Cityvarasto Oyj Company release 2 October 2025 at [1.30] [pm] EEST

Cityvarasto Oyj's initial public offering was significantly oversubscribed throughout the price range; final subscription price is EUR 16.00 per share

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, HONG KONG, JAPAN, NEW ZEALAND, SOUTH AFRICA OR SINGAPORE, OR ANY OTHER JURISDICTION IN WHICH PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

Cityvarasto Oyj ("Cityvarasto" or the "Company"), a Finnish company providing self-storage units and ancillary services, announces today the result of its Offering. The Offering attracted very strong international investor demand but also strong support from local investors. The Offering was significantly oversubscribed throughout the price range. Trading in Cityvarasto's shares on Nasdaq First North Growth Market Finland is expected to commence on 3 October 2025.

The Offering in brief

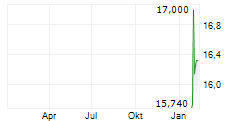

- The final subscription price in the Offering (as defined below) was EUR 16.00 per share (the "Final Subscription Price") in the Public Offering and the Institutional Offering (as defined below), and EUR 14.40 per share in the Personnel Offering (as defined below), which, in total, corresponds to a market capitalisation of Cityvarasto of approximately EUR 128 million immediately following the Offering.

- Cityvarasto will receive gross proceeds of approximately EUR 15 million from the Offering, and the Sellers (as defined below) will receive gross proceeds of approximately EUR 31 million (assuming that the Over-Allotment Option (as defined below) is fully exercised).

- The Offering consists of a total of 2,875,997 Offer Shares (as defined below) corresponding to approximately 36.0 per cent of the Shares (as defined below) in the Company after the Offering (assuming that the Over-Allotment Option will be exercised in full and excluding Shares held in treasury), divided into 938,628 New Shares, 1,562,239 Sale Shares (as defined below) and a maximum of 375,130 Additional Shares (as defined below).

- The total number of outstanding Shares in Cityvarasto will increase to 7,987,737 Shares and the total number of all Shares in Cityvarasto (including Shares held in treasury) will increase to 8,027,002.

- In the Offering, the Offer Shares will be allocated as follows:

- 2,742,263 Offer Shares will be allocated in the Institutional Offering;

- 125,116 Offer Shares will be allocated in the Public Offering. The commitments given in the Public Offering will be accepted in full for up to 40 Offer Shares, and if the subscription commitment was given for more than the minimum subscription amount of 50 Offer Shares, pro rata to the subscriptions made, equalling approximately 45.3 per cent of the commitments exceeding 50 Offer Shares; and

- 8,618 New Shares will be allocated in the Personnel Offering. The Company's board of directors has decided to accept the commitments given in the Personnel Offering in full.

- Elo Mutual Pension Insurance Company, Odin Eiendom, certain funds managed by Sp-Fund Management Company, SKAGEN Funds, Takoa Invest and Biomerit, a company controlled by the chairman of Cityvarasto's Board of Directors Aki Kostiander, have each individually subscribed for Offer Shares in the Offering for a total amount of approximately EUR 20 million, corresponding to approximately 43 per cent of the size of the Offering, assuming that the Over-Allotment Option will be exercised in full.

- After the Offering, Cityvarasto will have more than 1,000 shareholders.

- The Company has committed to a lock-up arrangement of 180 days and the members of the Board of Directors of the Company, the management team of the Company, and the personnel members participating in the Personnel Offering have committed to lock-up arrangements of 360 days. In addition, the Sellers have committed to a lock-up agreement of 360 days in respect of Stonerose Capital Oy and Matti Heiskanen, and 180 days from the Listing in respect of Feut AS.

- Stonerose Capital Oy and Feut AS have granted Skandinaviska Enskilda Banken AB (publ) Helsinki Branch ("SEB") as stabilising manager (the "Stabilising Manager") an over-allotment option which entitles the Stabilising Manager to purchase preliminarily a maximum of 375,130 additional shares in the Company (the "Additional Shares") solely to cover over-allotments in connection with the Offering (the "Over-Allotment Option"). The Over-Allotment Option is exercisable within 30 days from the commencement of trading of the Company's shares (the "Shares") on First North (defined below).

- The Offer Shares allocated in the Public Offering and Personnel Offering will be recorded in the book-entry accounts of investors on or about 3 October 2025. The Offer Shares allocated in the Institutional Offering are ready to be delivered against payment through Euroclear Finland Ltd on or about 7 October 2025.

- Trading of Cityvarasto's Shares on the First North Growth Market Finland ("First North") maintained by Nasdaq Helsinki Ltd ("Nasdaq Helsinki") is expected to commence on or about 3 October 2025 under the share trading code "CITYVA".

Ville Stenroos, Cityvarasto's CEO comments:

"I would like to thank the investors who participated our IPO. I am especially pleased that so many of our personnel became owners of Cityvarasto. I also believe that, with the listing, many of our new owners will also become our customers."

Aki Kostiander, Chairman of Board of Directors of Cityvarasto comments:

"I am very pleased that our IPO was a success. In terms of continuity of our determined growth strategy, the share issue and listing on Nasdaq First North will greatly promote our goal of growing both organically and through acquisitions. Therefore, a successful IPO was very important to us. However, I was already confident prior to the IPO that our company would interest investors, given that self-storage stands out favorably among real estate investments. Evidence of this can particularly be seen in the interest from significant foreign investors in the listing of our company."

Offering

The Board of Directors of Cityvarasto Oyj has today on 2 October 2025 decided on the completion of the Offering. The Final Subscription Price for the Offer Shares was EUR 16.00 per share in the Public Offering and the Institutional Offering, and EUR 14.40 per share in the Personnel Offering, which, in total, corresponds to a market capitalisation of Cityvarasto of approximately EUR 128 million immediately following the Offering. The Offering attracted very strong international investor demand but also strong support from local investors, and the Offering was significantly oversubscribed throughout the preliminary price range. After the Offering, Cityvarasto will have more than 1,000 shareholders. Trading of the Cityvarasto's shares ("Shares") on First North is expected to commence on or about 3 October 2025.

In the Offering, Cityvarasto will issue 938,628 new shares (the "New Shares") (the "Share Issue"), corresponding to approximately 11.8 per cent of the total number of outstanding Shares after the Offering assuming that the that the Over-Allotment Option will be fully exercised. In addition, the shareholders of the Company Stonerose Capital Oy, Feut AS and Matti Heiskanen (together "Sellers") will sell 1,562,239 existing Shares in the Company (the "Sale Shares") (the "Share Sale", and together with the Share Issue, the "Offering") assuming that the Over-Allotment Option is not exercised. Unless the context indicates otherwise, the New Shares, the Sale Shares and the Additional Shares (as defined below) are together referred to herein as the "Offer Shares".

In the Offering 2,742,263 Offer Shares will be allocated to institutional investors in Finland and, in accordance with applicable laws, internationally outside of the United States (the "Institutional Offering"), assuming that the Over-Allotment Option will be exercised in full, and 125,116 Offer Shares will be allocated to private individuals and entities in Finland (the "Public Offering"). In addition, 8,618 Offer Shares will be allocated to permanent and fixed-term full-time and part-time employees of the Company in Finland as well as to the members of the Board of Directors and the management team of the Company (the "Personnel Offering"). The commitments given in the Public Offering will be accepted in full for up to 40 Offer Shares, and if the subscription commitment was given for more than the minimum subscription amount of 50 Offer Shares, pro rata to the subscriptions made, equalling approximately 45.3 per cent of the commitments exceeding 50 Offer Shares. The commitments given in the Personnel Offering will be accepted in full.

Cityvarasto will receive gross proceeds of approximately EUR 15 million from the Offering, and the Sellers will receive gross proceeds of approximately EUR 31 million, assuming that the Over-Allotment Option is fully exercised. The total number of outstanding Shares in Cityvarasto will increase to 7,987,737 Shares and the total number of Shares in Cityvarasto (including Shares held in treasury) will increase to 8,027,002 after the New Shares offered in the Share Issue are registered in the Trade Register upheld by the Patent and Registration Office (the "Finnish Trade Register") on or about 2 October 2025.

The Offer Shares allocated in the Public Offering and Personnel Offering will be recorded in the book-entry accounts of investors on or about the first banking day after the completion decision on or about 3 October 2025. The Offer Shares allocated in the Institutional Offering are ready to be delivered against payment through Euroclear Finland Ltd on or about 7 October 2025.

Confirmations regarding the approval of the commitments and the allocation of Offer Shares will be sent to the investors who have submitted their commitments in the Public Offering on or about 9 October 2025 at the latest. Nordnet's own customers will see their commitments as well as allocation of Offer Shares on the transaction page of Nordnet's online service. Any excess payments made in connection with the commitments will be refunded to the investors' bank accounts approximately on or about the fifth banking day after the completion decision, i.e. on or about 9 October 2025. If an investor's bank account is in a different bank than the place of subscription, the refund will be paid to a Finnish bank account in accordance with the payment schedule of the financial institutions, approximately no later than two banking days thereafter. To Nordnet's customers who gave their commitments, the amount to be refunded will be paid to Nordnet cash accounts.

Trading of the Cityvarasto's shares ("Shares") on First North is expected to commence on or about 3 October 2025. The ISIN code of the Shares is FI4000176557, and the share trading code is "CITYVA".

Stonerose Capital Oy and Feut AS have granted the Stabilising Manager an Over-Allotment Option to purchase preliminarily a maximum of 375,130 Additional Shares at the Final Subscription Price solely to cover any over-allotments in connection with the Offering. The Over-Allotment Option is exercisable within 30 days from the commencement of trading in the Shares on First North (i.e., on or about the period between 3 October 2025 and 1 November 2025). The Additional Shares represent approximately 5.3 per cent of the Shares and votes vested by the Shares (excluding treasury Shares held by the Company) prior to the Offering and approximately 4.7 per cent of the Shares and votes vested by the Shares (assuming that the Over-Allotment Option will be exercised in full and excluding treasury Shares held by the Company) after the Offering.

The Stabilising Manager, may, but is not obligated to, engage in measures during the Stabilisation Period that stabilise, maintain or otherwise affect the price of the Shares. Any stabilisation measures will be conducted in accordance with Regulation (EU) No 596/2014 of the European Parliament and of the Council on market abuse (the "Market Abuse Regulation") and the Commission Delegated Regulation (EU) 2016/1052 supplementing the Market Abuse Regulation with regard to regulatory technical standards for the conditions applicable to buy back programs and stabilisation measures.

In connection with the Offering, the Company has committed to a lock-up arrangement of 180 days. The members of the Board of Directors of the Company and the management team of the Company have committed to a lock-up agreement with similar terms to that of the Company that will end on the date that falls 360 days from the Listing. The Sellers have agreed to comply with a lock-up agreement with similar terms to that of the Company that will end, with respect to Stonerose Capital Oy and Matti Heiskanen, 360 days from the Listing and, with respect to Feut AS, 180 days from the Listing. According to the terms and conditions of the Personnel Offering the personnel participating in the Personnel Offering have agreed to comply with a lock-up with similar terms to that of the Company and the Sellers that will end on the date that falls 360 days from the Listing.

SEB is acting as the sole global coordinator and bookrunner (the "Sole Global Coordinator") in the Offering. Krogerus Attorneys Ltd is acting as legal adviser to Cityvarasto. Roschier, Attorneys Ltd. is acting as legal adviser to the Sole Global Coordinator. Miltton Ltd is acting as communications adviser to Cityvarasto.

Further enquiries

Ville Stenroos, CEO, Cityvarasto Oyj, tel. +358 29 123 4747

Matti Leinonen, CFO, Cityvarasto Oyj, tel. +358 29 123 4768

Certified Adviser:

Skandinaviska Enskilda Banken AB (publ) Helsinki Branch, tel. +358 9 6162 8000

Information about Cityvarasto

Cityvarasto is a Finnish company established in 1999, operating in the self-storage, van rental and moving services sectors. In addition to the parent company Cityvarasto Oyj, the Cityvarasto Group includes, as its principal subsidiaries, PakuOvelle.com Oy, which specialises in van rentals, and Suomen Opiskelijamuutot Oy, a moving services company.

IMPORTANT INFORMATION

Neither this release nor the information contained herein is for publication, distribution or release, in whole or in part, directly or indirectly, in or into the United States, Australia, Canada, Hong Kong, Japan, New Zealand, South Africa or Singapore or any other jurisdiction in which publication or distribution would be unlawful. The information contained herein does not constitute an offer of securities for sale in the United States, nor may the securities of Cityvarasto Oyj (the "Company") be offered or sold in the United States absent registration or an exemption from registration under the U.S. Securities Act of 1933, as amended, and the rules and regulations thereunder. The Company does not intend to register any portion of the offering in the United States or to offer securities to the public in the United States.

The issue, offer, exercise and/or sale of securities are subject to specific legal or regulatory restrictions in certain jurisdictions. The Company or Skandinaviska Enskilda Banken AB (publ) Helsinki Branch assume no responsibility in the event there is a violation by any person of such restrictions.

The information contained herein shall not constitute an offer to sell or a solicitation of an offer to purchase or subscribe, nor shall there be any sale of the securities referred to herein in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration, exemption from registration or qualification under the securities laws of any such jurisdiction. Investors must neither accept any offer for, nor acquire, any securities to which this document refers, unless they do so on the basis of the information contained in the applicable prospectus published or offering circular distributed by the Company.

The Company has not authorised any offer to the public of securities in the United Kingdom or in any Member State of the European Economic Area other than Finland. With respect to each Member State of the European Economic Area other than Finland and which applies the Prospectus Regulation (each, a "Relevant Member State"), no action has been undertaken or will be undertaken to make an offer to the public of securities requiring publication of a prospectus in any Relevant Member State. As a result, the securities may only be offered in the Relevant Member States (a) to any legal entity, which fulfils the requirements of a qualified investor as defined in the Prospectus Regulation; or (b) in any other circumstances falling within Article 1(4) of the Prospectus Regulation. For the purposes of this paragraph, the expression "offer of securities to the public" means a communication to persons in any form and by any means, presenting sufficient information on the terms of the offer and the securities to be offered, so as to enable an investor to decide to purchase or subscribe for those securities. The expression "Prospectus Regulation" means Regulation (EU) 2017/1129 of the European Parliament and of the Council, as amended.

This communication is directed only at persons who are outside the United Kingdom or persons who are qualified investors within the meaning of the Prospectus Regulation as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 and are also (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order") or (ii) high net worth entities or other persons to whom it may lawfully be communicated, falling within Article 49(2) of the Order (all such persons together being referred to as the "Relevant Persons"). Any investment activity to which this communication relates will only be available to and will only be engaged with, the Relevant Persons. Any person who is not a Relevant Person should not act or rely on this document or any of its contents.

Full terms, conditions and instructions for the initial public offering are included in the prospectus that has been prepared by the Company in connection with the initial public offering. The prospectus is available on the website of the Company at www.cityvarasto.fi/ipo.

An investor is advised to read the prospectus before making an investment decision to fully understand the risks and rewards associated with the investment. The approval by the Finnish Financial Supervisory Authority of the prospectus shall not be considered as an endorsement of the securities offered.

FORWARD-LOOKING STATEMENTS

Certain statements in this release are "forward-looking statements." Forward-looking statements include statements concerning plans, assumptions, projections, objectives, targets, goals, strategies, future events, future revenues or performance, capital expenditures, financing needs, plans or intentions relating to acquisitions, the Company's competitive strengths and weaknesses, plans or goals relating to financial position, future operations and development, its business strategy and the anticipated trends in the industry and the political and legal environment in which it operates and other information that is not historical information. In some instances, they can be identified by the use of forward-looking terminology, including the terms "believes," "intends," "may," "will" or "should" or, in each case, their negative or variations on comparable terminology.

Forward-looking statements in this release are based on assumptions. Forward-looking statements involve inherent risks, uncertainties and assumptions, both general and specific, and the risk exists that the predictions, forecasts, projections, plans and other forward-looking statements will not be achieved. Given these risks, uncertainties and assumptions, you are cautioned not to place undue reliance on such forward-looking statements. Any forward-looking statements contained herein speak only as at the date of this release. Save as required by law, the Company does not intend to, and does not assume any obligation to, update or correct any forward-looking statement contained in this release.

INFORMATION TO DISTRIBUTORS

Solely for the purposes of the product governance requirements contained within: (a) EU Directive 2014/65/EU on markets in financial instruments, as amended ("MiFID II"); (b) Articles 9 and 10 of Commission Delegated Directive (EU) 2017/593 supplementing MiFID II; and (c) local implementing measures (together, the "MiFID II Product Governance Requirements"), and disclaiming all and any liability, whether arising in tort, contract or otherwise, which any "manufacturer" (for the purposes of the MiFID II Product Governance Requirements) may otherwise have with respect thereto, the shares have been subject to a product approval process, which has determined that the shares are: (i) compatible with an end target market of retail investors and investors who meet the criteria of professional clients and eligible counterparties, each as defined in MiFID II; and (ii) eligible for distribution through all distribution channels as are permitted by MiFID II (the "Target Market Assessment"). Notwithstanding the Target Market Assessment, distributors should note that: the price of the shares may decline and investors could lose all or part of their investment; the shares offer no guaranteed income and no capital protection; and an investment in the shares is compatible only with investors who do not need a guaranteed income or capital protection, who (either alone or in conjunction with an appropriate financial or other adviser) are capable of evaluating the merits and risks of such an investment and who have sufficient resources to be able to bear any losses that may result therefrom. The Target Market Assessment is without prejudice to the requirements of any contractual, legal or regulatory selling restrictions in relation to any offering of the shares.

For the avoidance of doubt, the Target Market Assessment does not constitute: (a) an assessment of suitability or appropriateness for the purposes of MiFID II; or (b) a recommendation to any investor or group of investors to invest in, or purchase, or take any other action whatsoever with respect to the shares.

Each distributor is responsible for undertaking its own target market assessment in respect of the shares and determining appropriate distribution channels.