Vancouver, British Columbia--(Newsfile Corp. - October 8, 2025) - Great Pacific Gold Corp. (TSXV: GPAC) (OTCQX: GPGCF) (FSE: V3H) ("Great Pacific Gold," "GPAC," or the "Company") is pleased to announce that it has set November 27, 2025 as the date on which the special meeting of shareholders will occur to approve the spinout (the "Spin Out") of Walhalla Gold Corp. ("Walhalla"), whereby Great Pacific will distribute the shares of Walhalla to the shareholders of Great Pacific. Walhalla will then own the Walhalla Gold Project in Victoria, Australia. An Information Circular setting forth the transaction in detail will be filed on www.sedarplus.ca prior to the special meeting.

Highlights:

Notice of Anticipated Record Date and Meeting Date: The Company has filed a notice of meeting and record date on SEDAR+ setting November 27, 2025 as the date for a Special Meeting of GPAC shareholders to approve the Spin Out of Walhalla. Shareholders as of October 20, 2025 will be eligible to vote at this meeting.

Submission of Initial Application for Listing: An updated NI 43-101 technical report and draft carve out financial statements have been prepared and submitted to the Canadian Securities Exchange as part of the initial application for listing Walhalla.

Anticipated Record Date for the Spin Out: It is expected that the date of record for which shareholders in GPAC will receive a full share in Walhalla will be shortly after the November 27, 2025 Special Meeting.

"The spin-out of Walhalla enables GPAC shareholders to retain full and direct exposure to a district-scale gold project in a proven jurisdiction. Walhalla has multiple drill ready targets, a rich mining history and is now consolidated under a single entity," stated Greg McCunn, CEO of Great Pacific Gold. "We have been making good progress on advancing the required financial, technical and legal documentation to support the Spin Out and we have now initiated preparation work for drilling the highly prospective Pinnacles target in early 2026."

Mick Carew, Great Pacific Gold's Vice President of Corporate Development is serving as Walhalla's interim CEO to prepare the Pinnacles target for drilling in early 2026.

Walhalla Gold Project

H&S Consultants Pty of Brisbane, Australia have completed an updated NI 43-101 technical report for Walhalla. The report is expected to be filed on SEDAR+ in conjunction with the information circular mail out for the November 27, 2025 Special Meeting.

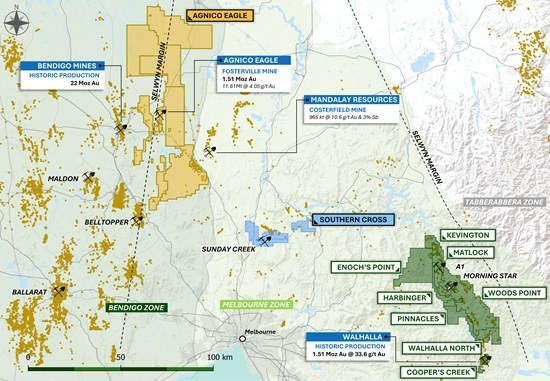

The Walhalla-Woods Point Goldfield is one of Victoria's significant goldfields (Figure 1) with an estimated total historic gold production from 54 mines of 2.2Mozs (72.2 tonnes) at a gold grade of 25.3g/t (Source: GeoVic, 2020), approximately 10% of the state's historic gold production. It is estimated that there are over 420 mines/workings for gold within the goldfield, which lies in the Palaeozoic-aged Melbourne geological structural zone, some 150km east of Melbourne.

Since gold was first found in 1851, the majority of production occurred in the 19th Century with only a few, larger mines continuing production in the 20th Century. No mines are currently operational.

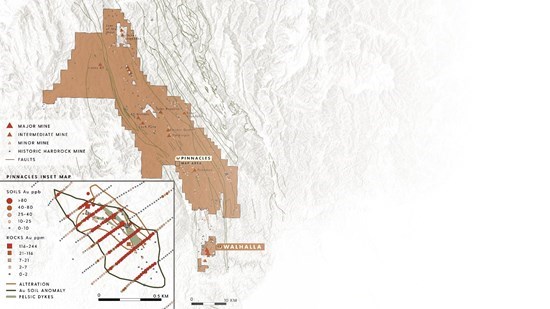

The prospect of significant gold mineralization for the Walhalla Gold Project area is currently defined by relatively shallow, historically high grade mine workings, coincident surface geochemical anomalism corresponding within a favourable geological domain and structural setting.

The exploration model for the Walhalla Gold Project is a high grade, shear hosted, orogenic gold system hosted within low metamorphic grade, marine, fine grained siliciclastics of the Walhalla Synclinorium. Of great significance is the association of gold mineralization with the 'dioritic' Woods Point Dyke Swarm intruded, along strike but across dip, into the sediments. This type of lode gold system is associated with continental margin accretionary orogens (oceanic-continental) typically occurring in terranes dominated by turbiditic (meta-sedimentary) rocks. The deposits are commonly associated with second- and third-order faults and shear zones resulting in moderately to steeply plunging, tabular to pipe-like orebodies.

The shear-hosted gold potential of the Walhalla Gold Project area has not been adequately tested by previous exploration programs. Production records from historical mining activities show the vein systems have the capacity to host significant high-grade mineralization along with complex stranded structural architectures capable of creating large, mineralised shoots.

Great Pacific Gold has consolidated most of the available ground covering the Walhalla-Woods Point Goldfield. The tenement package comprises nine, virtually contiguous, ELs (including one ELA) covering a total of 1,233km2. This provides a unique opportunity to target and explore the entire mineral field.

A multi-faceted approach to exploration is required. The exploration targets vary from historical mines that may have already received prior development and exploration, and thus may be drill-ready, through to regional stream sediment geochemical anomalies that require verification and follow-up sampling prior to soil sampling, trenching and drilling. Historical mine sites with adequate geological information can be assessed by drilling within a brief timeframe, dependent on the approval of suitable work plans.

Recommendations

The following key recommendations were made in the technical report to advance exploration:

The Pinnacle prospect represents a very high priority target for an immediate drill test (Figure 2).

Drill test Cohen's Reef/Long Tunnel.

Drill test structural targets for the Sun Hill-Black Diamond area.

Initial targeting should be focussed upon potential repetition of mineralization that plunges shallowly north in the upper levels of the Walhalla, Long Tunnel and Long Tunnel Extended mines.

Shallow, northern extensions of the Black Diamond/Overseas Option dyke, as well as Sun Hill, and Longfellows also warrant drilling.

Scout drilling of permitted specific targets generated by surface sampling and mapping throughout the Walhalla Gold Project.

A two-phased exploration budget is proposed in the technical report totalling A6,620,000 (Table 1).

Phase 1 Details

Phase 1 will comprise the 3D desktop studies to evaluate potential drill targets for Cohen's Reef and Sun Hill-Black Diamond. A successful outcome will be the identification of drill targets and possibly the delineation of any exploration potential or even Mineral Resources. Follow up would consist of diamond drilling. A total of 5,500m of diamond drilling is planned for Phase 1.

Phase 1 will also include the establishment of a dedicated GIS with all relevant geoscientific data and an assessment of the airborne magnetic and radiometric data. It may also be worthwhile completing an air photo interpretation in conjunction with LiDAR data to provide additional structural information. Combination of this with the new litho-structural model for gold mineralization is hoped to deliver a series of greenfield targets for follow up surface geochemistry and potentially diamond drilling in Phase 2. Consideration may be given to using AI to assist with target identification.

A drill ready target exists at the Pinnacle prospect and it is recommended that this is drilled as soon as possible. Drilling is likely to comprise at least two diamond holes with further holes depending on the drilling results.

Initiation of surface geochemical sampling for already known anomalous areas e.g. Star-Thomson and the Victors-Quartz-Harbinger area.

Phase 2 details

Once Phase 1 is completed the drilling and surface exploration data should be integrated using AI technology to generate targets within the broader ELs. An AI system is often a commercial enterprise that utilises artificial intelligence and machine learning to analyse geological datasets and generate potential targets. These targets would then be further assessed by follow up geological mapping, geochemical sampling and geophysical surveys to rank and prioritise for drill testing.

Contingent on outcomes from Phase 1, Phase 2 will comprise 12,400m of diamond drilling targeting down plunge and strike extensions of mineralization encountered in Phase 1. It will also aim to test the highest ranked targets generated by the desktop 3D study. Metallurgical testwork is recommended to characterise the occurrence of the gold within the quartz vein systems. The work outlined in Phase 2 will enable a decision point to be reached on the resource potential within the property and whether further work is warranted.

The proposed exploration programs are conceptual in nature and there has been insufficient exploration to define a mineral resource. It is uncertain if further exploration will result in the delineation of a mineral resource.

Table 1:

| Phase 1 | Expense Category | Cost AU$ |

| Diamond Drilling 5500m @ $250/m (1 rig) | 1,375,000 | |

| Geological drilling support (100 days @ 1000/day) | 150,000 | |

| Expanded Soil Sampling grid (2000 samples @ $70/sample all in) | 140,000 | |

| Geological mapping (10 days @ $1000/day) | 10,000 | |

| Assaying of drill samples (3000 @ $60/sample) | 180,000 | |

| Geophysics (data processing an airborne surveys) | 100,000 | |

| Data Management, Interpretation and reporting (60 days @ $1000/day) | 60,000 | |

| 3D assessment of potential mine targets & Mineral Resources | 100,000 | |

| Sub-total | 2,115,000 | |

| Phase 2 | Expense Category | Cost AU$ |

| AI Data Processing & Study | 100,000 | |

| Expanded Soil Sampling grid (3000 samples @ $70/sample) | 210,000 | |

| Diamond Drilling 12,400m @ $250/m (2 rigs) | 3,100,000 | |

| Assaying of drill samples (7500 samples @ $60/sample) | 450,000 | |

| Geological drilling support 150 days @ $2000/day (2 Rigs) | 300,000 | |

| Geophysics (Ground magnetics / 3D seismic) | 200,000 | |

| Data Management, Interpretation and reporting (120 days @ $1000/day) | 120,000 | |

| Metallurgical testwork | 25,000 | |

| Sub-total | 4,505,000 | |

| Total | 6,620,000 |

Figure 1: Walhalla Within Regional Context, Victoria, Australia

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11018/269608_b6a7c06b94b1ca37_002full.jpg

Figure 2: Walhalla Gold Project and Pinnacles Target Geochemistry Results, Victoria Australia

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11018/269608_b6a7c06b94b1ca37_003full.jpg

On behalf of Great Pacific Gold:

Greg McCunn

Chief Executive Officer and Director

For further information, visit gpacgold.com or contact:

Investor Relations

Phone +1-778-262-2331

Email: info@gpacgold.com

Qualified Person

The technical content of this news release has been reviewed, verified and approved by Callum Spink, the Company's Vice President, Exploration, who is a member of the Australian Institute of Geoscientists, MAIG, and a Qualified Person as defined by National Instrument NI 43-101 Standards of Disclosure for Mineral Projects. Mr. Spink is responsible for the technical content of this news release. Mr. Spink is not independent of the Company.

About Great Pacific Gold

Great Pacific Gold's vision is to become the leading gold-copper development company in Papua New Guinea ("PNG"). The Company has a portfolio of exploration-stage projects in PNG, as follows:

Wild Dog Project: the Company's flagship project is located in the East New Britain province of PNG. The project consists of a large-scale epithermal target, the Wild Dog structural corridor, stretching 15km in strike length and potentially over 1,000 meters deep based on a recent MobileMT geophysics survey. The survey also highlighted the Magiabe porphyry target, adjacent to the epithermal target and potentially 1,000 meters in diameter and over 2,000 meters deep. Drilling of the epithermal structure on the Sinivit target has yielded high-grade results, including WDG-02 which intercepted 7.0 meters at 11.2 g/t AuEq from 65 meters. The current drilling program will extend into 2026 with 5,000 meters planned over 28 holes.

Kesar Project: located in the Eastern Highlands province of PNG and contiguous with the mine tenements of K92 Mining Inc. ("K92"), the Kesar Project is a greenfield exploration project with several high-priority targets in close proximity to the property boundary with K92. Multiple epithermal veins at Kesar are on strike and have the same orientation as key K92 deposits, such as Kora. Exploration work to date by the Company at the Kesar Project has shown that these veins have high grades of gold present in outcrop and very elevated gold in soil grades, coincident with aeromagnetic highs. The Company conducted a diamond drill program on key target areas at the Kesar Project from November 2024 to May 2025 and are working on developing a follow-up Phase 2 program for Q1 2026.

Arau Project: also located in the Eastern Highlands province of PNG, the Arau Project is south of and contiguous to the mine tenements of K92. Arau contains the highly prospective Mt. Victor exploration target with potential for a high sulphidation epithermal gold-base metal deposit. A Phase 1 Reverse Circulation drilling program was completed at Mt. Victor in August 2024, with encouraging results. The Arau Project includes the Elandora licence, which also contains various epithermal and copper-gold porphyry targets.

The Company also holds the Tinga Valley Project in PNG.

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Great Pacific Gold cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by many material factors, most of which are beyond their respective control. Such factors include, among other things: risks and uncertainties relating to Great Pacific Gold's limited operating history, its exploration and development activities on its mineral properties and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Great Pacific Gold does not undertake to publicly update or revise forward-looking information.

Mineralization at the properties held by K92 Mining Inc. and at the Wafi-Golpu deposit is not necessarily indicative of mineralization at the Wild Dog Project.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/269608

SOURCE: Great Pacific Gold Corp.