VANCOUVER, BC, Oct. 20, 2025 /CNW/ - 0749116 B.C. Ltd. (formerly, Baroyeca Gold & Silver Inc.) (dba Terra Rossa Gold Ltd.) (the "Company") (TSXV: TRR) announces that it has completed its previously announced reverse takeover transaction (the "Transaction") with Terra Rossa Gold Ltd. ("TRG"). The Transaction was completed pursuant to TSX Venture Exchange (the "Exchange") Policy 5.2 - Changes of Business and Reverse Takeovers.

Name Change and Consolidation

As of October 16, 2025 and in connection the Transaction, the Company changed its name from "Baroyeca Gold & Silver Corp." to "0749116 B.C. Ltd.". As disclosed in the press release of the Company issued on October 9, 2025, due to an ongoing labour dispute between the British Columbia General Employees' Union (BCGEU) and the government of British Columbia, BC Registries (the "Job Action"), the Company was unable to change its name to "Terra Rossa Gold Ltd." (the "Name Change") upon completion of the Transaction (the "Closing"). Upon the cessation of the Job Action, the Company anticipates completing the Name Change.

In addition, effective October 17, 2025 and in connection with the Transaction, the Company completed a consolidation of the common shares of the Company on a basis of fourteen (14) pre-consolidation shares for one (1) post-consolidation share (the "Consolidation").

The new CUSIP number of the post-Consolidation common shares of the Company (the "Common Shares") is 98956K103 and the new ISIN number of the Common Shares is CA98956K1030.

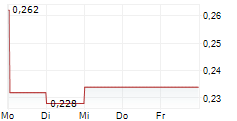

Subject to receipt of final approval of the Exchange, it is anticipated that the Common Shares will commence trading on the Exchange under the ticker symbol "TRR" as a Tier 2 Mining Issuer (the "Listing"). The anticipated trading date of the Common Shares will be as of markets-open on Wednesday, October 22, 2025.

Transaction

In accordance with the terms and conditions of the amalgamation agreement entered into between the Company, TRG, and 1460971 B.C. Ltd., a wholly-owned subsidiary of the Company ("Subco"), dated October 30, 2024, as amended from time to time (the "Amalgamation Agreement"), the Transaction was completed by way of a three-cornered amalgamation, whereby, among other things:

(i) Subco amalgamated with TRG to form an amalgamated company ("Amalco"), a wholly-owned subsidiary of the Company;

(ii) holders of common shares in the capital of TRG (each, a "TRG Share") received one (1) Common Share for each one (1) TRG Share held and the TRG Shares were cancelled; and

(iii) all issued and outstanding share purchase warrants and stock options of TRG that were exercisable to acquire TRG Shares have ceased to represent a right to acquire TRG Shares and provides the right to acquire Common Shares as of Closing.

As of Closing, the Company issued 66,591,600 Common Shares to the former holders of the TRG Shares.

Escrow

In connection with the Transaction, and in accordance with the requirements of the Exchange, certain securityholders of the Company have entered into a Tier 2 Value Security Escrow Agreement (the "Escrow Agreement") in respect of 6,216,577 Common Shares. Under the terms of the Escrow Agreement, 10% of such escrowed shares will be released upon issuance of the final bulletin of the Exchange in respect of the Transaction, with subsequent 15% increments being released 6, 12, 18, 24, 30, and 36 months from such date.

Business of the Company

Going forward, the Company will operate as a natural resource company focused on the acquisition, development, and operation of mining properties. At this stage, its principal focus will be the exploration and development of the Vetas Gold Project. The Company, through is wholly-owned subsidiary, Amalco, holds a 100% interest in the Vetas Gold Project, which comprises nine (9) mineral claims covering a combined area of approximately 313.9 hectares, located in the California-Vetas District, town of Vetas, Santander department, Colombia. Further details regarding the Transaction and the Vetas Gold Project can be found in the Company's filing statement (the "Filing Statement") dated September 29, 2025 and a technical report entitled "NI 43-101 Technical Report on the Vetas Gold Project Vetas, Santander, Colombia", each filed under the Company's profile on SEDAR+.

Concurrent Financing

In connection with the Transaction, TRG completed its concurrent non-brokered private placement for the issuance of 11,895,000 special warrants (the "Special Warrants") at a price of $0.50 per Special Warrant for aggregate gross proceeds of $5,947,500 (the "Special Warrant Financing"). Each Special Warrant was automatically converted, without payment of any additional consideration and without any further action on the part of the holder thereof, concurrent with Closing, into one unit of TRG, comprised of one (1) TRG Share and one (1) share purchase warrant exercisable to acquire Common Shares at a price of $0.75 per share for a period of two years. Concurrent with the closing of the Transaction, each TRG Share was exchanged for a Common Share.

New Board and Management

As of Closing, the Board of Directors of the Company is comprised of: Patrick Downey, Michael Halvorson, Tim Moody, Richard Wilson, and Patrick Robinson. In addition, the executive management of the Company is as follows: Patrick Downey (CEO) and Latika Prasad (CFO and Corporate Secretary). For further details and biographies of the new members of the board of directors and management, refer to the Filing Statement.

Issued and Outstand Share Capital

The following table sets out the issued and outstanding share capital of the Company on a non-diluted basis following the completion of the Transaction:

| Category of Security | Number | Percentage |

| Common Shares held by the previously existing shareholders of the Company (formerly, Baroyeca Gold & Silver Inc.) | 6,150,603 | 8.46 % |

| Common Shares issued to the former holders of TRG Shares (excluding the Special Warrant Financing) | 54,696,600 | 75.19 % |

| Common shares issued to holders of TRG Shares pursuant to the Special Warrant Financing | 11,895,000 | 16.35 % |

| TOTAL: | 72,742,203 | 100 % |

Change of Auditor

In connection with the Transaction, WDM Chartered Professional Accountants will resign as auditor of the Company and De Visser Gray LLP, auditor of TRG, will be appointed as auditor of the Company. In the opinion of the Company, no "reportable event" (as such term is defined in National Instrument 51-102 - Continuous Disclosure Obligations ("NI 51-102")) has occurred. The Company is relying on section 4.11(3)(a) of NI 51-102 for an exemption from the change of auditor requirements within section 4.11 of NI 51-102.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Investors are cautioned that, except as disclosed in the Filing Statement prepared in connection with the Transaction, any information released or received with respect to the Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of the Company should be considered highly speculative.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Forward Looking Information

This press release contains statements that constitute "forward-looking information" ("forward-looking information") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking information and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "anticipate", "believe", "continue", "estimate", "expect", "intend", "projected" or variations of such words and phrases or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information.

More particularly and without limitation, this press release contains forward-looking statements concerning the anticipated resumption of trading of the Common Shares, the issuance of the final bulletin by the Exchange, the proposed business of the Company going forward, and the anticipated Name Change. In disclosing the forward-looking information contained in this press release, The Company has made certain assumptions, including that receipt of final approval of the Exchange. Although the Company believes that the expectations reflected in such forward-looking information are reasonable, it can give no assurance that the expectations of any forward-looking information will prove to be correct. Known and unknown risks, uncertainties and other factors may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Such factors include but are not limited to: delay or failure to receive regulatory approvals and general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking information to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking information or otherwise.

The Exchange has in no way passed upon the merits of the Transaction and has neither approved nor disapproved the contents of this press release.

SOURCE 0749116 B.C. LTD.

Contact Information: 0749116 B.C. Ltd. (dba Terra Rossa Gold Ltd.), Latika Prasad, Chief Financial Officer, Tel: 604-802-8492, Email: [email protected]