Q3 2025

(Q2 2025)

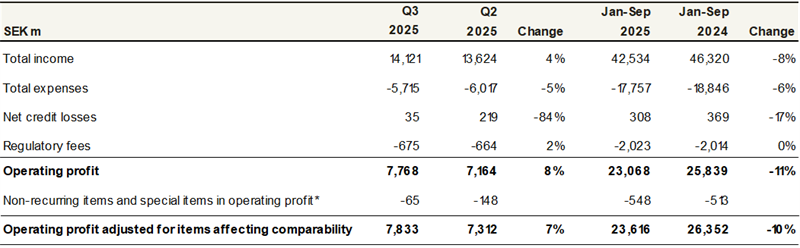

- Operating profit climbed by 8% to SEK 7,768m (7,164)

- Return on equity improved to 13.3% (12.7)

- Earnings per share grew to SEK 3.00 (2.77)

- The C/I ratio improved to 40.5% (44.2)

- The credit loss ratio (net reversals) amounted to -0.01% (-0.03)

- The common equity tier 1 ratio was 18.2% (18.4)

January - September 2025

(January - September 2024)

- Operating profit was SEK 23,068m (25,839)

- Return on equity was 13.0% (14.8)

- Earnings per share amounted to SEK 8.97 (10.41)

- The C/I ratio was 41.7% (40.7)

- The credit loss ratio (net reversals) amounted to -0.01% (-0.02)

- The common equity tier 1 ratio was 18.2% (18.8)

Income growth and high levels of customer satisfaction

Asset management volumes climbed in all home markets and lending volumes increased in the majority of them, particularly the UK and the Netherlands. However, lower short-term market rates led to a slide in interest rate margins during the quarter. Customers' appreciation of the Bank's decentralised, local and customer-centric business model contributed to accolades such as "Business Bank of the Year" and "Sweden's Small Enterprise Bank". In this year's SKI/EPSI surveys, the Bank's overall customer satisfaction was higher than both the sector average and its major competitors in all home markets.

Trimmed expenses and good credit quality

The heightened focus over the past year on improving efficiency, especially within central departments and business support units, has not only improved the C/I ratio, but also brought with it an improvement to general cost awareness. The C/I ratio improved in all home markets during the quarter. Credit quality remains good, and credit losses consisted of net reversals for the seventh consecutive quarter.

A position of financial strength

After anticipated dividends, the common equity tier 1 ratio amounted to 18.2%, corresponding to 3.5 percentage points over the amount required by the Swedish Financial Supervisory Authority and thus 0.5 percentage points over the Bank's long-term target range of 1-3 percentage points over the requirement. During the first nine months of the year, anticipated dividends were SEK 10.65 per share, equivalent to 119% of profit for the period. The Bank's credit ratings with the leading rating agencies remained the highest overall among peer banks globally, and Handelsbanken was ranked as one of the world's safest commercial banks during the quarter.

Information regarding the press conference

A press conference will be held on 22 October 2025 at 08:15 a.m. CET.

Press releases, presentations, a fact book and a recording of the press conference will be available at handelsbanken.com/ir.

For further information, please contact:

Michael Green, President and Chief Executive Officer

Tel: +46 (0)8 22 92 20

Mårten Bjurman, CFO

Tel: +46 (0)8 22 92 20

Peter Grabe, Head of Investor Relations

Tel: +46 (0)70 559 11 67, peter.grabe@handelsbanken.se

This information is of the type that Svenska Handelsbanken AB is obliged to make public pursuant to the EU Market Abuse Regulation and the Swedish Securities Markets Act. The information was submitted for publication through the agency of the contact person set out above, at 07:00 a.m. CET on 22 October 2025.

For more information about Handelsbanken, please go to: handelsbanken.com