WASHINGTON (dpa-AFX) - After showing a lack of direction early in the session, stocks have moved mostly lower over the course of the trading day on Wednesday. The major averages have slid more firmly into negative territory, with the tech-heavy Nasdaq showing a notable move to the downside.

Currently, the major averages are off their worst levels of the day but still in the red. The Nasdaq is down 144.96 points or 0.6 percent at 22,808.71, the S&P 500 is down 22.31 points or 0.3 percent at 6,713.04 and the Dow is down 150.16 points or 0.3 percent at 46,774.58.

The slump by the Nasdaq is partly due to a steep drop by shares of Netflix (NFLX), with the streaming giant plunging by 9.7 percent to a five-month intraday low.

Netflix is under pressure after the company reported weaker than expected third quarter earnings, citing a dispute with Brazilian tax authorities.

Shares of Texas Instruments (TXN) have also tumbled by 4.5 percent after the chipmaker provided disappointing fourth quarter guidance.

On the other hand, shares of Intuitive Surgical (ISRG) are soaring by 15.7 percent after the robotic-assisted surgery systems maker reported third quarter results that beat expectations.

Capital One (COF) has also jumped by 3.5 percent after reporting third quarter results that exceeded analyst estimates on both the top and bottom lines.

The weakness on Wall Street also comes amid renewed uncertainty about trade relations between the U.S. and China following the latest remarks from President Donald Trump.

During a lunch with Republican lawmakers in the White House Rose Garden on Tuesday, Trump said he expects to be able to reach a 'good deal' with Chinese President Xi Jinping but also suggested a meeting between the two leaders may not happen.

'Maybe it won't happen,' Trump said. 'Things can happen where, for instance, maybe somebody will say, 'I don't want to meet, it's too nasty.' But it's really not nasty. It's just business.'

Trump also indicated he may not follow through with a planned meeting with Russian President Vladimir Putin over the Russia-Ukraine war, saying he doesn't want to 'have a waste of time.'

Sector News

Semiconductor stocks have come under significant selling pressure over the course of the session, with the Philadelphia Semiconductor Index tumbling by 2.6 percent.

Considerable weakness has also emerged among networking stocks, dragging the NYSE Arca Networking Index down by 2.3 percent.

An extended pullback by the price of gold is also weighing on gold stocks, as reflected by the 2.1 slump by the NYSE Arca Gold Bugs Index.

Computer hardware, retail and airline stocks are also seeing notable weakness, while oil service stocks are bucking the downtrend amid a sharp increase by the price of crude oil.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in a mixed performance on Wednesday. Hong Kong's Hang Seng Index slid by 0.9 percent and Japan's Nikkei 225 Index edged slightly lower, while South Korea's Kospi surged by 1.6 percent.

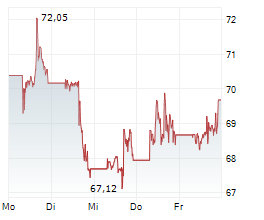

The major European markets have also turned mixed on the day. While the U.K.'s FTSE 100 Index is up by 1.2 percent, the German DAX Index is down by 0.4 percent and the French CAC 40 Index is down by 0.5 percent.

In the bond market, treasuries are seeing modest weakness after trending higher over the past several sessions. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, is up by 1.1 basis points at 3.974 percent.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News