULA. The Company would like to extend its gratitude to Briony for her leadership during her time as CFO.

ALUULA's Director of Finance, Dale Graham, will step into the CFO role effective November 1, 2025. Dale joined ALUULA in January 2024 and has been a key member of the senior leadership team. With close to a decade of experience in finance and accounting across multiple industries and a deep understanding of the company's operations, combined with his commitment to sustainability and performance, he is an ideal candidate to lead the financial functions through ALUULA's next phase of growth.

Financial Statements and Management's Discussion and Analysis

This earnings press release should be read in conjunction with ALUULA's unaudited interim condensed consolidated financial statements for the three and nine months ended July 31, 2025 and the related management discussion and analysis, which can be found on ALUULA's website and its issuer profile on the System for Electronic Document Analysis and Retrieval Plus at www.sedarplus.ca.

About ALUULA Composites

ALUULA is an ultra-light, high performance and recycle-ready composite materials brand that enhances the performance of outdoor gear. Proudly owned and manufactured on the Canadian west coast, ALUULA's innovation is driven by a deep understanding that equipment does not need to sacrifice performance for sustainability. ALUULA's materials are known for their unique construction capabilities and their ability to make products lighter, stronger, and more sustainable.

aluula.com | (TSXV: AUUA)

On behalf of the Board of Directors,

Sage Berryman

Chief Executive Officer

1-888-724-2470

For ALUULA investor inquiries, please contact:

1-888-724-2470, ext. 4

IR@aluula.com

For ALUULA media relations, please contact:

media@aluula.com

ALUULA's Brand Partners

The term "brand partners" does not refer to formal partnerships with our customers. The term refers to marketing relationships with our customers who use ALUULA's technology as a brand ingredient in their products.

TSX Venture Exchange

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

The information in this news release includes certain information and statements about management's view of future events, expectations, plans, and prospects that constitute forward-looking statements, including, but not limited to: the Company's list of brand partners growing; the Company's advancement of its materials development; the Company's future focus on Commercial Industrial and defense applications; the Company achieving its mission. These statements are based on assumptions subject to significant risks and uncertainties as described in the Company's management discussion and analysis. Because of these risks and uncertainties and as a result of a variety of factors, including the timing and receipt of all applicable regulatory, corporate third-party approvals, the actual results, expectations, achievements, or performance may differ materially from those anticipated and indicated by these forward-looking statements. Although the Company believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurances that the expectations of any forward-looking statement will prove to be correct. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267644

SOURCE: ALUULA Composites Inc.