PAREF obtained from its banking partners

a waiver of the ICR covenant

PAREF Group announces that it has obtained a waiver from all its banking partners for the suspension of its covenant ("covenant holiday") on the ICR (interest coverage ratio) ratio for the tests as of June 30, 2025 and December 31, 2025.

This waiver was requested in light of the temporary decrease to 1.05x of the ICR ratio, mainly due to the decline in the rental income, combined with the decrease in subscription commissions on SCPI funds in a still challenging market environment.

As a reminder, as of June 30, 2025, the gross financial debt of PAREF Group stood at €77 million, unchanged from December 31, 2024, 75% of which is hedged by derivatives instruments, with an average cost up to 4.63%, compared to 4.32% as of December 31, 2024.

This agreement, which reflects the confidence of the group's long-standing banking partners, provides for a covenant reset, setting the new thresholds at 1.20x as of June 30, 2026 and 1.50x from December 31, 2026 onwards. The guarantees and conditions attached to this agreement will be specified in an amendment contract to be signed in October 2025.

With Loan To Value (LTV) ratio of 33%[1], Secured Financial Debt (DFS) ratio of 23%[2] and a portfolio value of more than €150 million, the Group complies with the other financial covenants as of June 30, 2025.

Financial Agenda

October 23, 2025: Financial information as of September 30, 2025

About PAREF Group

PAREF is a leading European player in real estate management, with over 30 years of experience and the aim of being one of the market leaders in real estate management based on its proven expertise.

Today, the Group operates in France, Germany, Italy and Switzerland and provides services across the entire value chain of real estate investment: investment, fund management, renovation and development project management, asset management and property management. This 360° approach enables the Group to offer integrated and tailor-made services to institutional and retail investors.

The Group is committed to creating more value and sustainable growth and has put CSR concerns at the heart of its strategy.

As at December 31, 2024, PAREF Group manages over €3 billion AUM.

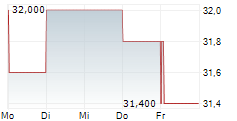

PAREF is a company listed on Euronext Paris, Compartment C, under ISIN FR0010263202 - Ticker PAR.

More information on www.paref.com

Press Contacts

| PAREF Group Samira Kadhi +33(7) 60 00 59 52 samira.kadhi@paref.com | Shan Agency Alexandre Daudin / Aliénor Kuentz +33(6) 34 92 46 15 / +33(6) 28 81 30 83 paref@shan.fr |

[1] LTV covenant: 50%

[2] DFS covenant: 30%

- SECURITY MASTER Key: mGpqkZeZYm6YlWuflZtoapdqZ2hmmmLImmnKlWhwmJqXm2xhl21pnMebZnJll25s

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-94296-press-release-paref-covenant.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free